Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

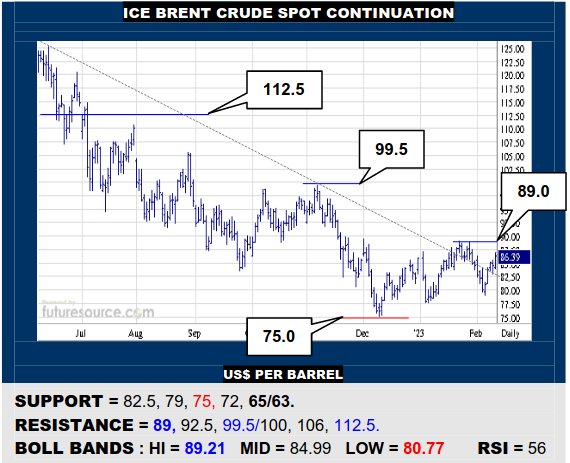

ICE BRENT CRUDE OIL SPOT CONTINUATION

Brent has shrugged off the downtrend and mid band for a second time so the week is ending well. Alas, bland indicators still demand defeat of 89 to disrupt mere ranging and cast it in a clearer basing context to free up the path to the 99.5/100 frontier. If foiled beneath 89 again, no cigar and a swerve back under 82.5 would return attention to the 75 trough.

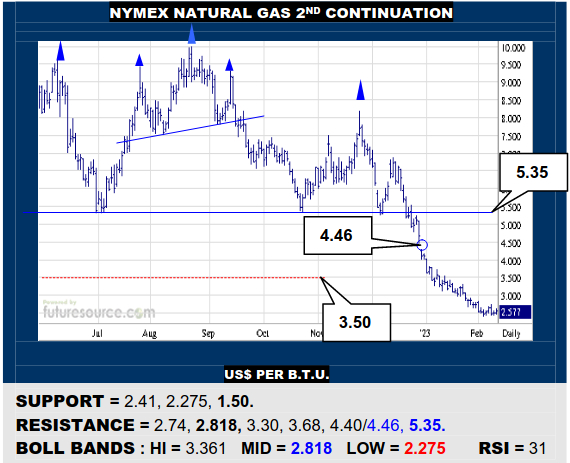

NYMEX NATURAL GAS 2ND CONTINUATION

Signs of finally leveling off for Nat Gas and RSI is enhancing this with a plainly divergent positive path. Must duly watch an immediate 2.74 resistance and the mid band approaching it (2.818). Clearing that niche would signal a rebound that could try for the 4.40’s gap. If blocked by the 2.70’s however, cater for further incremental erosion.

COMEX GOLD 2ND CONTINUATION

Gold clawed back a few Dollars this week but remained well shy of the mid band (1911) and 1915 new top border as an outside day Thursday then hinted at a bear flag forming. Thus still wary of further decay to 1830 and even the mid 1700’s, especially if the Dollar popped 104. Only a close over 1894 would start to revive and pin the crosshairs on 1915.

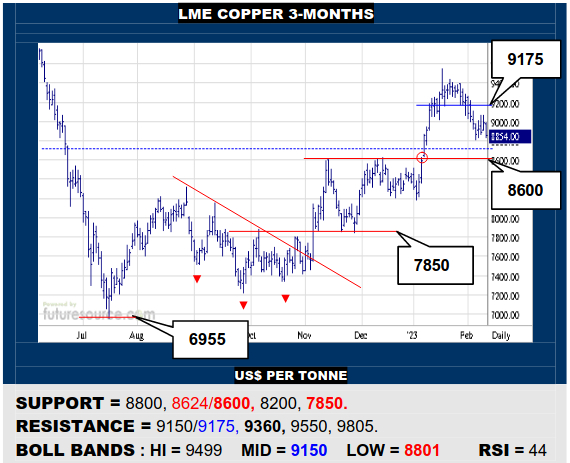

LME COPPER 3-MONTHS

A mild swell this week couldn’t reach either the mid band (9150) or a new small top rim just behind (9175) and implies a bear flag risk as Copper faded again Friday. Duly still mindful of testing a critical shelf at 8600, its collapse opening the way down to 7850. Only a jolt back over 9175 would instead propose the end of an early ’23 correction.

