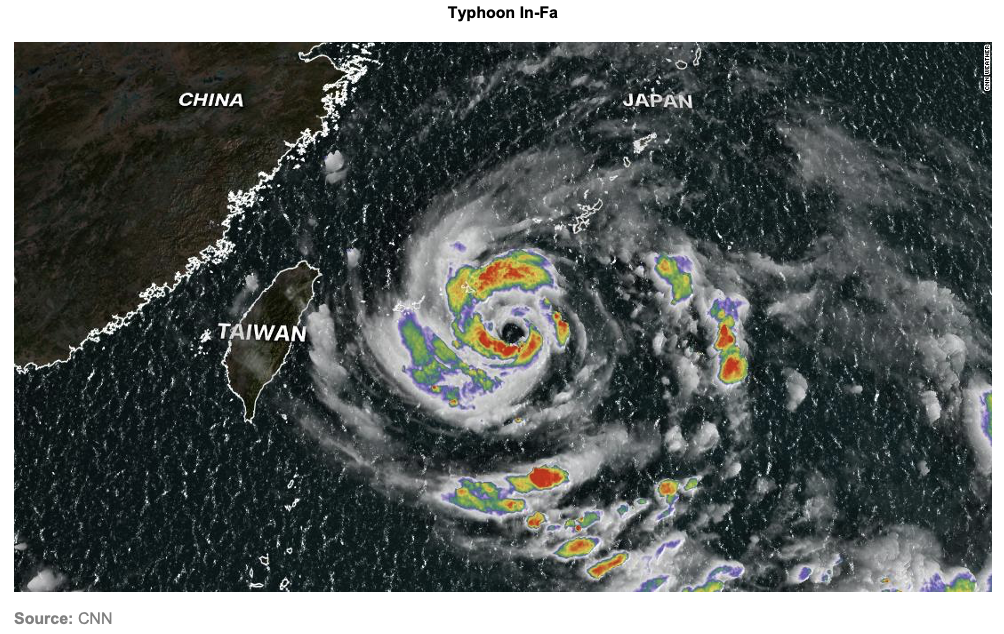

- Purified Terephthalic Acid (PTA) prices have jumped following the arrival of Typhoon In-Fa last week.

- Asian PET export prices broke higher too, but margins remain squeezed.

- PET export prices should track raw material costs until the end of the year.

Tight PTA Supply Drives Prices Higher

- Over the last three months, Asian PET export prices have been trapped inside a relatively tight range, as demand has stagnated, and process margins been squeezed.

- The arrival of Super Typhoon In-Fa, combined with increased crude volatility following the latest OPEC+ agreement, has catalysed a breakout, with PET prices jumping 50-60 USD/mt in the week.

