Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

ICE BRENT CRUDE OIL SPOT CONTINUATION

Efforts early in Q4 to retrieve the weekly uptrend failure were blocked by the large ’22 top above 97 and the latter half of Q4 has shown the true repercussions of the trend break. There is now only piecemeal support until 65, a full ‘20’s Fib retracement just behind at 63. Must make room to those levels then barring a surprise reflex back over 83.5.

NYMEX NATURAL GAS 2ND CONTINUATION

A potentially B-Berg saving catch at 5.35 again has seen Nat Gas jolt back up to provisionally overcome the 6.13 gap resistance. Needing to see that secured early next week via a further vault of the mid band (6.548) to really turn the tide towards 7.52 again whereas quick rejection from above 6.13 would place the key 5.35 back on alert.

COMEX GOLD 2ND CONTINUATION

The prior Nov flag buffered an early Dec dip (1770) so Gold retains a view of first an 1855 double bottom projection and then the 1890 flag target itself. Eying that 1770 flag rim support even closer henceforth though as the mid band has arrived, meaning any swerve back below could readily tear on through 1735 to delve away into the 1670’s.

LME COPPER 3-MONTHS

Copper has approached the big weekly top frontier at 8700 once more but is wheezing a bit as momentum dwindles. If the B-Berg leapt across the 114’s, a punch over 8700 here could soon rekindle forward drive and suggest scope to 9805. Feeling distinctly fragile meantime so watch the mid band (8225) closely for any signs of a quick setback to 7850.

CBOT SOYBEANS 2ND CONTINUATION

Beans have grappled free of the 1470’s to reassure the Nov downtrend escape and expand the road higher towards the next main top structure at 1560. Must secure this aboard 1470 in coming days to maintain faith in the ongoing advance. Any backlash under 1470 would be cautionary though, getting all the more serious if the mid band broke (1453).

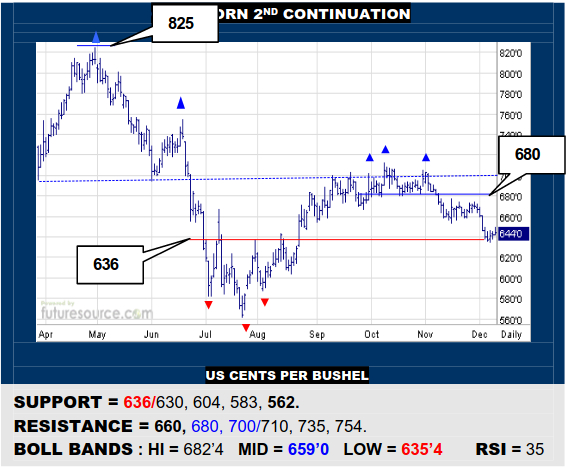

CBOT CORN 2ND CONTINUATION

Corn tested the former inverse H&S rim at 636 this week and is initially holding tight there. Nevertheless, it will now have to react back over 660 to dislodge the mid band and so buoy ideas of reining in a Q4 correction and thus starting out on the next upside leg therefore. If parried shy of 660, keep minding 636 for fear of a breakdown into the 580’s.

NY SUGAR #11 SPOT CONTINUATION

Further retrievals from the low 19’s still haven’t translated into a getaway topside, 19.94 now the escape hatch from a sketchy inverse H&S and also proposing the past month as a large bull flag aimed up to 22₵. No doubt wary of the risk to the B-Berg 109’s and if they gave way, beware washing back to challenge the 18.70 base support here instead.

NY COFFEE 2ND CONTINUATION

The Nov inverse H&S had very short lived effect and Coffee has worn that prior base away, posting a small bear flag in the process. Along with the teetering B-Berg, duly keep watch on 154 as a tripwire on south to actually reach a bigger weekly base border at 140 before expecting better support while otherwise having to vault 166.6 to stabilize quicker.

BLOOMBERG COMMODITY INDEX

The B-Berg is still gritting its teeth to hold the frequently tested 109’s support but is far from solid given the wayward state of the Crude markets, seemingly just one other significant component breakdown (like Nat Gas) from tipping over this critical Fibonacci divide. Its’ good fortunes are Metals maintaining altitude and a Dollar that hasn’t yet mounted any useful revival. Even so, it will take at least a hop back over 113.7 and fairly swift reassurance via a mid band break (114.6) to signal actually digging out of this mess. Otherwise, a clean snap of the 109’s terrain would suggest final surrender of the ‘20’s upswing and a minor backboard at 106 looks unlikely to survive that, the low 90’s then beckoning.

US DOLLAR INDEX

A subdued spell in the Dollar (perhaps again on Fed watch for mid next week) but it is an important period as it nears the main weekly 103’s support while the EU arrives at a corresponding 1.06-1.08 resistance zone. RSI has meandered sideways in the 30’s since earlier in Nov so the applying of the brakes in that time is having an effect, if only subtle for the moment. The key feature overhead is the mid band (106), needing a reaction back over there to really highlight the 103’s bracing and buoy ideas of pulling out of a Q4 correction, meaning trouble for the B-Berg. However, sweeping on through 103 would instead confirm the prior weekly uptrend collapse and open a path to first 97 and towards 89 in due course.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary