Insight Focus

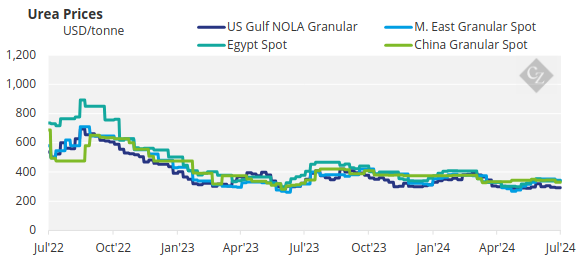

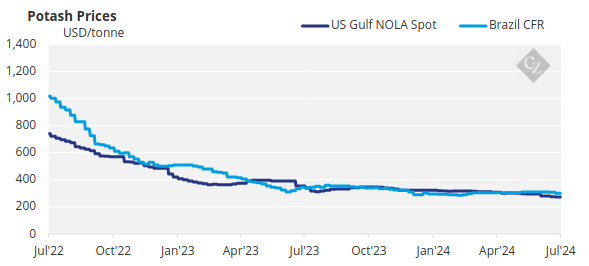

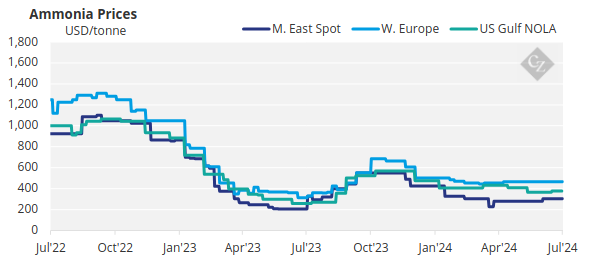

The international urea market is still in hibernation following the low-volume India tender, while most processed phosphate markets bar Pakistan are inactive. Granular potash prices came under pressure this week and the ammonia market remained flat with limited supply availability both East and West of Suez.

Interest in Urea Dips

The international urea market is neither here nor there with few, if any markets, showing any interest in engaging. The India tender fizzled out with a mere 433,500 tonnes at prices that would give netbacks of between USD 345-348/tonne to Middle Eastern producers. Between 300,000-340,000 tonnes will be supplied from the Middle East and the rest will most likely come from Russia.

Other than that, producers seem relaxed with Southeast Asian producers committed well into August due to production issues in Malaysia and sales by Brunei to Australia and other Southeast Asian markets like Vietnam and Thailand.

Iranian producers have been forced to reduce their FOB to levels below USD 300/tonne with one sale reported at USD 296.50/tonne FOB. Iranian producers are looking to place up to 150,000 tonnes in the next couple of weeks.

China to date in 2024 has only exported 140,000 tonnes, down 86.2% on last year with the government maintaining export restrictions to keep prices domestically low. There are no signs that China will enter the export market for the remainder of 2024.

Nigerian producer Dangote is still at 50% capacity and with the domestic season in full swing, no meaningful exports are expected to take place. Algerian producers are looking for August shipment and offers are at USD 370/tonne, which appears a bit rich with Brazilian netbacks assessed at around USD 335/tonne.

European buyers are busy enjoying their Proseccos. This means the only markets that are about to start engaging are in Latin America with Brazil, Mexico and Argentina the power houses. Brazil has been offered at around the USD 370/tonne CFR level but is so far showing no interest. However, these buyers will come into the market with only about 3.5 million tonnes imported to date for 2024.

The outlook for the urea market is therefore stable to firm for the time being.

Processed Phosphate Awaits India, Brazil

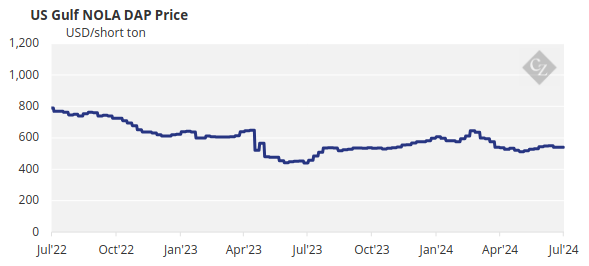

Processed phosphate markets saw little activity of interest this week. The only exception was a transaction in Pakistan, which paid as high as USD 610/tonne CFR for DAP this week. This marks a USD 40/tonne increase on the week and USD 67/tonne on a fortnight ago.

