Insight Focus

Carbon utilisation presents other opportunities, particularly for maritime markets or new uses, so that element of 45Q is also important. The US’ 2022 Inflation Reduction Act’s tax credits support biofuels. Carbon capture (45Q) and agriculture practices under 45Z are key strategies. The industry is also exploring growth in vehicles, maritime and industrial markets while pushing for year-round E15.

Brian Jennings has played a role in US agricultural and energy policy for over two decades, including serving as a legislative assistant to US Senator Tim Johnson (D-SD) and as a lobbyist with a South Dakota farm organization.

Brian Jennings

Brian helped draft and enact the 2002 Farm Bill, crop insurance reform, and the Renewable Fuel Standard (RFS).

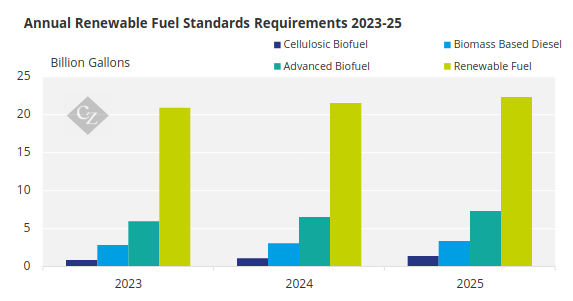

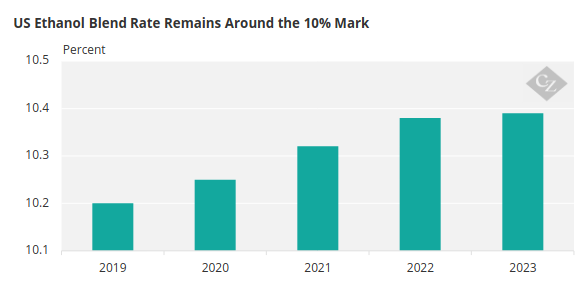

Source: EPA

Jennings joined the American Coalition for Ethanol (ACE) in 2004 as its top executive. He has presented testimony to Congress, federal government agencies and state legislatures and has represented the US ethanol industry before major newspaper editorial boards and national television and radio.

Jennings grew up on a South Dakota cattle ranch and grain farm, which his family has owned and operated for more than 100 years. He is a graduate of South Dakota State University.

I sat down with Jennings to discuss the future of the biofuels industry and the impact of recent policy changes.

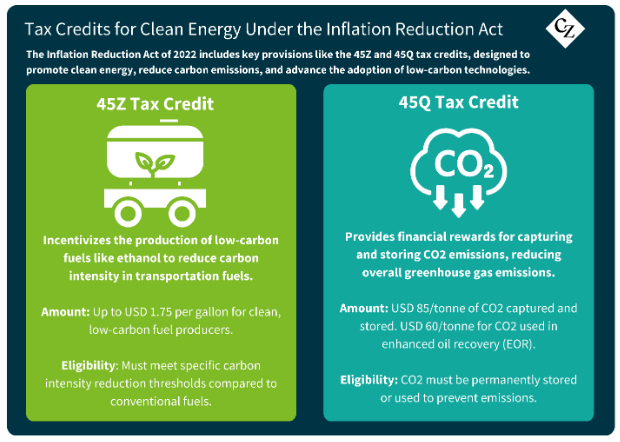

The 2022 Inflation Reduction Act created the 45Z and 45Q tax credits to encourage the production of clean transportation fuels. How important are these tax credits to the US biofuels industry?

These tax credits are critically important to recoup investments, to reduce carbon intensity and unlock new opportunities to market ethanol in the US and globally. We cannot and will not fulfil low carbon fuel market opportunities domestically and globally until, and unless, we are able to make meaningful reductions in carbon intensity.

The quickest way to reduce carbon intensity is carbon capture and sequestration (45Q). The next most meaningful way is through agriculture practices, which we hope/expect are part of a final 45Z regulation.

Carbon utilisation presents other opportunities, particularly for maritime markets or new uses, so that element of 45Q is also important.

In what ways can ethanol producers help influence the adoption of Climate Smart agricultural practices?

If ag practice Greenhouse Gas (GHG) benefits are allowed as part of the 45Z tax credit final regulation from Treasury, ethanol producers would have the option to engage their corn suppliers (farmers) on the importance of low carbon corn– it will be their choice.

We are working with several ethanol companies who express interest in doing this, but not until they know the rules of the road regarding 45Z.

How likely is it that the Trump administration will gut current biofuels initiatives?

We believe this is unlikely because ethanol and biofuels are important to the Trump base.

Are Trump’s cabinet appointees for Agriculture and Energy supportive of greater ethanol production and use in the greater energy mix?

We believe so, yes.

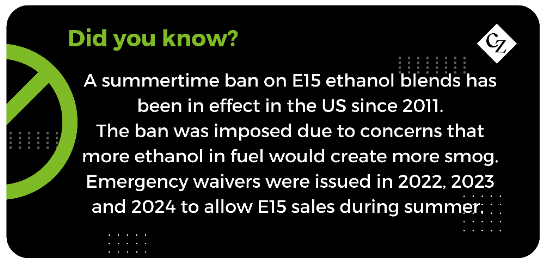

Can and will the US Congress pass legislation to restore year-round nationwide E15? What would be the impact on the ethanol industry?

Congress must pass legislation, because with the exception of EPA emergency waivers, other EPA attempts to allow E15 year-round have been and will be challenged by oil interests in court.

Congress must once and for all update the statute to ensure E15 can be used year-round in all parts of the country. We came closer than ever in 2024, and we’re working with our champions in Congress to get this over the finish line in 2025.

SAF is a hot topic around the world. Is the US ethanol industry gearing up?

Frankly the policy/incentive structure needs to improve dramatically before the US ethanol industry gears up to pursue SAF in a meaningful way. The current tax incentive is viewed by some as inadequate, and by all as not long enough, to get the SAF industry going.

Specifically, what changes are needed to improve the policy/incentive structure?

The experts we talk to say steps must be taken to help make SAF much more cost competitive with kerosene/fossil-based aviation fuel. That may require additional tax incentives/benefits or financial subsidies, beyond what is available today in the US.

Others suggest that in addition to more significant tax benefits or subsidies, a mandate would be needed to support SAF.

SAF is a potentially massive and game-changing market opportunity if the policy structure is sufficient, so of course the industry is keeping a sharp eye on that potential.

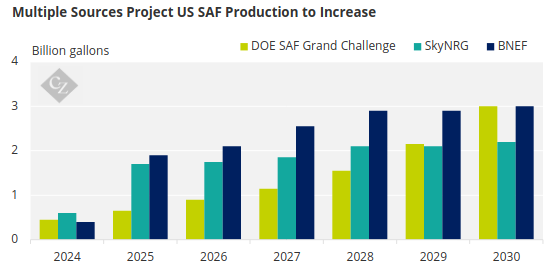

Source: ING

Could there be some new market opportunities for ethanol beyond SAF?

First and foremost, we are not ceding the light-duty vehicle market. The current blend rate in the US stands at between 10% and 11%, and we know E15 year-round will help increase that percentage.

Source: EIA

We also know mid-level blends such as E20 and E30 have a role in the future, and E85 is a near-term market opportunity today for flexible fuel vehicles (FFVs). So, we have a long way to go in pursuing greater market share for on-road vehicles. US ethanol exports reached a record in terms of value and volume in 2024. We will continue to push for opportunities to export.

Finally, the industry is also looking at maritime, heavy-duty and industrial markets in the future.

What Role does ACE Play in the US ethanol industry?

ACE was formed over 35 years ago largely by visionary farmers and agribusinesses that believed ethanol would give farmers a value-added market opportunity and help revitalize the struggling rural communities depending upon agriculture.

When corn prices fell below USD 2/bushel in the mid-to-late 1980s, farmers were looking to add value to their crops. Without any template or precedent – and long before the explosion in clean technology or mainstream enthusiasm for sustainability – brave individuals came together and committed their own money and time to rescue their families, neighbours and communities by building ethanol plants.

One of these brave individuals was Minnesota farmer Merle Anderson who travelled with his banker to Lincoln, Nebraska, to learn more about ethanol, and came back with evangelistic passion. With the help of others, Merle devoted blood, sweat and tears to form ACE as a true coalition, a big tent for organisations and people from all walks of life who believed ethanol could help lift farmers and rural communities out of the economic doldrums they were facing at the time.

Today, ACE represents nearly 200 member companies across the nation, including ethanol producers, commodity organisations, rural electric cooperatives and industry vendors.

Biofuel factory