Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

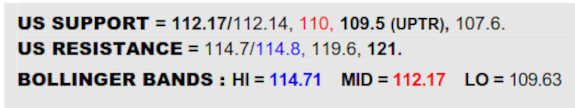

ICE BRENT CRUDE OIL SPOT CONTINUATION

A stab at the top above 97 as last week ended was promptly rebuked and Brent was teetering on its mid band (91) as this week concludes. Basically a rejection then and if the mid band cracked, watch for the 86.7 monthly base rim to be questioned anew, the mid 60’s beckoning below. Must decisively pop 97 to otherwise shore up the footing.

NYMEX NATURAL GAS 2ND CONTINUATION

Quite quiet as the mid band has kept the lid on Nat Gas and so warns to watch 6.56 as a nearby tripwire down from an interim ledge towards the key 5.35 trough to roughly meet a H&S top projection. However, it would also threaten a big new double top while meantime only veering up to close over the mid band (7.12) would suggest a firmer footing.

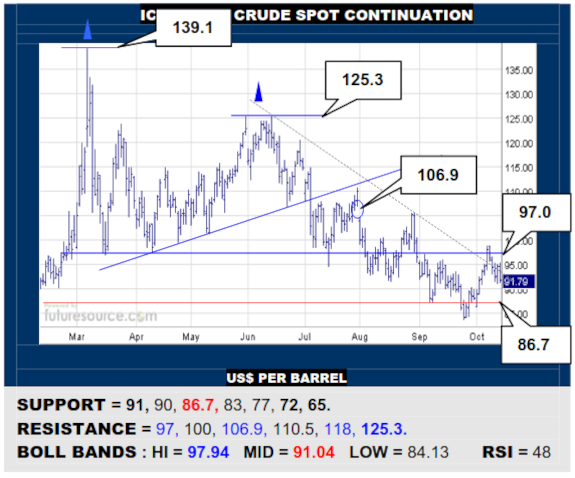

COMEX GOLD 2ND CONTINUATION

A prior brief downtrend disruption failed to gel and Gold has swerved back down through the 1670’s, reiterating a massive new 2-year dual top $400 in height. This is tilting towards the next long term shelf at 1360 then while only another hold clear of 1613 might suggest less of a danger and at least keep the path back to 1735 accessible.

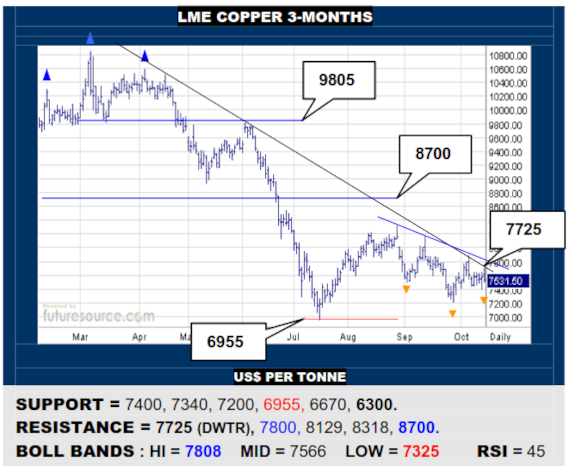

LME COPPER 3-MONTHS

Copper was foiled by its downtrend again Friday (7725) as the Dollar is doing a much better job holding up than the B-Berg. Must hurdle both the trend and the 7800 neckline behind to really spruce things up here with a new inverse H&S to light a path to 8700. Meantime watch 7400 closely as a tripwire on down to 6955 and possibly on through to 6300.

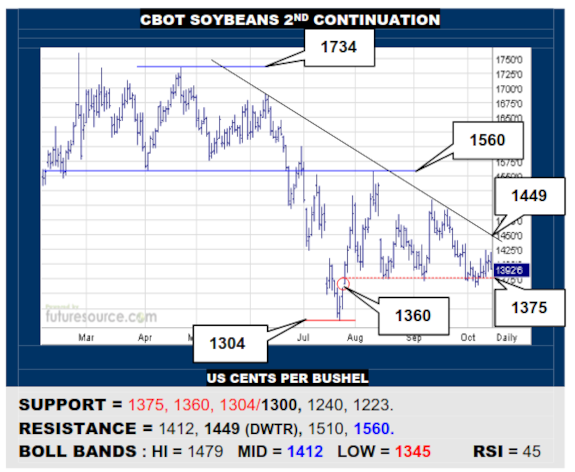

CBOT SOYBEANS 2ND CONTINUATION

Though Beans fought off a 1375 disruption via an inside day last week, the resulting swell still hasn’t clearly broken the mid band (1412) so it feels more like a correction. Must ultimately shed the downtrend (1449) to hail a more promising turn then whereas chewing through 1375/1360 could otherwise pull out the rug on down into the lower 1200’s.

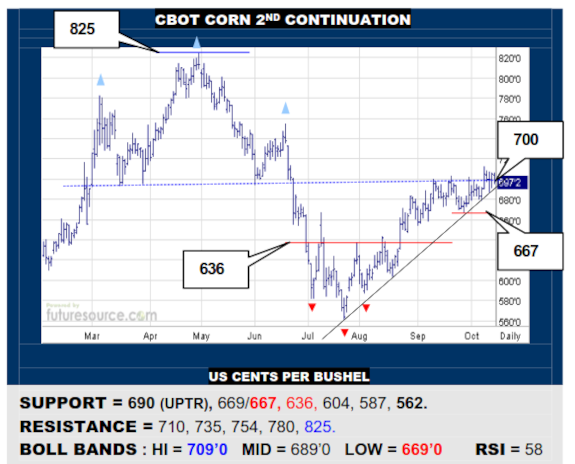

CBOT CORN 2ND CONTINUATION

Corn finally pushed into the 700’s, perforating the previous first half H&S top but there wasn’t much response, the market just treading water since. This is asking momentum questions so watch a nearby uptrend (690) for any break to undercut recent efforts and signal veering lower to 667 and probably 636. Must close over 710 to stir a bit more drive.

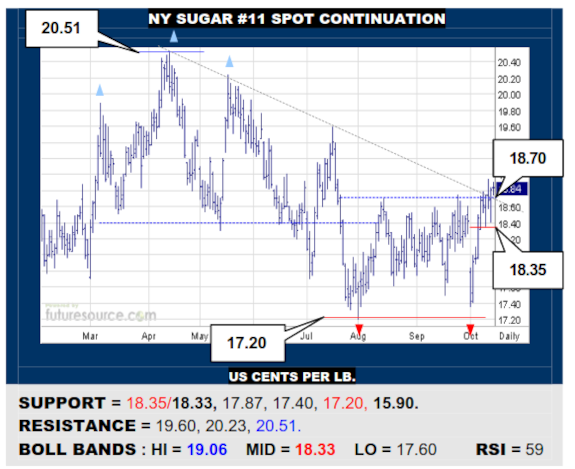

NY SUGAR #11 SPOT CONTINUATION

Sugar gnawed free of the 18.70 resistance and frayed its downtrend doing so but the laboring macro has denied much of a reaction. A new 1.5₵ double bottom insists it still be given a chance early next week to reach for a 20.20 projection but watch 18.35 meantime as the mid band intersects, any backlash below warning of a retreat towards 17.20.

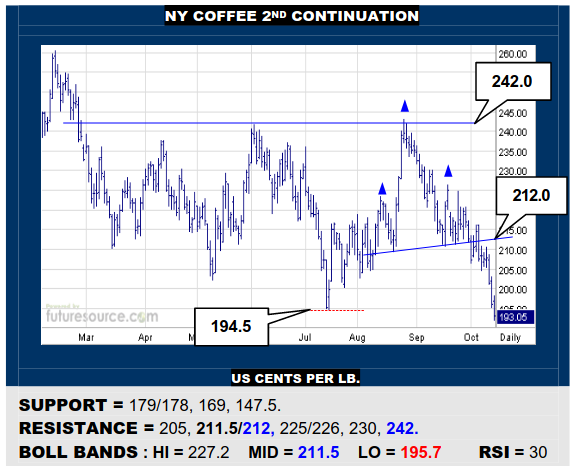

NY COFFEE 2ND CONTINUATION

The new H&S top pressed its point this week and Coffee has tumbled to break the 194.5 Jly trough as it narrows the distance down to a derived top projection at 179/178. Both RSI and ADX are endorsing the fall so only the Dollar pulling back under 112 could apply some restraint here and create a chance for a correction back up towards 205.

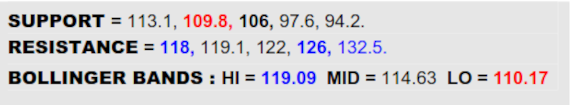

BLOOMBERG COMMODITY INDEX

Despite an outside day rebound the session prior, the B-Berg has thus far only just nipped at the 116 border to the Q3 H&S top as the Dollar held its mid band Friday to restrain commodities. This makes for a questionable footing as the mid band has frayed and leaves the commodity index well shy of the 118 level that must be exceeded to truly rip open the top structure and replace with a new inverse H&S. If that happened in sync with the Dollar being swept from the 112’s, the macro would shift tangibly to the good and 126 would come into sight. Alas, right now it is a very creaky perch and breaking 113 would warn of a defining dice with the pivotal weekly prop at 109.8.

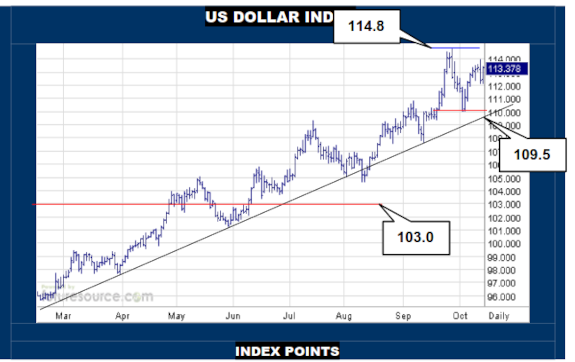

US DOLLAR INDEX

A ragged Thursday for the Dollar as it suffered an outside day but the arriving mid band (112.17) tamed this wobble Friday. If that were enough to get the wheels turning higher again across 114.8, the greenback would emerge from a somewhat jittery patch ultimately unscathed and the promise of further Fed rate hikes would dial in focus once more on the millennium high at 121. Keep a very keen eye on that 112 ledge all the same because it now looks key to holding up at these elevations. If another backlash came and toppled over, loss of the mid band could quickly snowball into a clash with the pivotal 110/109.5 uptrend crossroads where far more serious damage could occur.