Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

See a sample of TechCom’s Sugar Technical Review by clicking ‘Download PDF’ above.

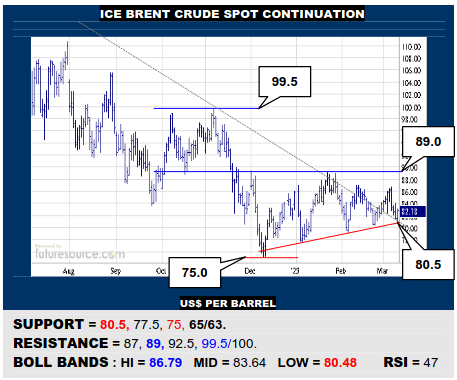

ICE BRENT CRUDE OIL SPOT CONTINUATION

Yet a third downtrend escape has stumbled shy of 89 early in Mch so where the ’23 action was originally giving off a basing vibe, it is now at risk of morphing into more of an H&S top shape. Keenly minding 80.5 as the neckline tripwire to spark a drop to 75 and maybe on to 65. Only successive hops of 87 and then 89 would revitalize this ailing scene.

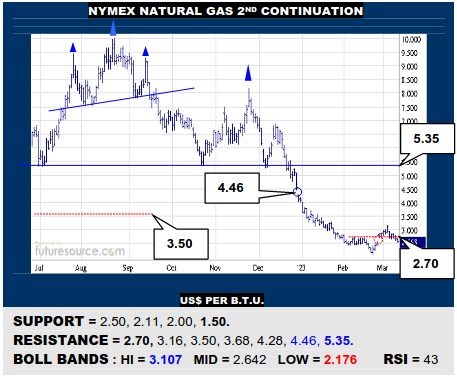

NYMEX NATURAL GAS 2ND CONTINUATION

A quick rebuke from the 3’s has eroded 2.70 support and on through a gap to 2.59. Nat Gas must thus now produce an instant rebound over 2.70 to make the gap fill the main issue and hint at ending a brief Mch correction to access the 3’s again. If not, falling from the 2.50’s would instead signal a renewed threat to 2.11 with risk down to 1.50.

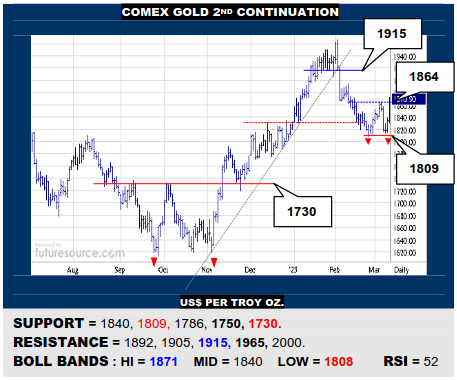

COMEX GOLD 2ND CONTINUATION

A setback as the Dollar index challenged 105.6 this week was mopped up clear of the prior 1809 trough and Gold has rallied again to pierce 1864 and claim a modest new double bottom. If the Dollar now fell from the 104’s, this base would be validated and sights set on 1915. If the Dollar held the 104’s however, don’t be so sure of the foothold yet.

LME COPPER 3-MONTHS

A muddled spell between the mild Q1 downtrend (9040) and the main 8600 support keeps Copper on tenterhooks. If the Dollar were ditched from the 104’s and the downtrend popped here, a Q1 correction would end and a next leg higher to 10K would be implied. If the downtrend wore through 8600 instead, beware a next step down to 7850.

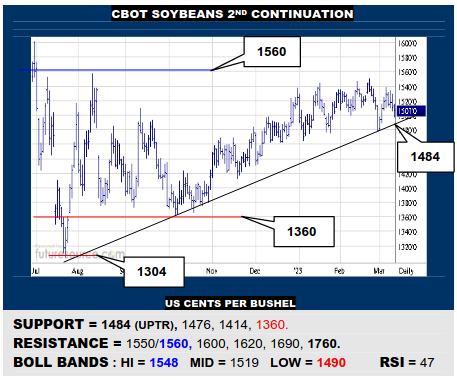

CBOT SOYBEANS 2ND CONTINUATION

Still more fumbles shy of the 1560 resistance in Beans has merited tightening the angle of the uptrend (1484). Corn serves as a blueprint for what can happen if an uptrend fails in such conditions so beware that outcome snowballing through 1476 back towards 1360. Only finally defeating 1550/1560 might spark new upside impetus.

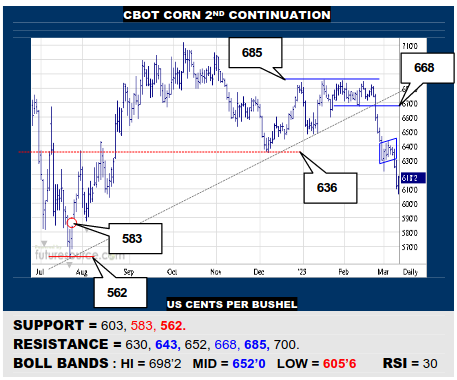

CBOT CORN 2ND CONTINUATION

Nearby 630’s congestion failed to retrieve Corns’ breakdown and has led into a bear flag forming. With a 60₵ flagpole, this flag now projects on down to fill a residual 580’s gap before expecting more of a braking effort. Otherwise it will demand a jolt back over 643 as the mid band arrives there to pull off a more immediate rescue.