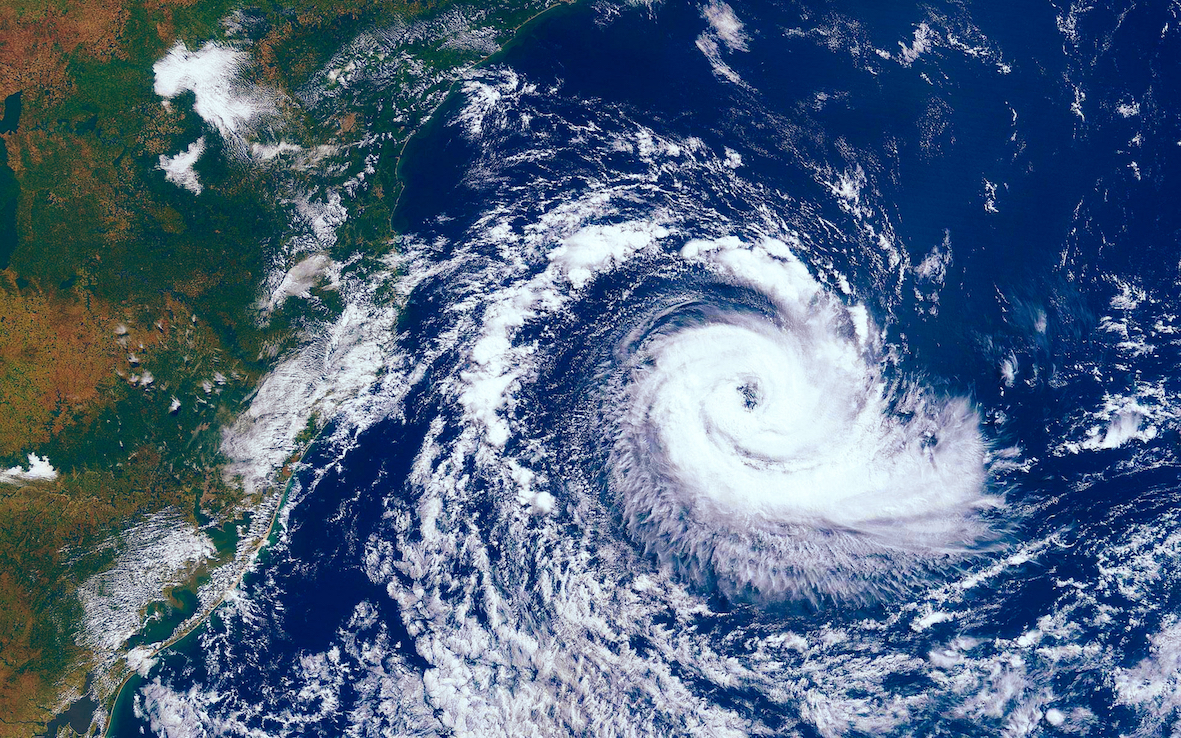

- Over the last week, two Typhoons, In-Fa and Cempaka, have brought flooding and devastation to large parts of China.

- Last week, Henan’s capital, Zhengzhou, experienced massive floods.

- A month’s worth of rain, or around four times the amount that caused the recent floods in Germany, fell in the space of an hour.

- Zhengzhou meteorologists said the level of rains the capital received in three days was a “once in a thousand years” event.

- Affected by the typhoon, the main ports along the Yangtze River are closed and PTA supplies cannot be normally picked up from warehouses.

- Larger coastal container ports used from PET resin exports are largely unaffected.

- The threat of slower deliveries has caused PTA prices to surge, however, given China’s tighter PTA supply due to recent production cuts and increased polyester demand.

How Has the PET Resin Market Responded?

- The surge in raw material costs over the last week also led PET producers to swiftly move prices upward, breaking above 1,000 USD/mt for the first time since April.

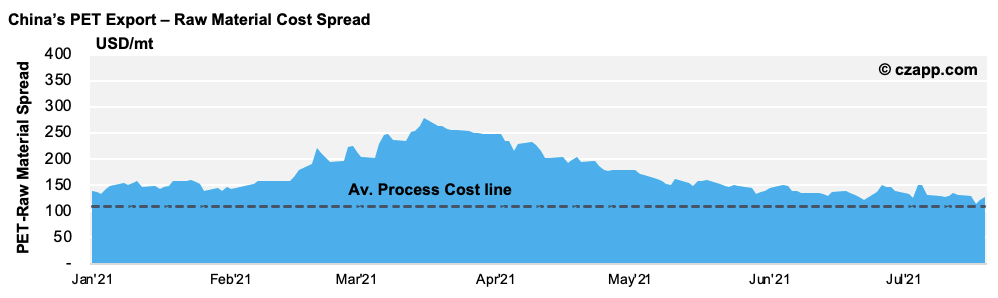

- However, despite export prices rising, producers were unable to improve margins due to the continuing weak demand.

- At present, the spread between spot raw material costs and PET export prices is barely above the 110 USD/mt average breakeven threshold.

- Based on average process economics, those less advantaged Chinese producers (typically non-feedstock integrated with smaller capacities) will already be in a loss-making situation.

