Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

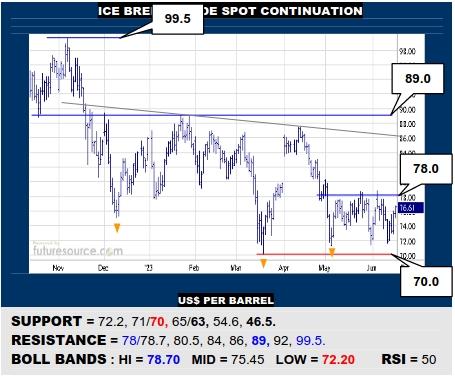

ICE BRENT CRUDE OIL SPOT

The lower Bollinger band (72.2) keeps shielding the 70 precipice as Brent continues the interim spell of ranging. It does still need to bust free across the 78’s to mold the range into a preliminary base and jerk the upper Bollinger into a clearer turn north to pave the way on to 89. Do just stay wary of a cavern down to 63 however if 70 were to succumb.

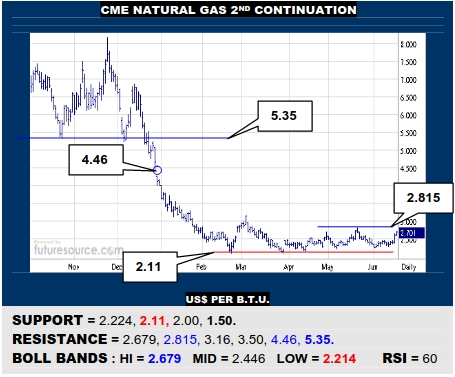

NYMEX NATURAL GAS 2ND CONTINUATION

Another bid to steer up out of the mire by Nat Gas is testing the upper Bollinger (2.679), which has yet to be stirred into an upturn. Must thus defeat the preceding 2.815 apex to separate this from prior efforts and rejuvenate ideas of a saucer base, largely clear skies in the 3’s and 4’s. Stall shy of 2.815 and fears of another ranging dip would grow.

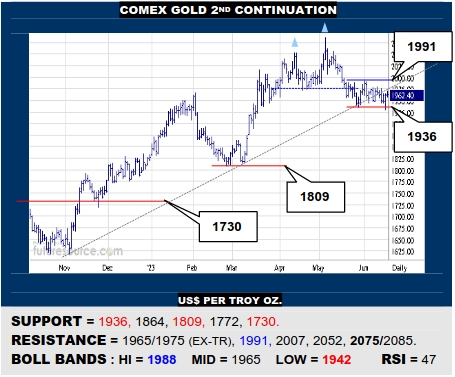

COMEX GOLD 2ND CONTINUATION

More of a gouge under the uptrend has still been warded off by the 1936 support so if Gold could quickly reflex over the mid band (1965) and ex-uptrend (1975), it would buoy ideas of a correction ending, stoking hopes to pop 1991 and rally for the 2070’s again. Alas, if confined by the ex-trend, still beware far more open space under 1936.

LME COPPER 3-MONTHS

A Fed pause and tamed Dollar helped Copper overhaul the 8440 hurdle and chase the upper Bollinger band into the 8600’s. Must duly cater for further gains to an 8890 Fib retracement and the sloped neckline to the H&S (8925), especially if the Dollar broke 100.8. Watch the mid band (8264) and 103.4 Dollar top rim for any signs of faltering instead.

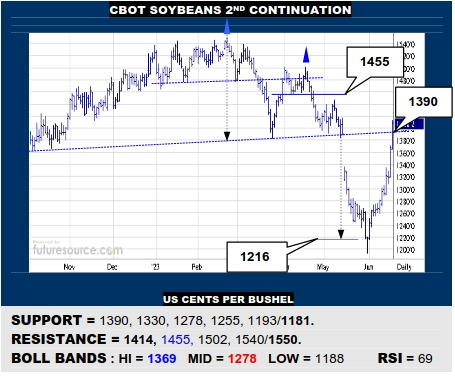

CBOT SOYBEANS 2ND CONTINUATION

A potent reply from the 1190’s has poked over the 1390 H&S neckline to a 1414 Fib retracement of the preceding fall. Intrigued to see what comes next. If Beans can secure grip above 1390, be ready to stretch on to 1455 and even 1500. If the wheels spun and denied a footing over 1390 though, beware this becoming an apex and delving away to 1330.