Brazilian buyers are starting to feel the pinch with lower MAP affordability, soybean season coming to an end and prices reaching USD 635/tonne CFR, which is up around USD 65/tonne over the past two months.

Indian buyers have been quiet this week and prices remain unchanged from last week. A second supplier confirmed third-quarter phosphoric acid contract agreements with buyers in India at USD 950/tonne CFR 100% P2O5 with 30 days credit. This follows last week’s reported Q3 settlement between JPMC and CIL at the same price, which was up USD 2/tonne from Q2.

China’s countrywide MAP operating rate remains at around 62% of capacity while that for DAP is up around 2% week on week at 52%, according to Longzhong. Local sources report the average operating rate for MAP in Hubei province has increased by 2.5% week on week to around 60% of capacity. China’s June DAP exports declined, while MAP exports jumped compared with the same month of 2023, according to preliminary Chinese customs statistics.

June DAP exports decreased 48% to around 480,000 tonnes from 928,759 tonnes in June 2023. This leaves DAP exports for January-June down 37% year on year at 1.51 million tonnes, according to Global Trade Tracker data. China’s June MAP exports increased more than sixfold to around 320,000 tonnes from 49,332 tonnes in the same month last year, with the volume for the first six months up 1% year on year at roughly 930,000 tonnes.

The outlook for phosphate prices is stable to firm but with India and Brazil stalling, prices may come under pressure.

Potash Under Pressure

Granular potash prices came under downward pressure this week, while standard MOP prices held flat as more signed contracts were announced. Canpotex surprised the market by settling at USD 283/tonne CFR when signing a fresh contract with Indian importer CIL, USD 4/tonne higher than India’s IPL settled last week. A price disparity in the Indian potash contract agreement has not been seen since August 2011, when a range of USD 470-490/tonne CFR was negotiated.

Southeast Asian granular MOP prices declined USD 20/tonne at the high end of the range to USD 325- 330/tonne CFR, following the recent decline of standard MOP prices in the region. In contrast, sMOP prices held flat at an average of USD 281.50/tonne, although higher offers are anticipated. As demand remains low in the region, many market players are not expecting the increase in prices to be accepted by buyers.

Brazilian MOP spot prices were assessed at USD 305-315/tonne CFR, unchanged this week, although downward price pressure is expected. A more bearish view has entered the market as affordability worsens, demand slows and stocks remain high. As MOP deliveries continue, port delays have also started to build in recent weeks.

Potash prices are expected to remain flat-to-soft in the coming weeks as the spot prices adapt to the new potash contracts.

Ammonia Remains Subdued

The global ammonia market was largely subdued this week with availability generally limited both East and West of the Suez, though the supply outlook across the former would appear more positive.

In the Middle East, demand for FOB volume is strong and some suppliers have been forced to reject inquiries for cargoes as inventories are low following recent production curtailments. Further east, activity in the rest of Asia remained subdued, with demand from China lacking.

Producers of caprolactam and acrylonitrile (ACN) both there and in nearby South Korea and Taiwan are said to have slashed output rates in recent weeks, thus limiting demand for anhydrous material.

It was a similarly slow week for those in Southeast Asia, with term cargoes continuing to load from Malaysia and Indonesia. Maintenance works in the latter could remove some tonnes off the market through the second half of July, though this could be offset by improved availability from other domestic producers.

Prices in the Western Hemisphere could hold steady-to-firm for as long as supply constraints persist, while the opposite could occur East of Suez following the long-awaited resumption in output at Ma’aden.