Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

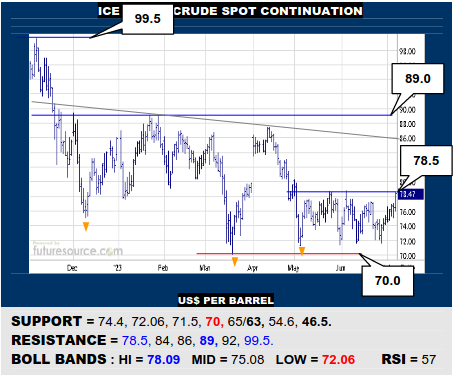

ICE BRENT CRUDE OIL SPOT

Yet a fourth clamber back up from the low 70’s now faces the same old challenge as before in Brent, namely to pop the 78.5 resistance in order to hone the past two months into a preliminary base from which to shoot for the 86-89 realm. If foiled by 78.5 once more, do always be wary of any next drop as actually breaking 70 could cascade through to 63.

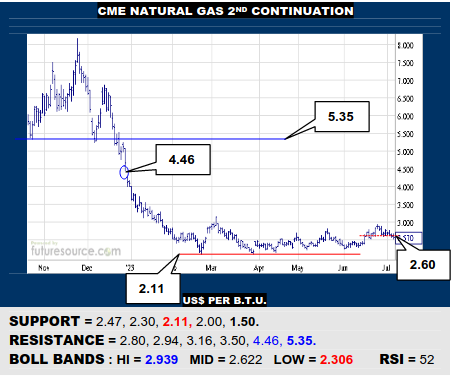

NYMEX NATURAL GAS 2ND CONTINUATION

What looked the best upside escape yet still faltered late in Jun and Nat Gas has slid back through its mid band and rear guard support at 2.60 to create a small H&S type pattern. This warns to cater for a dunk to 2.30 even if not initially fearing for 2.11. Otherwise needing to pivot back over 2.80 to dispel the impression of a nearby top.

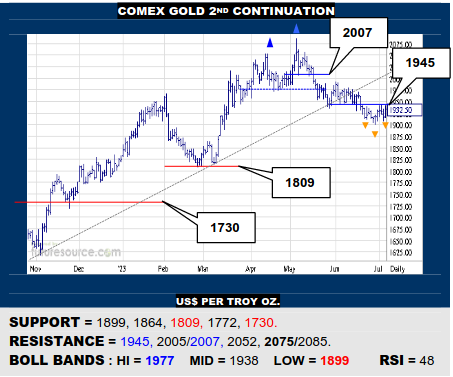

COMEX GOLD 2ND CONTINUATION

Curious action in Gold as a Jun uptrend derailment never really pulled out the rug and the market has been piecing together a small inverse H&S shape in the past three weeks. If it could complete this by piercing 1945, it could trigger a stab back up to test the ex-trend (2005/2007). If blocked at 1945 though, stay wary of the relatively thinly guarded 1800’s.

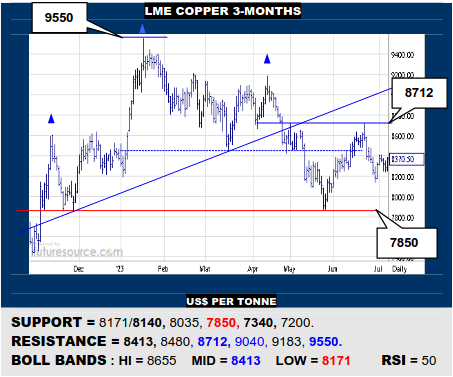

LME COPPER 3-MONTHS

A late Jun setback was caught by the lower Bollinger band (8171) and Copper has stabilized a little early in Jly. If it could now lunge free of the mid band (8413), this weeks’ consolidation could resolve as a flag and aim towards 8712 again for a bigger basing opportunity. A frail footing meantime so mind 8140 as a tripwire back to 7850 again instead.

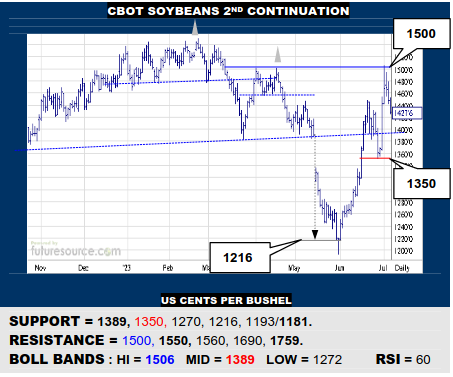

CBOT SOYBEANS 2ND CONTINUATION

A late Jun dip was tempered by the mid band to spark a next flurry to 1500 but Beans faltered there and would duly now be ready for another approach to that underlying mid Bollinger (1389). If it gave way, beware emulating Corn with a steep sell off into the 1200’s again. If the mid band held tight, 1500 could be tested again seeking the 1700’s beyond.

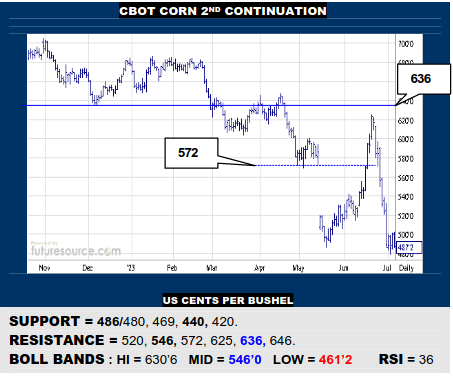

CBOT CORN 2ND CONTINUATION

Unlike Beans, Corns’ fumble just shy of the bigger weekly H&S border at 636 led to a total capitulation and it has crashed back out of the 500’s. Wary of nearby congestion becoming a bear flag then and a break of 480 would duly threaten an ongoing dive into the 440-420 monthly support. Must at least pop 520 to dispel flag fears and stabilize better.

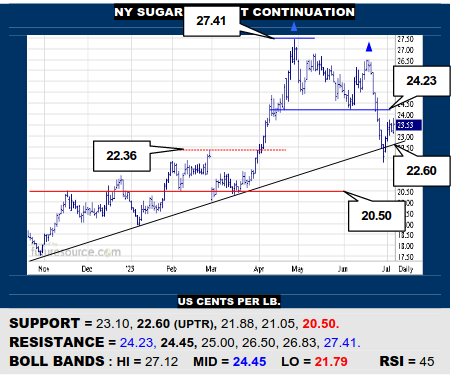

NY SUGAR #11 SPOT CONTINUATION

The dive from the Q2 offset dual top briefly glimpsed under the spot continuation uptrend but this was quickly plucked back up after the Jly contract retired. Even so, Sugar must go on to pierce the 24.23 top rim and soon arriving mid band (24.45) to make real repairs. If blunted in the low 24’s however, beware a second downswing on towards 20.50.

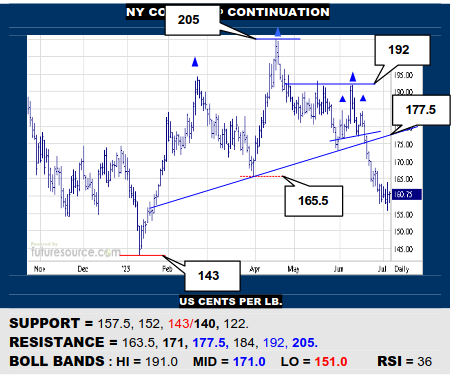

NY COFFEE 2ND CONTINUATION

Some dabbing the brake in the upper 150’s piques ideas for a corrective chance for Coffee to bounce but it must bust free of 163.5 resistance to open an initial path to the mid band (171) and the lesser possibility of following through to try the 177.5 H&S neckline itself. Dubious grip meantime and a close under 157.5 would resume towards 140 instead.

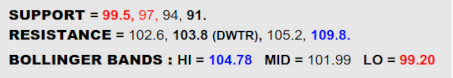

BLOOMBERG COMMODITY INDEX

Consistent with some rather non-committal flailing action in the Dollar, the B-Berg has also been nipping and tucking in the past fortnight after a mid-Jun stab at 105 simply served to confirm the presence of a broader downtrend. That trend has pressed on in the meantime and still presents a pivotal escape hatch not too far overhead (103.8) if the Dollar seriously fumbles its own rather lukewarm rebellion, then able to set sights on 109.8 as the next hurdle to a major overall shift in the macro balance. Must stay mindful of the 99.5 support meanwhile though if the Dollar somehow found a way out over 103.4 as a break there would form a new upright H&S aimed down through 97 to the 94 area.

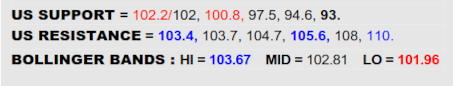

US DOLLAR INDEX

Renewed Fed rate hike expectations had nudged the Dollar up to prod the small top above 103.4 lately but it failed to make any lasting impression and fell back through its mid band Friday, leaving the recent swell looking ostensibly corrective. Admittedly, a burst free of the mid 103’s could liven things up later on and inject new verve to reach towards the broader base exit that remains 105.6. Meantime though, the past fortnight is looking toppier in its nature so keep a watch over the 102 figure now, its demise nullifying the recent murmurs of new life and warning of a potentially decisive third test of 100.8 where a next weekly step lower to the 93’s could be triggered.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.