Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

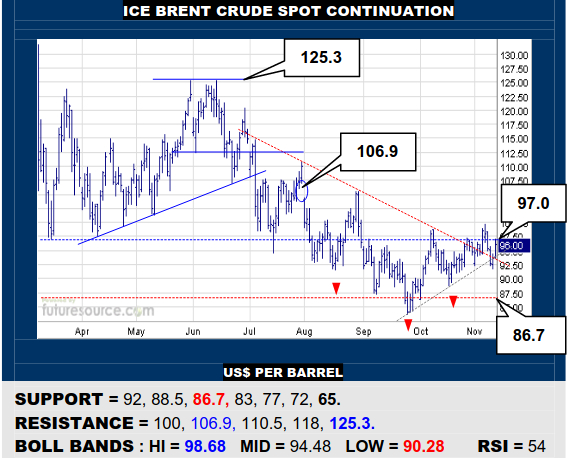

ICE BRENT CRUDE OIL SPOT CONTINUATION

Brief fraying of a nearby uptrend has been retrieved to largely keep the inverse H&S base intact but Brent must escape into the 100’s to truly conquer the ’22 top. That would prove the new base and access a 106’s gap en route towards the 112’s. Only coming up short of 100 again and breaking 92 would more seriously undercut this bid to turn higher.

NYMEX NATURAL GAS 2ND CONTINUATION

A lunge through the former bear flag was still then bluntly intercepted by the 7.52 initial border of the prior H&S top and Nat Gas has ducked back sharply. Hence wary of recent days becoming a bear flag so watch 6.10 as a tripwire down to 5.35 again. Otherwise needing to clear 6.85 to try for 7.52 again with an inverse H&S chance in mind.

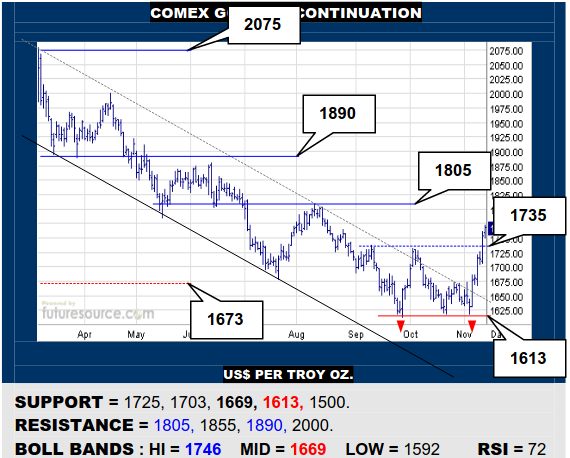

COMEX GOLD 2ND CONTINUATION

Golds’ third reply from the 1613 support shed the ’22 downtrend and has gone on to break 1735 and build a $120 double bottom. This now implies potential on across 1805 to the 1850’s while the improved macro scene persists. Only slipping back under 1725 would question the new base and threaten the mid band (1669) as a door back to 1613.

LME COPPER 3-MONTHS

Copper reacted to its inverse H&S in Nov and has driven out over 8320 to expand the second half ’22 into a larger double bottom. In turn, the market has a legitimate shot at puncturing the prior weekly top rim at 8700 and reaching on up to 9400. Only a blunt rebuke back through 8100 would dilute the momentum and thus veer back towards 7500.

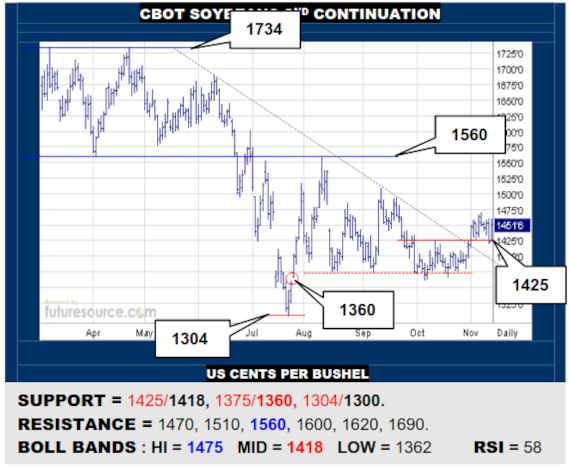

CBOT SOYBEANS 2ND CONTINUATION

Immediate 1425 to mid band (1418) bracing caught this weeks’ twitch and thus maintained the prior downtrend escape. This still preserves a flaggish shape to early Nov and piercing 1470 could duly crack the whip on towards 1560. Only breaking the mid band would more seriously undermine the footing and threaten a tumble back to attack the 1360’s.