- Facing losses, Chinese PET producers are starting to announce maintenance plans, whilst others lower operating rates at plants.

- At present, the arrival of Typhoon In-Fa has had no clear impact on PET production.

- PET price rises will do little to improve the competitiveness of Asian exports to major markets.

- Export demand remains dampened by high freight rates and poor schedule reliability, with few new inquiries.

- The end of the peak season is also visible for many buyers within Northern Hemisphere markets.

- With the recent recovery in domestic production in Europe, converters are increasingly seeking cheaper and lower risk resin closer to home.

- Even with the potential for PET production cuts, export demand is now on the seasonal slowdown, and we see limited upside for process margins through to year end.

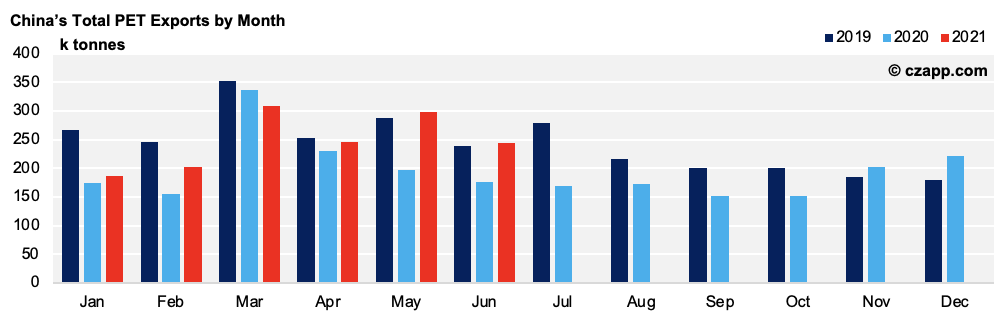

- China’s PET export volumes are down by around 18% month-on-month for Jun’21.

- Exports to most major target markets have seen demand weaken.

- Those to Russia are down 62% month-on-month, as are those to the Philippines (43%), Ukraine (32%) and Algeria (70%).

PTA Futures Jump Upwards

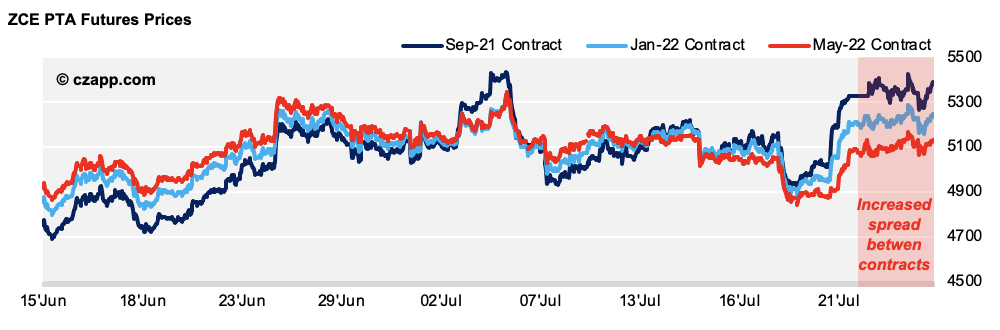

- With the rise in spot PTA prices last week, PTA futures also jumped upwards.

- Noteworthy was the spread increase between the September and January contracts indicating that PET supplier costs for forward prices next year are far cheaper than they are now.

Market Outlook

- With PET margins set to remain suppressed in the near-term, Asian PET export prices should track raw material costs through to the end of the year.

- Whilst any disruption to PTA supply following the recent typhoon should be short-lived, PTA demand from the polyester fibre market could build through Q3, supporting raw material prices.

- Taking into consideration the current spread between the September and January PTA contracts, raw material costs may slow through Q4, indicating a potential pullback in PET resin prices over this period.

- On the flip side, any further strengthening in crude oil could propel PTA and PET prices higher; both Goldman Sachs and JP Morgan have raised oil price forecasts following the latest OPEC+ agreement.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…