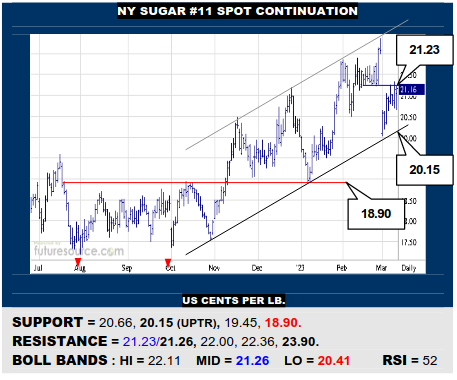

NY SUGAR #11 SPOT CONTINUATION

Sugar has recovered from the Mch-May passing of the baton but must soon overcome the 21.20’s to reassure this transition and get back on track towards first 22.36, then with an eye on 23.90 in due course. Much more wheelspin at 21.23 would otherwise fuel fears of losing the scent where a close under 20.66 would threaten the interim uptrend (20.15).

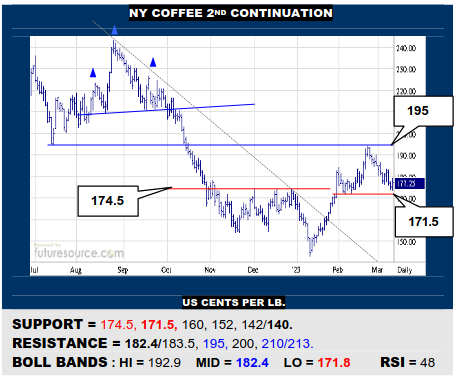

NY COFFEE 2ND CONTINUATION

The 174.5-171.5 support band is initially providing a buffer and Coffee scored an outside day higher Friday. This presents a shot at going back on the offensive but will need to close over 183.5 quickly to rekindle the upmove and even have a chance beyond 195 to 210. If denied shy of 183.5, keep minding 171.5 as a trapdoor back down towards 140.

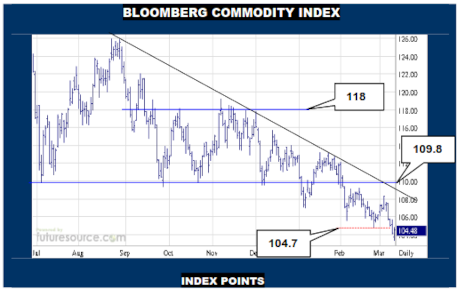

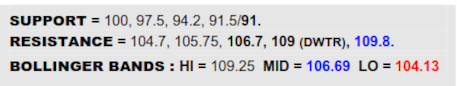

BLOOMBERG COMMODITY INDEX

With the Dollar previously holding 104.1 a couple of times early in Mch, a B-Berg bounce fell shy of the 109’s and it has veered away to new lows again this week under 104.7. Alas, with the greenback then stumbling and returning attention to 104.1 a third time Friday, the slip in the commodity index was tempered a bit so early next week could be revealing. If currency fell from the 104’s, there would be opportunity to quickly gather back the slip here and give an initial rumble of a false breakdown. If currency shaped up again instead, RSI is poised to track to new lows though, in that case having to embrace the breakdown and acknowledge sparse support thereon towards the 97’s.

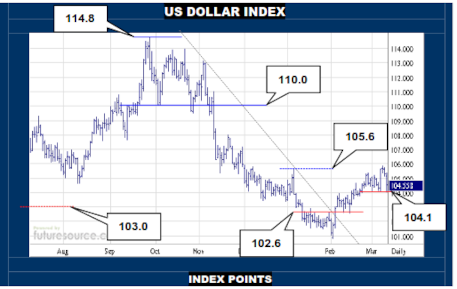

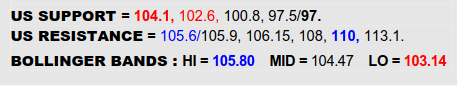

US DOLLAR INDEX

Why any one stat should trump all those preceding it as opposed to demanding a string of corroborating data over several weeks is a mystery but having never got a clear breath above 105.6 midweek, the employment/wage report tugged the Dollar back to its focal 104.1 ledge again Friday. If this third test brought an actual break, the Q1 swell would be in real trouble and focus would shift down to 102.6 as the final tipping point to conclude a correction and head for an exit from triple digits. Pivotal moments meantime however and with a raft more data coming next week, if 104.1 survived, all could be forgiven and clearer conquest of the upper 105’s could revive the search for 110.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary