Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

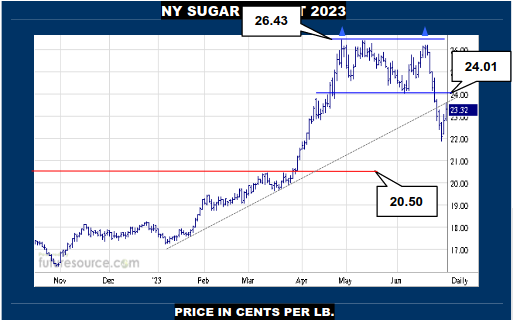

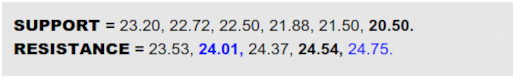

NEW YORK SUGAR #11 OCTOBER 2023

With the Jly out to pasture, NY continued a nearby relief bounce Monday and happened to nip at the now ex-uptrend broken last week (23.60). Can’t initially make a big fuss about this reaction however as the market is now approaching the shadow cast by the Q2 double top beyond 24.01. Certainly keeping an open mind to the possibility of giving that 24₵ frontier a prod but if Fund systems are going to tack on more shorts, their assault is liable to come in the 24.01 to mid band (24.43) span. Bust through and all could be well. Falter and be ready to head for 21₵ again.

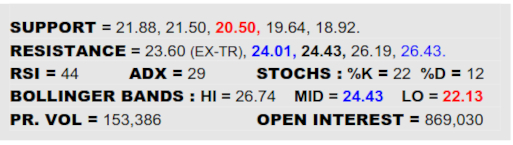

LONDON WHITES #5 OCTOBER 2023

Similarly, London has taken some corrective air in the past couple of sessions and probed into the 640’s Monday. This is approaching the ex-uptrend it lately derailed from (652) but there is then the new Q2 double top rim (661) and mid band (667.4) to contend with. If the shedding of Jly Raws allowed the market to go ripping back up across all of those, it could really shake things off and create an altogether brighter outlook. Must be distinctly cautious of the 660 realm initially though as a flinch could abruptly elicit another wave of selling down to 600.

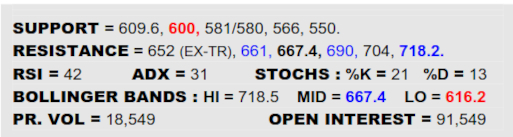

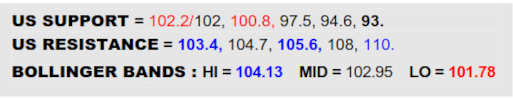

US DOLLAR INDEX

Clearly the Dollar flattened out in the first half of ’23 after a Q4 ’22 dive and taking the sky-high overview of the monthly chart still gives suggestion of a huge ’15 – ’21 base making a rather slow motion catch here. Even so, to buoy this argument will soon need nearby 103.4 resistance overhauled to sharpen the latest bid to turn north and bring the mainstay hurdle at 105.6 into better focus again, a breakout there then developing a significant new base that would measure on up to 110. The outlook would cloud over for the Dollar however if it fizzled at 103.4 and swerved away under 102, then suggesting a decaying situation that could compound seriously with the loss of 100.8.

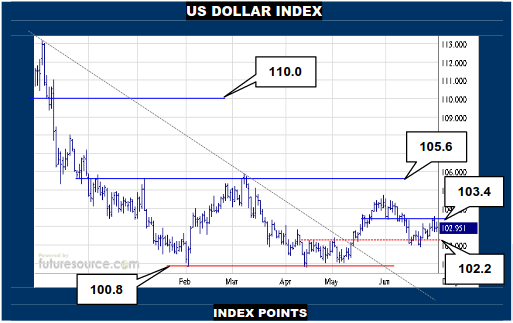

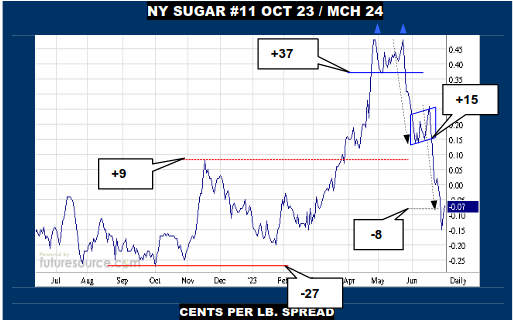

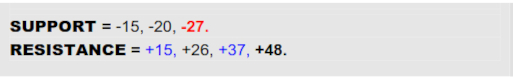

NY SUGAR #11 OCT 23 / MCH 24 SWITCH

VALUE : -7

A task of reorientation in the Oct/Mch switch as so much has happened in a month, an early Q2 dual top tripping an initial dive which, after a fortnights’ bear flag breather, elicited a second similar dive. Thus the big early ’23 uphill has been brusquely ripped down again back to square one (nearly). Would now cater for a bounce while flat prices take some post-Jly contract air and stabs into modest positive terrain wouldn’t be such a surprise. Alas, while flat price must make a significant impact into the 24’s to really shake things up again, so must this switch pop +15 at much the same time to suggest new life whereas faltering shy of +15 would look just corrective, keeping the door ajar towards the -20’s.

NY SUGAR #11 OCT 23 INTRADAY SNAPSHOT

Friday saw the crushing dive of the preceding week and a half tamed as the immediate downtrend was popped and this reaction hustled on back up to a lesser 38.2% Fib retracement Monday (23.53). That is just typical corrective dimensions initially, consistent with a market shaking off its ‘black sheep’ contract. Question now is, ‘what else you got left in the bag?’ If things promptly cooled in the mid 23’s, it could be largely dismissed as just a provisional ‘relief’ reaction that might not mean much else, keeping the path into the 21’s beckoning. If able to push on by the 23.50’s though, look for more of a searching effort into the low 24’s towards a 24.54 full 61.8% retracement before going on alert again for a new downturn.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.