Insight Focus

EUAs have fallen to six-month low. US tariff announcements triggered widespread sell-off across energy and equities. Volatility overshadowed the annual release of verified emissions data showing a 5% drop in 2024.

US Tariffs Spark Volatility in European Carbon

European carbon prices have swung wildly in the last three weeks, buffeted by volatility in energy and financial markets in response to the introduction of new import tariffs by the US that have cast doubt on Europe’s longer-term industrial outlook.

The severe price swings overshadowed the annual publication of verified emissions data from the more than 11,000 installations covered by the EU ETS, which came in largely as forecast.

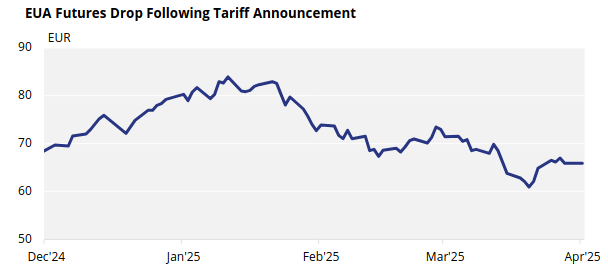

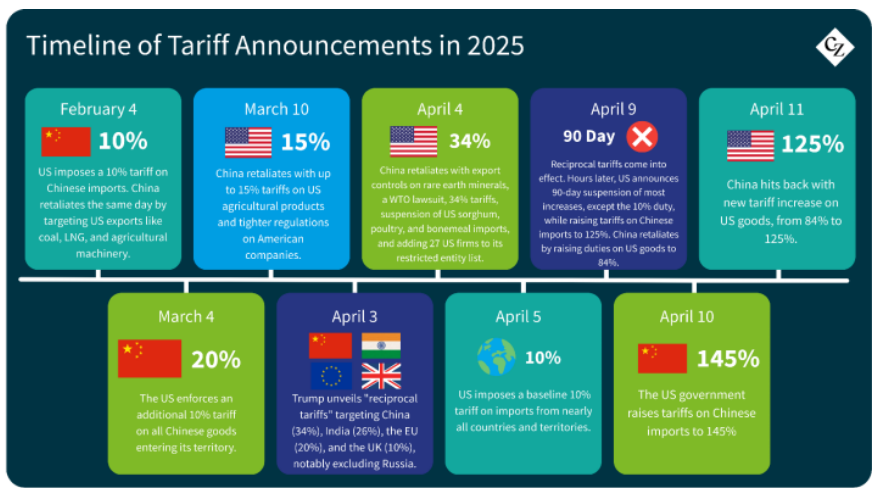

Energy and carbon markets were thrown into confusion from the last week in March, as traders began to speculate over the breadth and scale of US tariffs that were scheduled to be announced on April 2. EUA futures prices began to slide from a high of EUR 74.23/tonne as many participants adopted a “risk-off” strategy ahead of the announcement.

Source: ICE

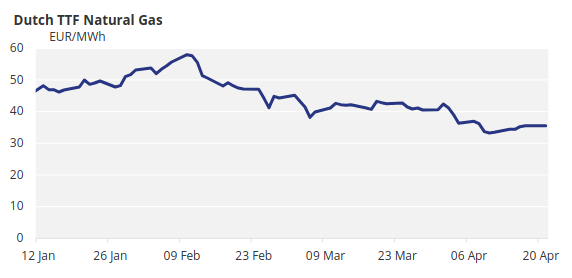

After the White House had announced a universal 10% import tariff, with selected countries having additional levies imposed, EUAs, natural gas and electricity prices began to tumble.

Within a week of the first announcement, carbon had dropped as much as 19% from its mid-March highs to a low of EUR 60.07, while front-month natural gas prices had retreated by 18%.

Sources described the plunge in prices as reflecting a sense of panic among energy traders, who switched from watching natural gas prices to monitoring the ebb and flow of US and European equity markets, using share prices as a proxy for the EU’s industrial outlook in a new era of US protectionism.

The initial shock of the tariff announcements was followed by some rowing back by the White House, in which tariffs were delayed or, in the case of China, ramped up. By the Easter break, the tension had largely abated, but the resumption of trading this week is likely to see renewed focus on US geopolitical moves.

Funds Slash Positions as Carbon Prices Stabilise

The three-week sell-off also featured a widespread reduction in long exposure by investment funds. Speculators held a little over 75TWh in natural gas net length, compared to nearly 300TWh in the fourth quarter of 2024.

For carbon, the price decline saw funds slash their net long positions to just 1.7 million EUAs, after a five-month stretch of net length that had ballooned to as much as 60 million allowances.

Since reaching their EUR 60.07 low on April 9, however, EUA price has stabilised and even rallied slightly. The December 2025 futures market went into the Easter break at EUR 65.89/tonne and had nearly breached key technical resistance levels at just over EUR 68 in the days prior.

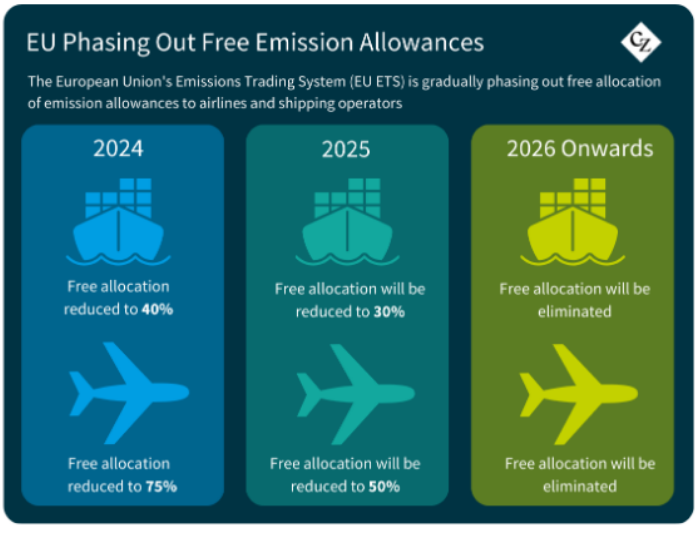

While the market was busy reacting to the news from Washington, Brussels quietly published the annual verified emissions data for the 11,500-odd plants as well as 1,500 aircraft operators that participate in the EU ETS.

According to preliminary data, emissions fell by 5% in 2024, driven chiefly by a 12% drop in emissions from the power sector. The European Commission explained that renewable energy output had risen 8% and nuclear by 5%, while gas-fired power generation declined 8% and coal output fell 15%.

Overall industrial emissions were little changed, the data showed, though there were some variations among different sectors. The Commission reported that fertiliser emissions were up 7% while cement dropped by 5%.

Analysts had predicted a decrease in the range of 6-7%, and it was a 15% jump in aircraft emissions that generated the surprise result.