Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

All hands on deck were still keeping the spot uptrend intact Wednesday (23.40) as NY tries to reorient itself in the wake of suffering a new (mainly) Jly H&S. Can’t claim a full blown restoration yet as the market must jolt back over its mid band (24.17) to dispel the top and make a more persuasive return to the up-track. The chance is there while the B-Berg and Brent are still chewing away topside but, if the Dollar stormed the 103’s, such prospects would fade and toppling from the uptrend could instead precipitate a much heavier long exodus towards 20.50.

LONDON WHITES #5 OCTOBER 2023

Having survived a dice with the 677 support earlier this week, London jogged back up over its mid band for a more resilient display Wednesday. Once again, this doesn’t perform a total fix for the technical scene and 677 remains a key prop, a break below in unison with NY’s uptrend failing signaling much more serious fatigue that could bring the low 600’s into again. Still maintaining a fragile balance meanwhile though and escape over 705 ought to find much clearer skies, a new mid year base then paving the way towards 800.

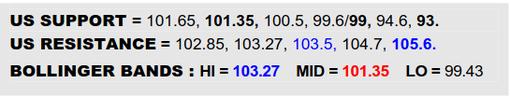

US DOLLAR INDEX

By and large the Dollar has held the fort in the 102’s since its swift recovery from a quick prod at the 99’s in Jly and the upper Bollinger band is meantime responding to the revival as it reaches on towards 103.5. Nevertheless, Wednesday brought a quieter inside day that just asks a preliminary question about the footing at these levels. Must accordingly keep an eye on the 101.65 to mid band (101.35) span as Brent adjacently tries for a next key step up in its resuscitation process across $87.5. If the Dollar veered back under its mid band and Brent made the 87’sescape, it would notably shore up the macro and tilt away towards the 99’s again here.

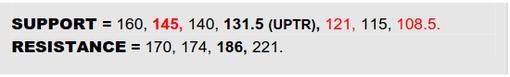

#5 / #11 WHITE PREMIUM OCT 2023

VALUE : $166.5

The White Premium took a dip back in recent days after an early Aug apex at $170 but it hasn’t thus far been a serious disruption and Wednesday brought renewed upside efforts. Must still be making room for a push by $170 to a $174 projection from the broad Q2 flag therefore and a longer term weekly peak at $186 wouldn’t look outlandish if London flat price popped 705. Meanwhile however, do keep tabs on $160 as an initial stumbling block if broken in conjunction with 677 as that would err for a more extensive setback to test the main $145 flag frontier, key bracing to prevent a more enduring backlash that might even jeopardize the uptrend ($131.5).

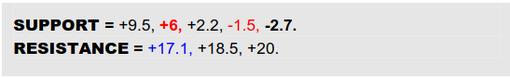

LONDON WHITES #5 OCT / DEC 2023 SWITCH

VALUE : +$14.5

As flat price dunked back to rattle the 677 ledge lately, Oct/Dec Whites also underwent a dip but kept elevation well clear of the more important +$6 support and a new rally here Wednesday currently gives early Aug a flaggish gist to restore focus on the April peak of +$17.1. Expectations of hitting that level and even breaking through would grow significantly if flat price got loose over 705. In the meantime though, the latest brief setback has provided a new +$9.5 reference point to watch if 677 failed to survive, a break there then warning of a likely clash with that +$6 shelf.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.