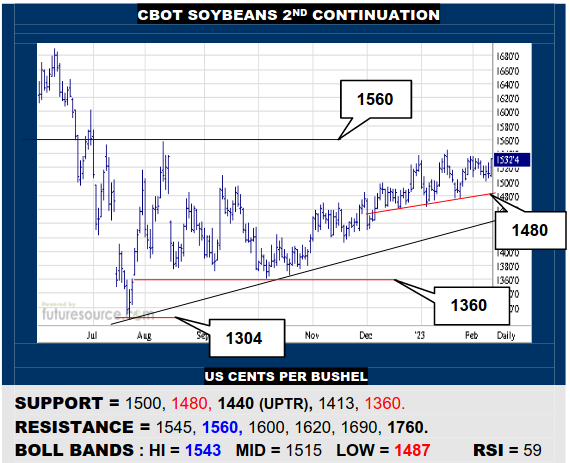

CBOT SOYBEANS 2ND CONTINUATION

The fine art of pulling teeth continues as Beans make yet another bid to disrupt the 1560 weekly frontier. Finally busting through would be liable to shed the restraints and stir some upside impetus to 1690, if not the long term peak at 1760. Beware if refused again and the Dollar index popped 104, then fearing a more violent backlash to attack 1480.

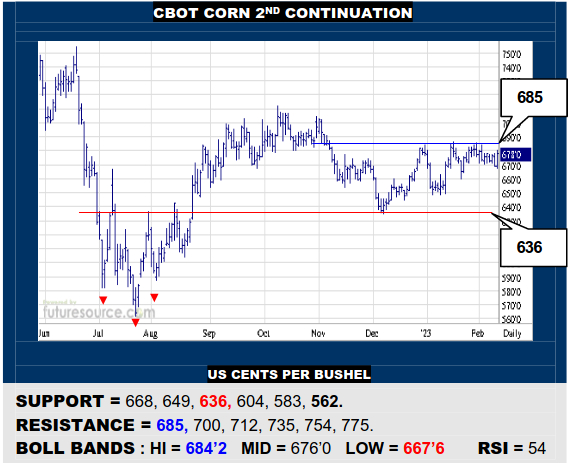

CBOT CORN 2ND CONTINUATION

Slight fraying of the 670 ledge was briskly recouped by an outside day Friday. This seems to offer Corn a final make or break shot at 685. If it bust through and the Dollar cooled, there would at last be a chance to gain some momentum and dispatch 712 for a run on up to 775. Denial by 685 again would otherwise threaten a swerve back towards 636.

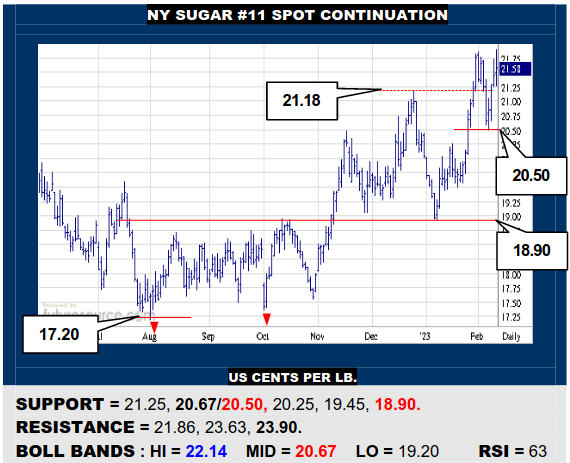

NY SUGAR #11 SPOT CONTINUATION

Sugar gathered up an early Feb dip without bothering its mid band and is back needling the 21.80’s. A close over 21.86 would thus infer moving on from a brief correction and would keep the road lit to 23.90. Beware any Dollar index hop over 104 though making the 21.80’s a stiffer wall and steering the market back to a pivotal dice with the 20.50 trough.

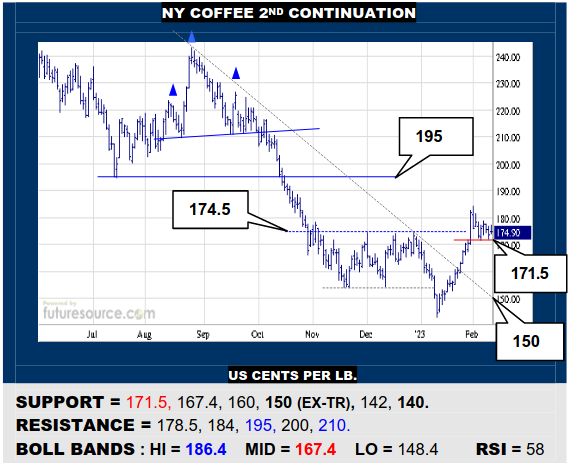

NY COFFEE 2ND CONTINUATION

The Jan verve has faded but in holding a new 171.5 support ledge, Coffee is retaining a chance to post a flag so watch 178.5 now as the trigger for a new flurry higher into the low 200’s. Only if pressed back to close under the 171’s while the Dollar speared 104 would the revival be liable to deflate, loss of the mid band (167.4) warning of a dunk to 150.

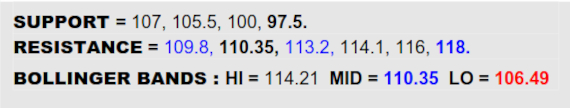

BLOOMBERG COMMODITY INDEX

Oddly similar action to the Dollar lately only not quite as vivid, the B-Berg has wrestled back a quick dunk under 107 this week and consolidated thereafter. That is a respectable first step but what it now needs to sharpen up this reaction is fresh defeat of the 109.8 divide highlighted by a break of the approaching mid band (110.35), preferably along with the Dollar veering back under the mid 102’s to undo its getaway effort. Alas, if the commodity index was generally held in check below 110, this bump would remain firmly lodged in the corrective category and there would still be cause for concern about fairly flimsy looking support rungs on down into the mid 90’s.

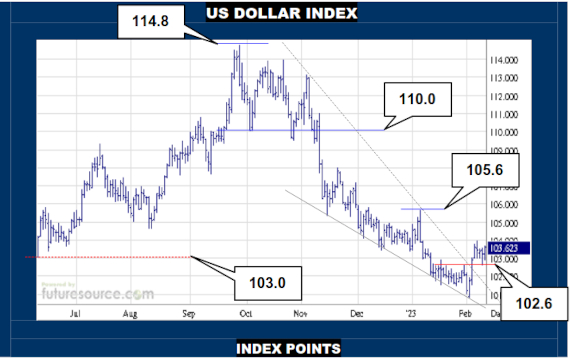

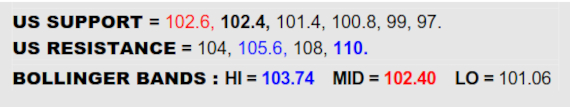

US DOLLAR INDEX

Tearing free of its interim downtrend as last week ended, the Dollar has performed a composed consolidating display during this week, dipping briefly back towards the 102.6 divide where it held securely. Quite calm and collected for now then and this patch of congestion after the trend break has obvious bull flag prospects that warrant a close watch of 104, a breakaway beyond implying a next quick drive to 105.6, seeing more extensive blue sky after that all the way to 110. Implied danger for commodities then and it will otherwise need a twist back through the 102.6 to mid band (102.4) to signal more of a stumble to instead give the B-Berg more oxygen.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary