Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

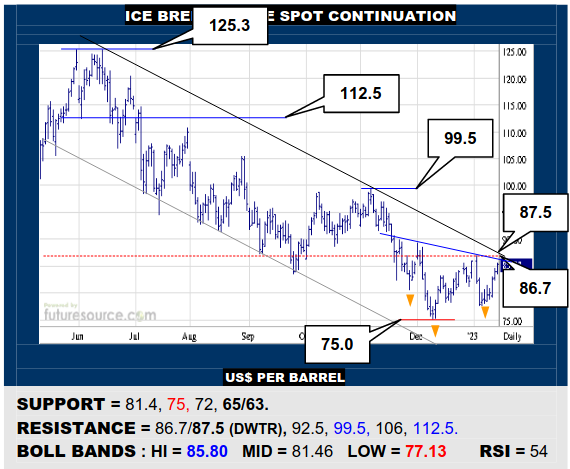

ICE BRENT CRUDE OIL SPOT CONTINUATION

Though wearing through a monthly base rim at 86.7 late in Nov, Brent fended off subsequent dips such that there are signs of life via a possible inverse H&S emerging. Must defeat the mid term downtrend (87.5) to prove this new base and set sail for 99.5 though. If foiled again near 87, don’t yet trust the footing nor view the 75 trough watertight.

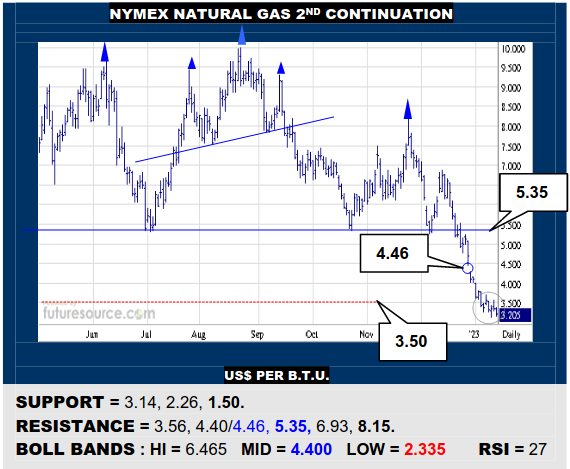

NYMEX NATURAL GAS 2ND CONTINUATION

Nat Gas has eroded its next main support at 3.50 but without any dire response and this weeks’ action even infers some loss of impetus and a potential framework for a tiny inverse H&S. Watch 3.56 accordingly as a trigger for a bounce into the 4.40 area gap. If failing to pop 3.56 however, so there would remain risk for a further leg south to 1.50.

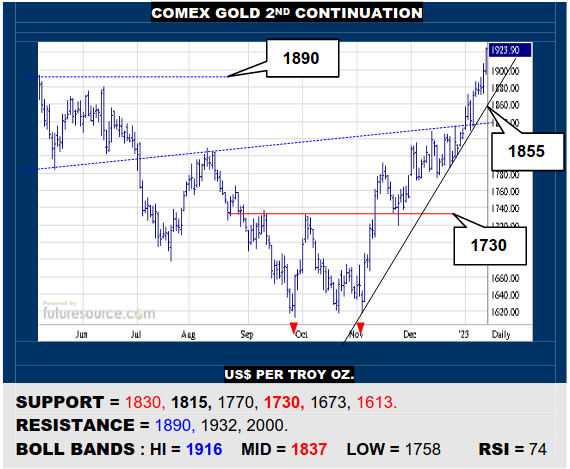

COMEX GOLD 2ND CONTINUATION

A next hurdle at 1890 only briefly delayed Golds’ resurgence and it has driven on into the 1900’s, little now obstructing passage to 2000, RSI making new highs to reassure the advance. Thus even seeing scope back up to the 2070’s peaks again then, only a sharp swerve back under the uptrend (1855) and mid band (1837) undercutting this move.

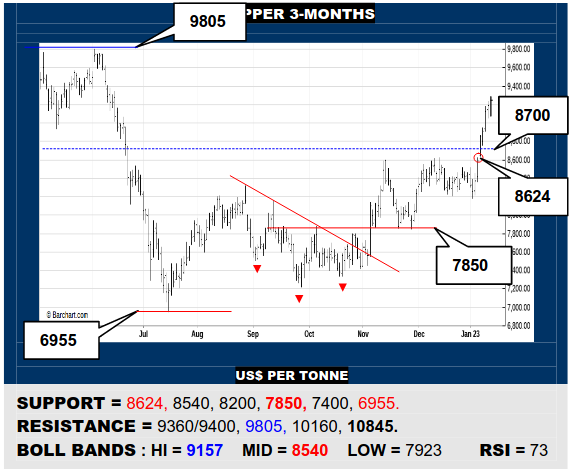

LME COPPER 3-MONTHS

With a prior weekend breakaway gap in the 8600’s, Copper has bust through the 8700 weekly top rim to pave the way to a Fib retracement of last years’ 10845-6955 decline (9360). Would be prepared for a pause there but only twisting back under 8624 would signal a reversal. If later able to overhaul 9360 as well, the 10750/10845 peaks would beckon.

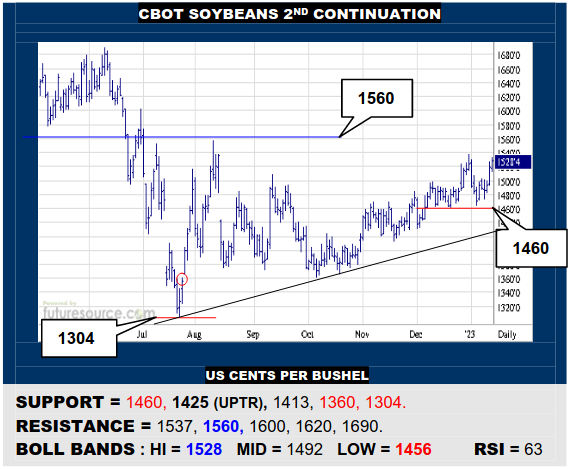

CBOT SOYBEANS 2ND CONTINUATION

A jittery start to ’23 but the 1460 support guarded the uptrend so Beans are back on course towards the next main crossroads at 1560/1575. Get through there and the mid 1700’s would be fair game. If held in check around 1560 or just diverted back under 1500, beware breaking 1460 to actually test out the trend (1425), 1360 beckoning below.

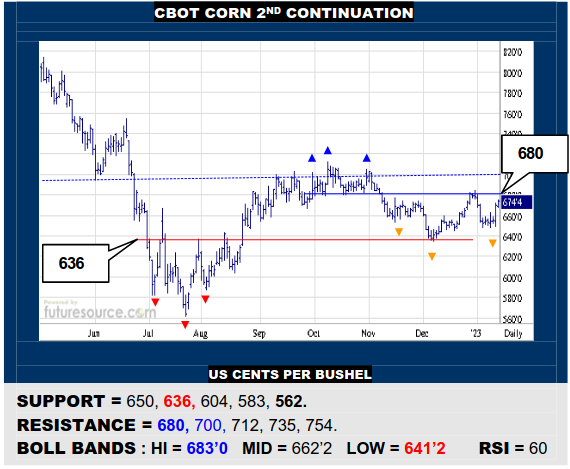

CBOT CORN 2ND CONTINUATION

Corn has headed off an early ’23 dip well clear of the 636 base border and there is duly some sense of a new if slightly ragged inverse H&S trying to form. Watching 680 as a trigger to spark more extensive gains then that could pierce 712 and stretch into the 750’s. Only another refusal at 680 would pose more serious risk to the 636 buffer.

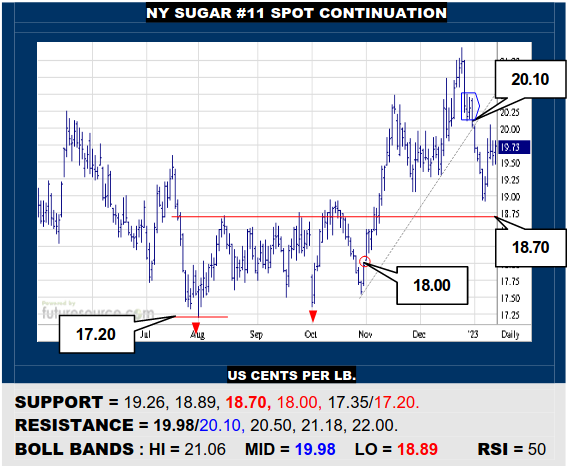

NY SUGAR #11 SPOT CONTINUATION

A rebound in Sugar has been blunted in the low 20’s near the mid band but subsequent upper 19’s congestion still raises prospects for a bull flag. Keep minding 20.10 as an escape hatch back up to 21.18 then while only a second rebuke from the low 20’s would warn of toppier conditions developing and a growing threat to the 18.70 base rim.

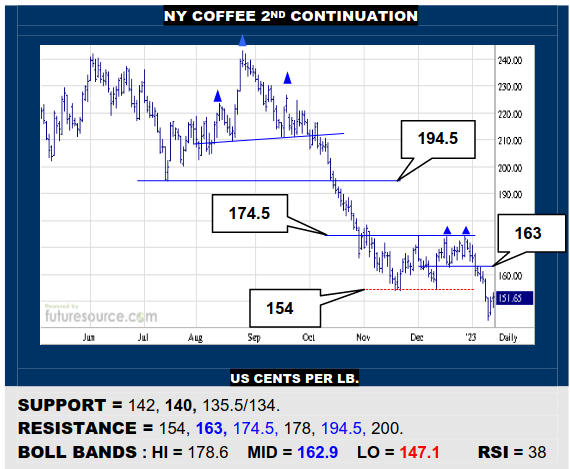

NY COFFEE 2ND CONTINUATION

Coffee ultimately wore through the 154 troughs to approach the much better weekly support shelf at 140, where it has just started to show new signs of life. If this led to reemergence over 154, look for an intensifying recovery and popping 163 could unleash a stretch for the 190’s. Alas, if confined under 154, so the 140 area could expect a more stringent test.

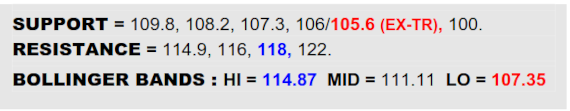

BLOOMBERG COMMODITY INDEX

A break of 103 by the Dollar has helped the B-Berg pad its bounce off the ex-downtrend and get to grips with the first truly pivotal obstacle presented by the 111 resistance and the arriving mid band (111.1). If the Dollar stayed down and the commodity index could hammer in some hooks beyond here, it would suggest a clutch catch had occurred at the very outset of ’23 that could significantly change the complexion of the macro for this year, higher rungs at 118 and even 126 then in consideration. Must make the 111’s attack count though, whereas faltering here and ducking back below 109.8 while the Dollar recovered across the 103’s would make for a much bleaker start to ’23.

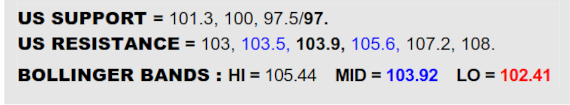

US DOLLAR INDEX

An attempt to rebound early in ’23 abruptly imploded and the Dollar has twisted south and now broken the 103 weekly support pivot, appearing to depart a small bear pennant in the process. Two months on from its derailment from the main ’20’s uptrend, this is looking like the next significant snap to dismiss any ideas of just a big correction and propose a more enduring turn south where the low 97’s appear to be the next ledge of any substance and even the 89’s come back into view below. Only a sudden reflex back up across 103.5 and the mid band dropping towards it (103.9) would shake off this latest injury and instead revive ideas of trying to curtail the Q4 weakness and get back on the horse.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary