Insight Focus

- Global supply chains have still not returned to normal.

- Poor harvests, adverse weather labour shortages have compounded the issue.

- All this will affect breakfast foods around the world.

We’ve all heard about the potential wheat shortages caused by Russia’s invasion of Ukraine, but many other staples on our breakfast plates could be hit by the current supply chain issues. Here are just some of the dishes that you should expect to be impacted by current supply chain issues.

Porridge

Porridge – or some variety of it – is typically eaten in eastern and northern Europe, as well as New Zealand and Australia. In Russia, Poland, Belarus and Ukraine an oat-based dish called Owsianka is a breakfast staple.

Russia is the second-largest oat producing country in the world, having produced 4.1m tonnes in 2020 – over 16% of global supply. Russia’s invasion of Ukraine has jeopardised that supply, given Russia’s increasing isolation from global trade.

Canada is the largest producing country in the world, with 4.6m tonnes produced in 2020, while the EU produces 9.3m tonnes. These regions account for about 55% of global production.

But long before the Russian invasion, the oat industry was facing issues. Both the US and Canada have been plagued with issues, including drought and equipment delays. North American oat harvests were near record lows in 2020 and less area was planted for 2021/22. The USDA expects Canadian exports to fall on reduced supply, while demand from the US and Latin American remains strong.

In the EU, the USDA estimates that 2021 production fell from 9.3m tonnes to 7.4m tonnes in 2020. The majority – 6m tonnes – is earmarked for feed and a marginal amount should be exported. Ending stocks are being depleted from 445k tonnes for the 2020/21 harvest to 331k tonnes for 2021/22. The five-year average stock level is 451k tonnes.

Fruit

Fruit is commonly eaten for breakfast around the world. In Mexico, papaya, mango and melon are common, while in Germany, fruit consumption generally takes the form of berry marmalades and preserves.

COVID lockdowns have been disrupting supply chains since 2019. Food and particularly fruit is very susceptible to supply chain delays due to its perishable nature. The US, for example, imports 55% of the fresh fruit it consumes, while the EU trades about 30m of the 80m tonnes of fresh fruit and vegetables it produces annually.

The US and Spain are the two largest fruit exporters globally, followed by the Netherlands, Mexico and China. China is a major fruit exporter, having exported 3.55m tonnes in 2021.

China has been following a zero-Covid policy imposed by the government, meaning isolation and lockdown in the event even one case is detected. This has

heavily disrupted global freight, with huge backlogs at Chinese ports. According to Bloomberg, congestion at Chinese ports is gridlocking 10% of the global containership fleet, meaning fewer vessels are available to carry goods.

Many farmers have now cut their 2021/22 plantings for various produce after logistics scarcity left millions of tonnes of perishable goods to rot on farms.

One major input cost for cold chain storage is electricity. Energy costs vary globally but according to the Cold Chain Federation, “the operation of a low-temperature, industrial-size cold store facility requires approximately 30kWh per cubic metre per year”. In Europe, insurer Allianz expects a 30% rise in energy costs in 2022, adding huge costs to the energy bills of cold chain storage operators.

Douhua (Tofu Pudding)

Tofu pudding is eaten in several forms across Asia-Pacific. In Vietnam, it’s referred to as Tau Hu Nuoc Duong and is normally served at Dim Sum. In the Philippines, it’s known as tah and is served with brown syrup. In Northern China, it’s often eaten as a savoury snack with soy sauce.

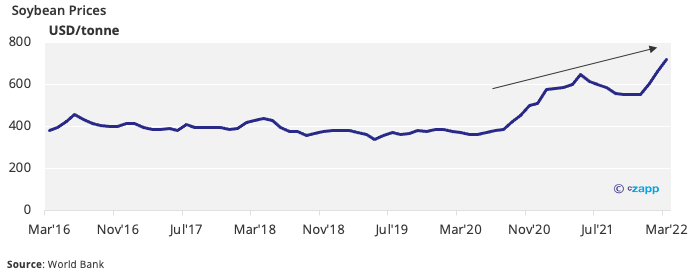

Tofu is made from soybeans, the price of which has been soaring amid a global grain shortage. Bottlenecks in logistics have also limited supply.

China produces just 14m tonnes of soybeans each year. In 2020, it imported over 100m tonnes, making it particularly vulnerable to the current supply chain volatility.

In addition, the largest soybean producers globally are Brazil and the US, each producing about 125m tonnes per year. Both Brazil and the USA are highly exposed to Russian fertilisers, with Brazil sourcing about 9.8m tonnes of fertiliser each year from Russia, which equates to around 23% of supply. Brazil and the US are now working to boost domestic fertiliser output but this is unlikely to come to fruition in the short term.

Ful Medames

Ful medames is a traditional Egyptian breakfast food. It comes in the form of a stew of cooked fava beans served with olive oil and several herbs and spices.

With soybeans increasing in price and becoming scarcer, the search for alternatives is on. Research from the University of Copenhagen suggests fava beans hold great promise as a non-soy source of plant protein. And with focus on more environmentally friendly alternatives, some of the demand for soybeans could shift to fava beans.

This is especially important for China, which is the largest producer of fava beans, accounting for over one-third of global production. China is also the largest consumer of soybeans. If it can substitute some of its soybean demand with fava beans, this will alleviate some pressure on imports but could also take some fava bean supply from the Middle East.

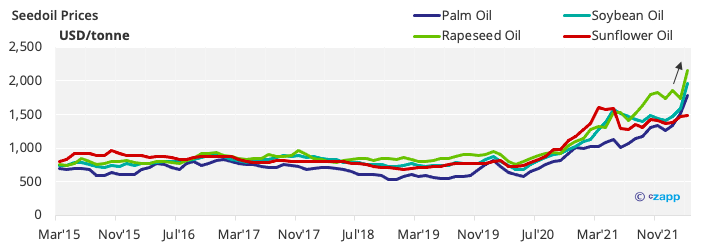

Another ingredient in ful medames is olive oil. Given that Ukraine and Russia are the two largest sunflower oil producers globally, accounting for over 50% of production, the war has driven the price of all cooking oils skyrocketing.

This could lead to a shortage of cooking oils in the Middle East, meaning a key ingredient in ful medames would become cost prohibitive.

Moo Ping

Moo Ping is a common feature in Thai street food and is often eaten for breakfast. Moo Ping and other grilled meats make a convenient, filling and tasty breakfast but are usually served throughout the day.

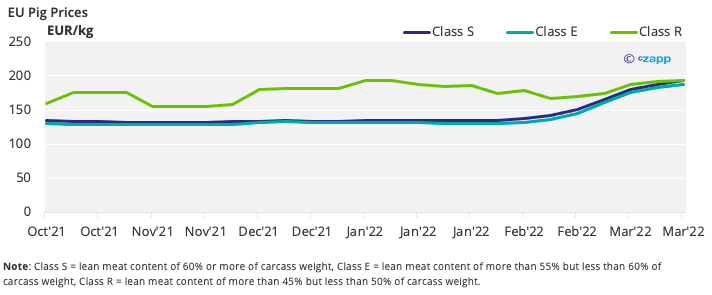

Globally, the swine industry has been contending with a variety of problems, such as chronic labour shortages, disrupted CO2 supplies andincreasing transportation costs. In the UK, farmers have warned that about 170,000 pigs face culling due to a lack of abattoir workers. The USDA’s 2022 pork production forecast was reduced by 65m tonnes due to lower-than-expected slaughter numbers for February.

China produces and consumes roughly half of the world’s pork. Over the past few years, China has been struggling with African swine fever across its herds, although it’s now rebuilding.

Asia is not the only consumer of pork for breakfast. In North and Eastern Europe, bacon and sausages are a common breakfast staple – so the situation could get worse for Wurst eaters.

The EU is the second-largest pig meat producer, accounting for 21% of global production. Across Europe and particularly in Germany, there’s been a massive sow herd liquidation. The number of pigs on European farms was down 5% on the year at the end of 2021 to 142 million. Prices are now close to EUR 200 per kg carcass from as low as EUR 130 per kg in October.

Shakshuka

Shakshuka is a traditional North African and Middle Eastern breakfast meal made from eggs, tomatoes, olive oil and spices. The dish is said to have originated in Tunisia.

Certain countries are currently facing a major egg shortage ahead of Easter and Passover holidays. A chronic grain shortage caused by the war in Ukraine has caused huge feed cost increases for farmers and are squeezing margins to the limit.

Chicken feed typically contains cereals such as wheat, corn, sorghum, barley or rye, in addition to proteins from soybean, canola or sunflower meal. In addition, fat is rendered from pig or beef fat or linseed, soy, sunflower or palm oil. As we’ve covered previously, the prices of all these inputs are skyrocketing amid the Russia-Ukraine war. The lack of feed ultimately leads to smaller or fewer eggs.

Spain is a major egg exporter, selling about 92k tonnes per year to the international market. The trucker strike in Spain is also causing complications for importing countries, forcing Israel to import eggs from Poland to ensure supply is sufficient for the upcoming Passover holiday. On this date, egg consumption increases by about 10% to around 22 eggs per person per month.

The other primary ingredient in Shakshuka is tomato. With McDonald’s rationing tomatoes on its burgers, you know the issue must be serious. The shortage is partially due to a drought in California, which produces about 6% of the world’s tomato supply, or about 12m tonnes.

Morocco has also announced limitations on tomato exports, which it sends mainly to EU markets. Prices soared this month, generating protests as concern grew over shortages ahead of Ramadan. Morocco is the EU’s largest tomato importer outside of the trading bloc.

Pão de Queijo (Cheese Bread)

Brazilian cheese bread is a common breakfast snack, often paired with a cup of coffee. It is thought to have originated in the country’s southeast but the robust dairy industry in Minas Gerais state is credited with refining the recipe.

As far as global commodities go, wheat is in short supply. Unfortunately, it’s one of the main ingredients in Brazilian favourite pão de queijo.

Another issue the staple might face is the supply of cheese. Farmers trying to feed dairy cows are facing the same issues as those feeding chickens for eggs. Dairy cows mainly eat grass, which accounts for over half their diet, but grains also make up about a quarter. Cows are also fed protein-rich feeds such as soybean meal.

With lower grains availability, this could lead to a less-balanced diet for dairy cows, in turn creating issues for milk and cheese yield.

Other Insights That May be of Interest…

Russian Invasion Could Make India a Major Global Wheat Player

Explainers That May Be of Interest…