Insight Focus

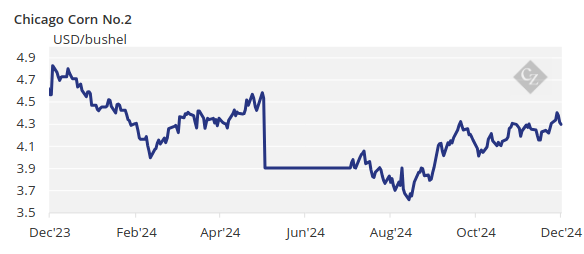

Corn rallied this week following a bullish WASDE report. China and Brazil reduced their production forecasts. Profit-taking emerged by the end of last week, but with harvest pressure gone and the market adjusting to lower stock levels, consolidation is expected.

The December WASDE report has resulted in a tighter corn balance, prompting an upward revision to our price forecast. With western hemisphere crops already harvested, attention now shifts to South American planting progress, which is running well, with conditions remaining excellent thus far. Additionally, cold temperatures and their potential impact on planted wheat should be another focus in the coming weeks.

By the end of last week, we observed some profit-taking in Chicago for both corn and wheat. However, there appears to be no reason for the market to trade lower now that corn harvest pressure has subsided, and the market has already priced in the new, lower stock environment. Expect consolidation of last week’s price movements, with corn potentially testing the USD 4.5/bushel level.

We are revising our forecast for Chicago corn for the 2024/25 crop (September/August) upwards, now expecting an average of USD 4.35/bushel, compared to the previous forecast of USD 3.90/bushel, following the December WASDE. The average price since September 1 has been USD 4.18/bushel.

Corn Rallies Following Bullish WASDE

Corn in Chicago started the week strong, following export inspection exceeding estimates and expectations of lower stocks in the December WASDE. The rally continued on Tuesday following a bullish WASDE report, but profit-taking emerged in the second half of the week, with the March future closing 0.5% higher week-on-week.

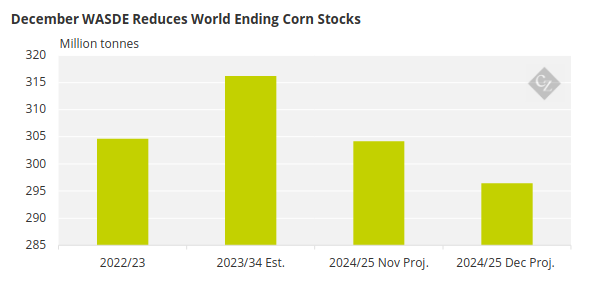

The December WASDE report surprised the market with a 200-million-bushel reduction in US corn ending stocks for the 24/25 crop, entirely from the demand side. The USDA projected 150 million bushels of higher exports and 50 million bushels of increased demand for ethanol. The market had anticipated a reduction of just 31 million bushels, which explains the rally immediately following the publication.

The new ending stock figure of 1.739 billion bushels is below last crop’s figure of 1.76 billion bushels, bringing the stock-to-use ratio down to 11.5% from 12.9% previously.

Global corn stocks for 2024/25 were reduced by 7.7 million tonnes, not only due to higher consumption and exports in the US but also because production was revised lower in the EU by 800,000 tonnes and in Mexico by 700,000 tonnes. This now represents a yearly stock destruction of 19.8 million tonnes.

Source: USDA

China’s CASDE (its equivalent of the WASDE) also published its December report last week, reducing its corn production forecast by 3.2 million tonnes to 297 million tonnes, compared to 293.8 million previously. Similarly, Brazil’s CONAB downgraded its corn production forecast for 2024/25 by a marginal 170,000 tonnes to 119.63 million tonnes, down from 119.8 million tonnes. This was immaterial to the market.

Western hemisphere corn is now fully harvested. In South America, summer corn planting in Brazil is 72.2% complete compared to 65.9% at this time last year, with crop conditions remaining favourable, according to CONAB. Corn planting in Argentina is 55.6% complete, with 97.9% of the crop rated as good or excellent.

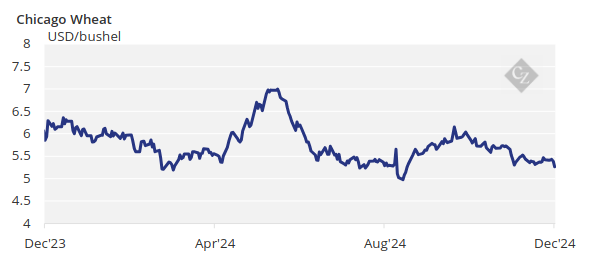

US Wheat Outlook Shifts, Weather Forecast Mixed

On the wheat front, the December WASDE reduced US carry by 20 million bushels, primarily due to a 25 million bushel increase in exports, partially offset by a 5 million bushel increase in imports. The market had been expecting an immaterial reduction of just 2 million bushels in US carry.

Wheat prices initially followed corn’s lead, but the negative end to the week resulted in weekly losses in Chicago, while Euronext posted weekly gains.

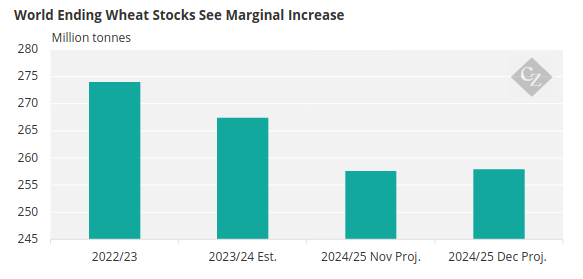

World stocks increased by a marginal 300,000 tonnes, contrary to the market’s expectation of a 600,000-tonne reduction. Production in the EU was revised lower by 1.3 million tonnes and in Brazil by 400,000 tonnes and global consumption was also reduced, resulting in slightly higher stocks. The yearly stock draw stands at 9.5 million tonnes.

Source: USDA

By the end of the week, US sales were published at 12% down week-on-week and 31% lower compared to the four-week average, prompting a market sell-off.

On the weather front, rains continue to benefit central and southern Brazil as well as Argentina, which is highly favourable for corn development. In the US, little rain is expected across the Corn Belt, but mild temperatures are favouring wheat development. Ample rainfall is forecasted for France and Germany, while Eastern Europe is expected to experience cold and dry conditions.