Insight Focus

- Interpreting economic indicators has become more and more difficult through 2023.

- For the supply chain, the good news is that pressure has eased, and freight prices may be stabilising.

- While there is some room for optimism, rate hikes are likely to continue for the meantime.

Supply Chain Pressure Eases

The past few years have been characterized by tangled supply chains and difficulty transporting goods. Now, it seems like the pressure has finally unravelled.

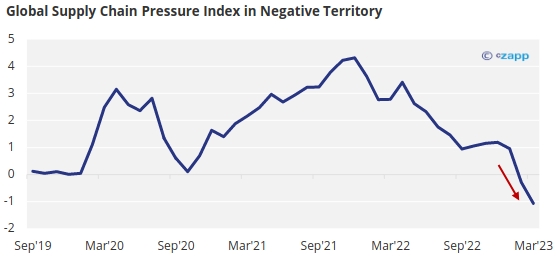

According to the New York Fed’s supply chain pressure index, the issues causing a lot of price inflation over the past few years are being alleviated. In the two most recent readouts, the index dropped into negative territory, meaning the supply chain is feeling no pressure at all.

Source: New York Fed

A Glimmer of Hope for Freight Rates

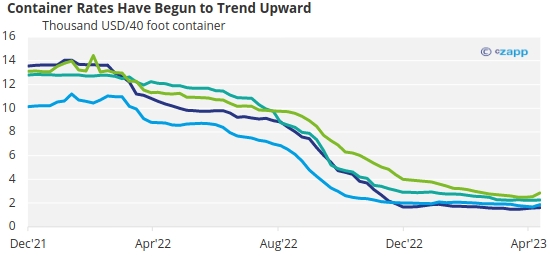

A lack of supply chain pressure could be seen as a negative factor for freight rates. In mid-2021, supply chain blockages were a huge supporting factor for freight prices, given there was huge demand and limited supply.

But even as supply chain pressure is easing, it seems container prices are beginning to turn a corner. The New York and Los Angeles routes assessed by Drewry made substantial month on month gains in April after a sustained fall over 2022 and 2023.

Source: Drewry World Container Index

An uptick in container rates could indicate an increase in consumer spending.

GDP Still Healthy Despite Headwinds

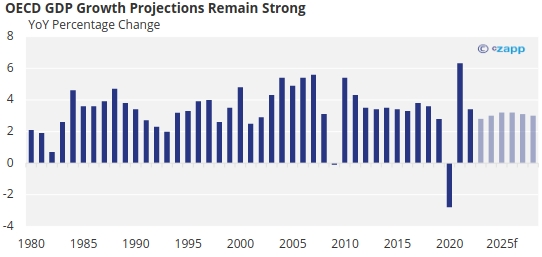

GDP is an important economic indicator and is generally a good measure of an economy entering a recession. OECD GDP contracted into negative territory during The Great Recession in 2009, and again in 2020 during the worst of the Covid-19 pandemic.

Source: IMF

However, IMF predictions show that year over year GDP is not expected to enter negative territory in the period to 2028.

Everyday Costs Will Remain High

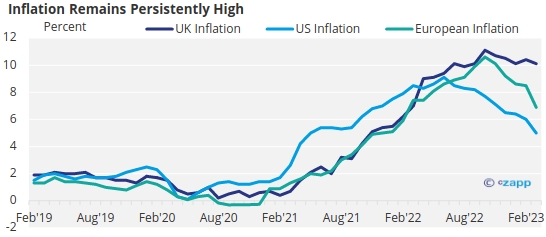

Across many economies, inflation continues to come in above target levels. In the UK, inflation has been in double digits since September. And even though the US and Europe have managed to rein in price inflation, it is still much higher than target levels at 5% and 6.9%, respectively.

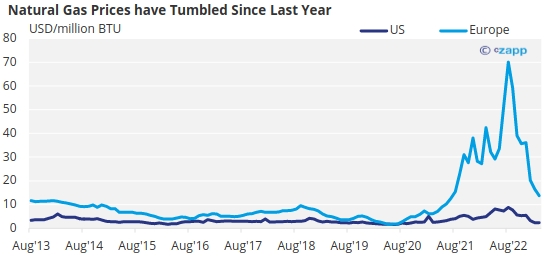

This remains true despite energy prices – one of the biggest contributing factors to inflation in 2022 – dropping to near-normal levels.

Source: World Bank

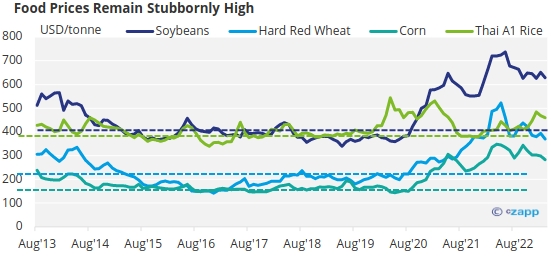

But despite falling energy prices, the cost of food remains stubbornly high. There are a number of factors contributing to this environment, including uncertainty over the future of the Ukrainian grain corridor and drought in Europe.

Note: Dotted line indicates 2019 average

Source: World Bank

Concluding Thoughts

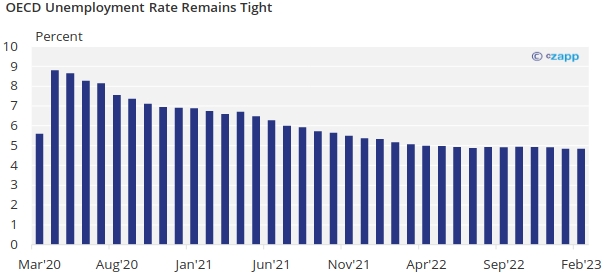

Even as costs remain high, employment is tight. According to the OECD, unemployment in February was just 4.8%, its lowest point in over three years.

Source: OECD

Low unemployment levels can be seen as inflationary as they increase costs for businesses and generate additional economic spending.

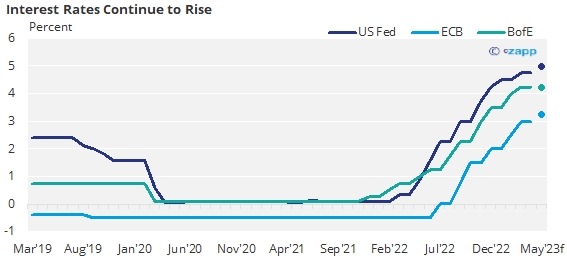

Despite positive signals across several economic indicators, continued inflation will ultimately create difficulty in doing business as costs inevitably rise. Interest rates are expected to be hiked at least one more time by the Fed, while higher inflation in the UK and EU might create the need for even more hikes.

Source: US Fed, ECB, Bank of England