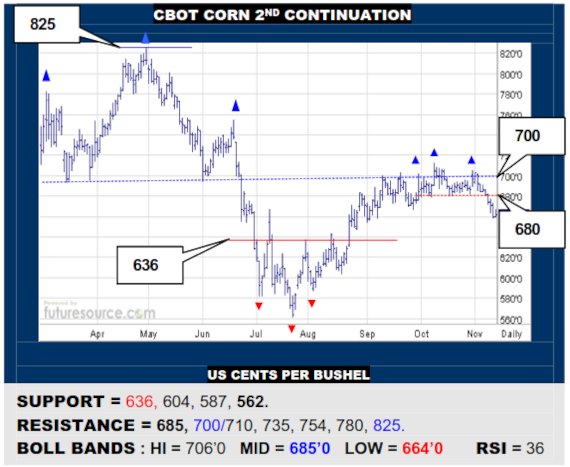

CBOT CORN 2ND CONTINUATION

The inability to find grip over 700 finally saw Corn stumble and break its 680 support, thereby forming a small new H&S in the shadow of the much bigger first half ’22 version. The market duly looks vulnerable to a dip back to the prior base rim at 636. Otherwise needing a mid band break (685) to go back on the offensive much more immediately.

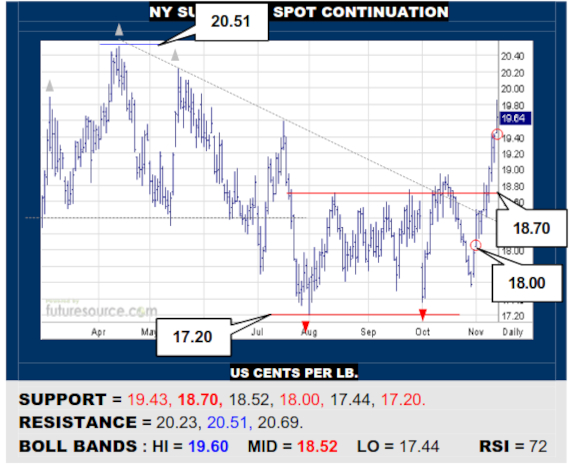

NY SUGAR #11 SPOT CONTINUATION

A downtrend escape followed by completing a double bottom injected new verve into Sugar but now a tiny 19.40’s gap asks new momentum questions. Hold the 19.40’s perch then and a further push for 20.51 would look readily possible. However close back under 19.40 and be wary of a flinch and setback to test the 18.70 base border.

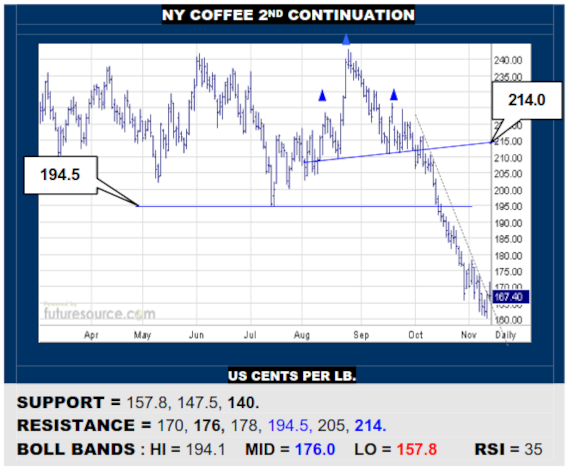

NY COFFEE 2ND CONTINUATION

Despite delving on down to 160, Coffee has now scored a downtrend escape after a key reversal Thursday so there are hints of growing corrective strain. Thus minding the mid band (176) for a reaffirming vault to temporarily turn the tide towards 194. Only if hemmed in under the mid band would there be lingering risk of pressing on down to 140.

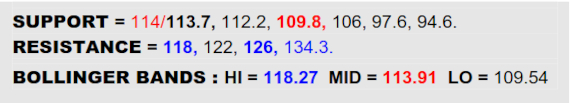

BLOOMBERG COMMODITY INDEX

Propped up by its mid band (now 113.9) before the CPI figure, the B-Berg sustained its getaway from the previous downtrend and hustled back up to renew scrutiny of the 118 resistance Friday. A twitchy Nat Gas market is denying easy access though so it will take clear defeat of the 118’s to finally dispatch the Q3 H&S and install a new Sep-Nov double bottom in its place, the implied outcome then being a first real recovery leg back up to 126 where a much bigger double bottom opportunity would be at stake. Only prolonged 118 difficulties and a backlash below 113.7 would reel back through the ex-trend and warn that the 109.8 foundations were going to be challenged again.

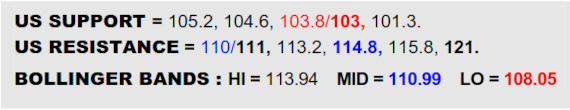

US DOLLAR INDEX

Initial jitters after the latest Fed meeting gnawed away this years’ uptrend and the CPI then administered the coup de grȃce to send the Dollar tumbling. The nearly 5 point top left above 110 now projects down to the low 105’s but in finally being knocked from its perch, it seems likely that the greenback will retrace to previous early ’17 and early ’20 peaks in the 103.8-103 span before better bracing should be encountered. If the 103’s did then hold up, there would be an argument to be made for resuming a much broader overall climb of the past decade. However, if that crucial 103’s buffer were to succumb too, a retrenchment all the way to the 90/89 realm would need considering.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary