Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

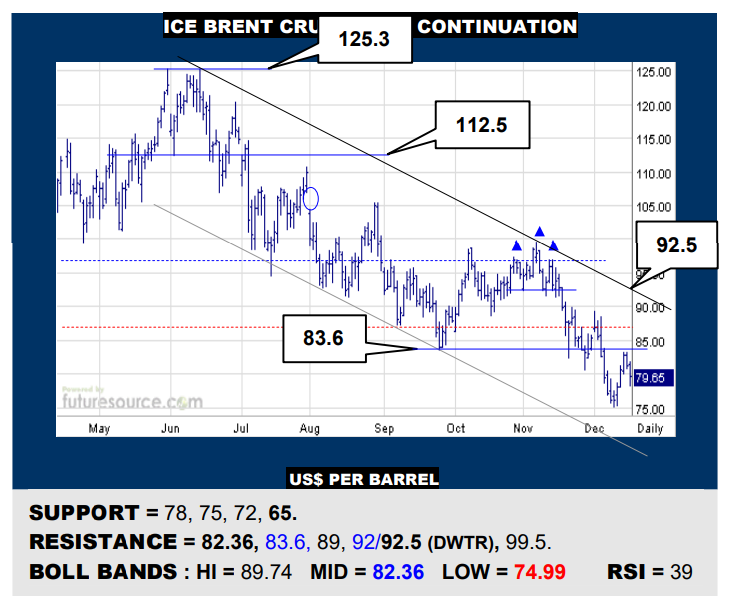

ICE BRENT CRUDE OIL SPOT CONTINUATION

Brent staged a bounce this week but has been intercepted by the 83.6 prior trough and arriving mid band. That initially errs just for a corrective breath then and demands conquest of the 83’s to make a better mark and create scope to the main downtrend (92.5). If not, beware the pressure resuming and expanding the retreat to the 65 weekly support.

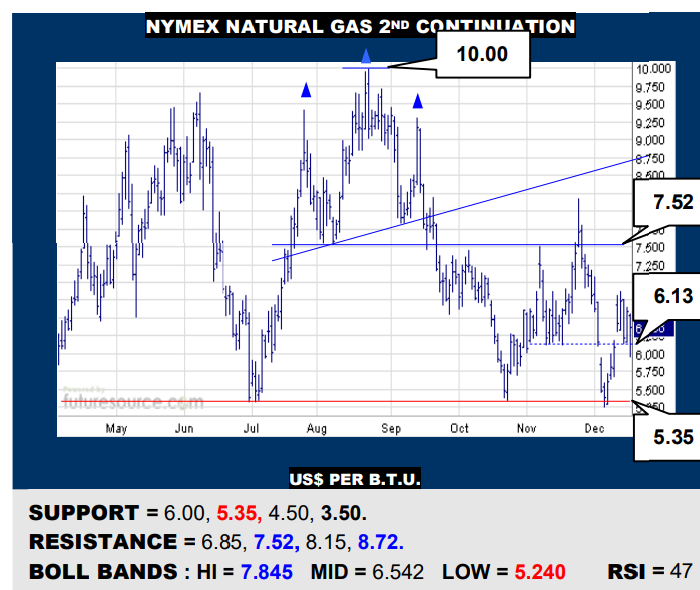

NYMEX NATURAL GAS 2ND CONTINUATION

Nat Gas made a vital B-Berg saving catch at its 5.35 support early in Dec to rebound hopefully over its 6.13 gap resistance but is struggling to secure this rebound. While holding 6.00, there could yet be a flag chance to reach for 7.52 again. However, ousting from the 6’s would target 5.35 once more with threat of a crushing new ’22 H&S top.

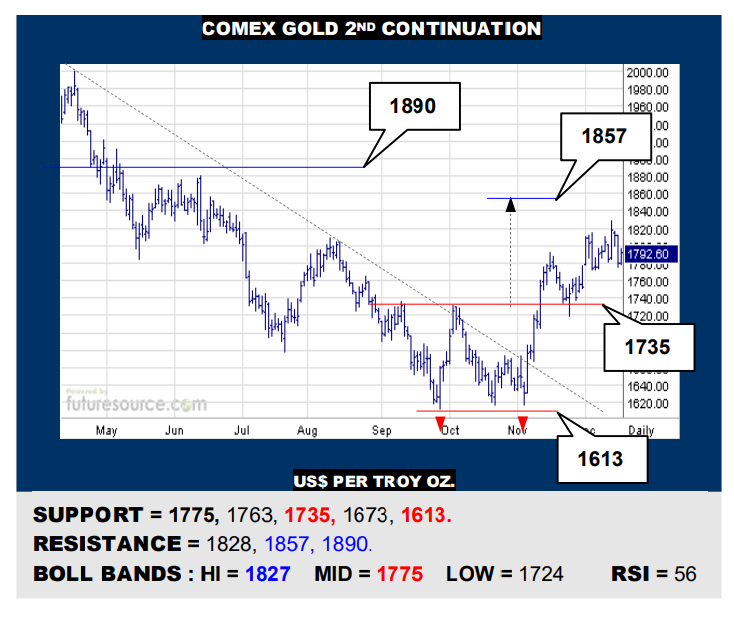

COMEX GOLD 2ND CONTINUATION

Tenuous times for Gold as it has met tougher 1820’s resistance from a pre-Jly top and slipped back to tag its mid band (1775). It badly needs to mop up here to resuscitate the climb and still have a shot at an 1857 double bottom projection. If the mid band broke, beware falling back to the 1735 rim of that base, a critical defence against a total upending.

LME COPPER 3-MONTHS

Fading once more in the shadow of the main weekly top border at 8700, Copper has tailed off to dice with its mid band (8265). It needs to dig in the heels here to preserve sight of that key 8700 hurdle. Otherwise loss of the mid band would form early Dec into a tiny new H&S and warn of further retrenchment to a pivotal clash with the 7850 reversal tripwire.

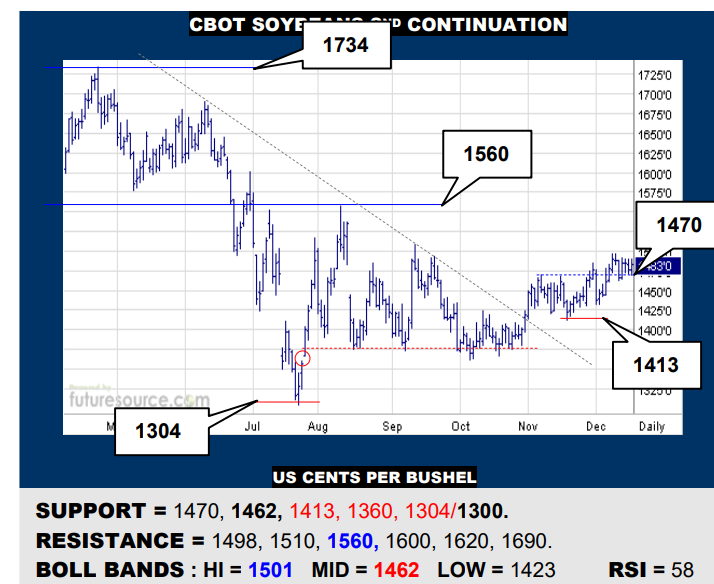

CBOT SOYBEANS 2ND CONTINUATION

Beans have largely held the 1470 area to stay ahead of the mid band trailing not far behind (1462). Maintaining a tepid climb then that still has sight of 1560 currently. Be immediately more cautious if the mid band was broken however, then losing the upside scent and liable to trip a sharper backlash to 1413 and even the 1360’s if the B-Berg broke 109.

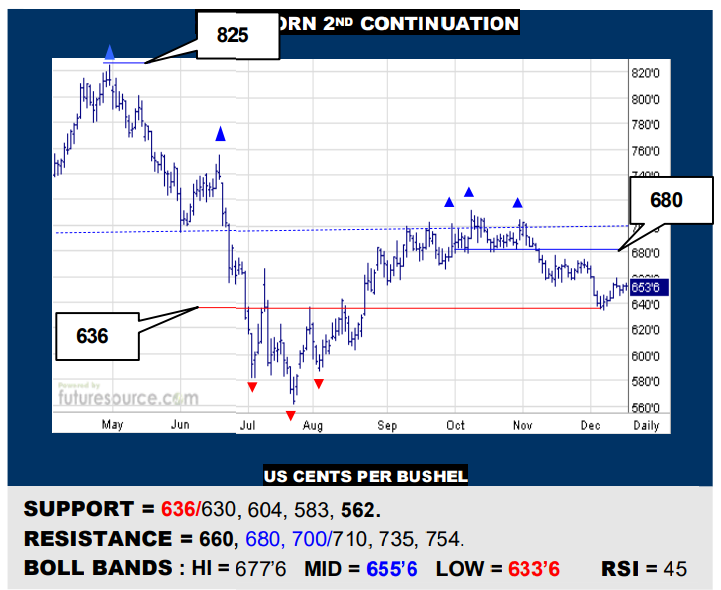

CBOT CORN 2ND CONTINUATION

Corns’ initial rebound from the 636 base rim was blocked by the 660 resistance and so really only looks corrective for the time being. Must jolt beyond 660 to sharpen up the turn higher and create further scope to 680 and even the 700’s. Meanwhile still wary of risk posed to 636, a break below warning of more extensive fallout to the 580’s.

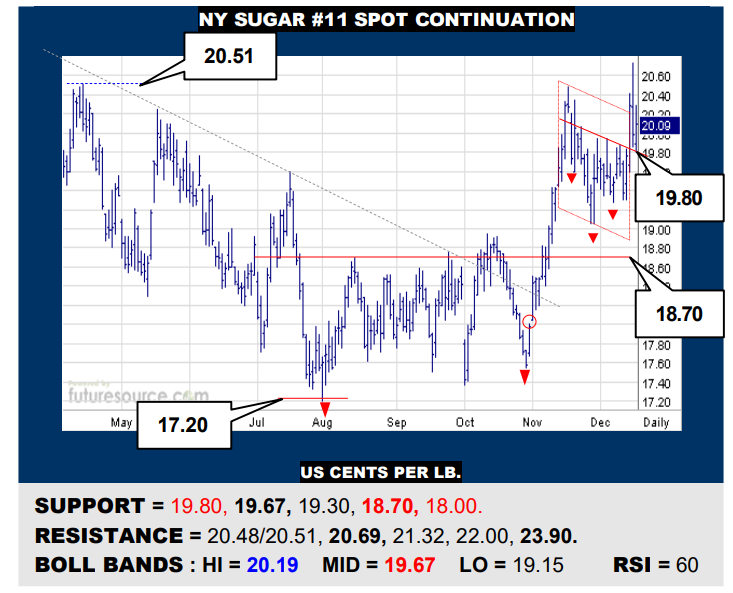

NY SUGAR #11 SPOT CONTINUATION

An inverse H&S and implied flag breakout midweek failed to escape weekly resistance in the 20.60’s but Sugar has still kept its footing above 19.80, just ahead of the mid band (19.67). While balanced on there, another bid for release over 20.69 could unleash a rally to 22₵. Alas, breaking the mid band might instead trip a retreat to the 18.70 base rim.

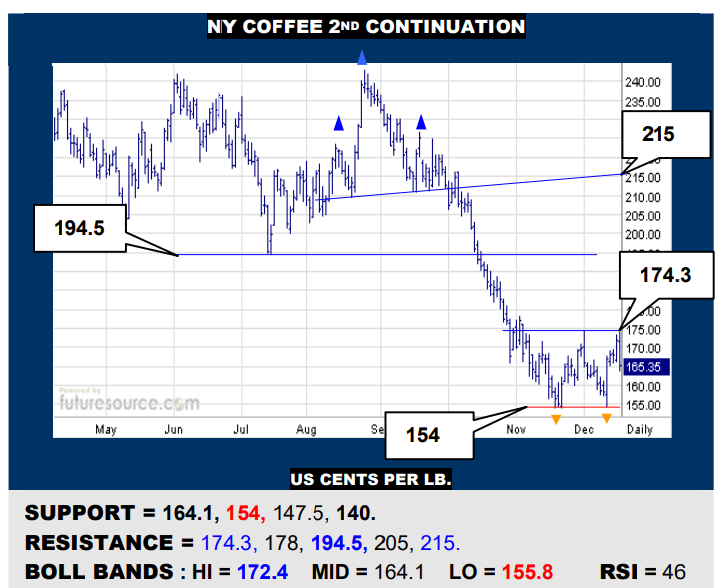

NY COFFEE 2ND CONTINUATION

Coffee tried for a double bottom this week but missed the 174.3 exit by a whisker Friday and doubled back to an outside day. If this broke the mid band (164), be prepared for another delve to try the 154 support with risk of pressing on to 140 below. Must hold 164 otherwise to still have a shot at finishing the base and reaching back up towards 194.

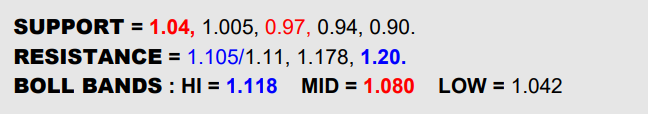

B-BERG / US DOLLAR RATIO

Generally Q4 has been encouraging for the macro scene as the Dollar fell back towards its key 103 precipice and the B-Berg kept toughing it out aboard the 109’s, lately bringing a good hold at the 1.04 Ratio support marking a localized base. Nonetheless, initial 38.2% Fib retracement resistance at 1.105/1.11 has still proven stubborn since and shows the need for a Dollar break of 103 or B-Berg exit over 118 (optimally both) to open a path on up to 1.20 (61.8% retracement). A sense of discomfort meantime while fumbling shy of 1.11 that this swell hasn’t fully shed its corrective colors so keep minding 1.04 for warning of the energy malaise spreading across a wider swath of the commodity sector.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.