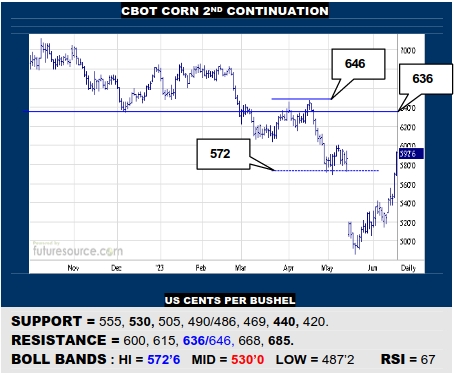

CBOT CORN 2ND CONTINUATION

Corn has filled the baton-pass gap back up to 572 and thus deserves some added space towards the 636 top frontier. However, that marks a major H&S neckline on the weekly scene as well so prospects beyond the 630’s are much slimmer and would be ready for a new crest there. Meantime watch 555 as a tripwire back to attack the mid band (530).

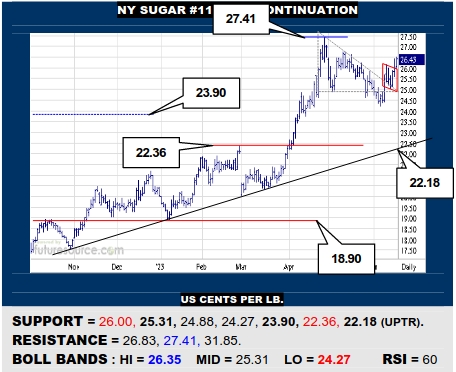

NY SUGAR #11 SPOT CONTINUATION

Sugar shrugged off its prior triangle top and has pushed away from a bull flaggish shape late this week. If it can hold the 26’s, this flag escape suggests scope on up to re-test the 27.41 high and even reach to the 30’s thereafter. Any swerve back under 26.00 however would question the getaway and instead return focus to the mid band (25.31).

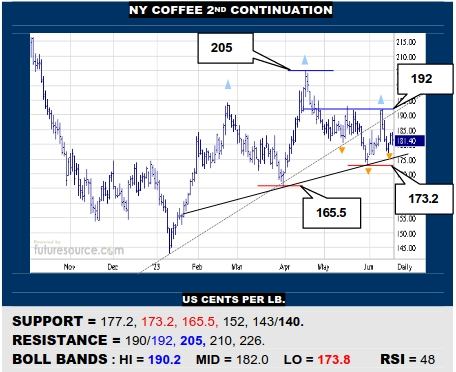

NY COFFEE 2ND CONTINUATION

“That’s another nice mess you’ve gotten me into Stanley.” Very twitchy Q2 action has Coffee on edge with the risk of ’23 unraveling into a large H&S top if the 173.2 trough gave way, in that case opening a path down to the low 140’s again. Must otherwise rebound beyond 192 to peg a smaller inverse H&S to get back on the gas into the 200’s.

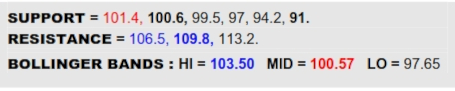

BLOOMBERG COMMODITY INDEX

The Fed letting off the gas at least temporarily has pressed the Dollar back against the 102.2 ropes and allowed the B-Berg to surge clear of the 101.6 prior lows, rendering a modest new 5-pip inverse H&S. That sets a preliminary target at 106.5 as the commodity index appears to react back from a false breakdown finish to the decline of the past year or so. However, for ultimate proving purposes that there has really been a pivotal shift in the macro, the broader 109.8 divide (and 1.07 on the Ratio) must be overthrown and it is highly likely the Dollar will have to hit new lows under 100.8 to facilitate that. Meantime watching the 101.4 base rim to mid band (100.6) niche as key buffering underfoot.

US DOLLAR INDEX

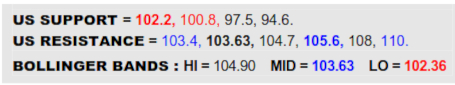

First the debt ceiling fix and then this weeks’ pause from the Fed have pulled the rug from under the Dollar and it has dropped back to needle the early Q2 base zone under 102.2, leaving a tiny new dual top in the process. The provisional rumbles from this imply that May was more just serving in a corrective role as the failure to hurt 105.6 never allowed the downtrend escape to develop into a major base. However, to really validate that will still require 100.8 to subsequently give way, whereupon another hefty step down to the 93’s would threaten. If able to reflex off the low 102’s back over 103.4 and the lurking mid band though (103.63), so the Dollar would get back in the fight.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.