Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

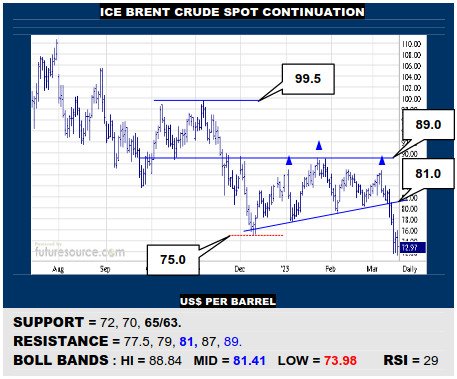

ICE BRENT CRUDE OIL SPOT CONTINUATION

Expulsion from the 80’s twisted Brents’ previous basing effort into a new H&S top just over $10 in height. This projects to 70 but better support only shows at 65/63, the latter a Fib retracement of the broader ‘20’s advance from 16 to 139. Room for a corrective breath meantime but must hack back over 81 to make any substantive impact topside.

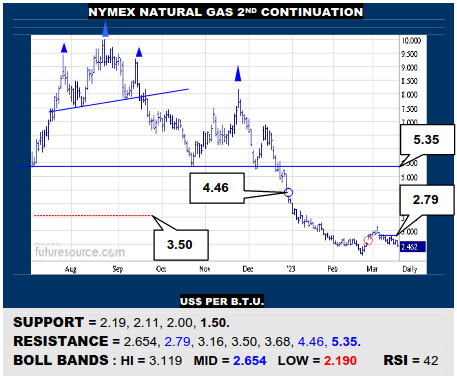

NYMEX NATURAL GAS 2ND CONTINUATION

Nat Gas tried to grip after filling the 2.60’s gap but looked to be losing that battle Friday so the lower Bollinger band (2.19) and Feb low at 2.11 are back in view, a break of the latter exposing 1.50. Alternatively needing a clear cut mid band break (2.654) and close over 2.79 to instead suggest shedding a correction for a rally to the 4’s.

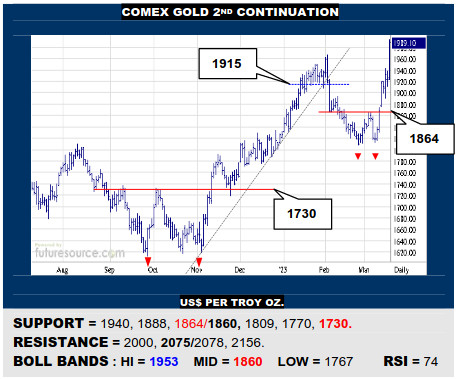

COMEX GOLD 2ND CONTINUATION

Gold’s escape from a sub-1864 double bottom really lit the match and it quickly dispatched the 1915 resistance and pushed beyond the most recent 1965 apex. The 2000 figure is merely psychological resistance now then while exceeding it could access peaks in the 2075/2078 region. Only a flinch and swerve beneath 1940 could undercut this rally.

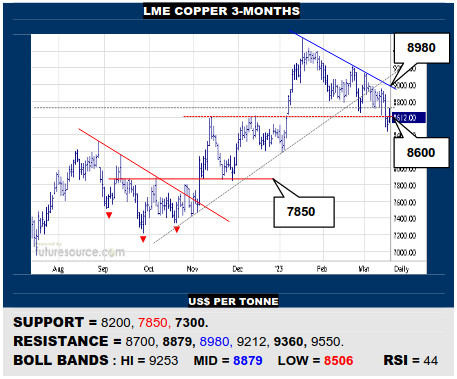

LME COPPER 3-MONTHS

Copper couldn’t reach the Q1 downtrend and has fallen away to break the 8600 support shelf. This is casting Q1 in more of a triangle top role and there isn’t much underneath, a step down at 8200 appearing to lead on towards 7850. Only if the Dollar broke 102.6 and sparked a jog back over the mid band (8879) would the damage done be repaired.

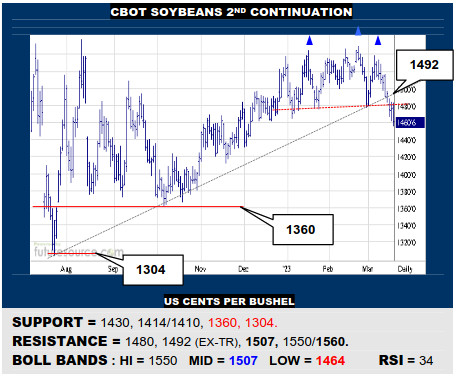

CBOT SOYBEANS 2ND CONTINUATION

One too many flinches in the 1540’s has since seen Bean pull back and break its mid term uptrend, then going on to create a H&S top above 1480. This top projects on down to the 1410 vicinity and even 1360 is not an unreasonable prospect. Only a jolt back over the ex-trend (1492) and the mid band (1507) would make any reliable repairs here.

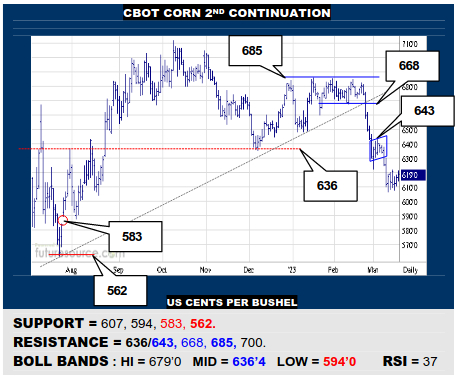

CBOT CORN 2ND CONTINUATION

A week of consolidation under 620 currently gives a similar bear flag vibe to the early Mch action in the 630’s so Corn still looks vulnerable and a break of 607 would threaten an ongoing decline to patch the 580’s gap dating back to last summer. Must otherwise rebound over the 636/643 resistance to make repairs and light the way back up to 668.

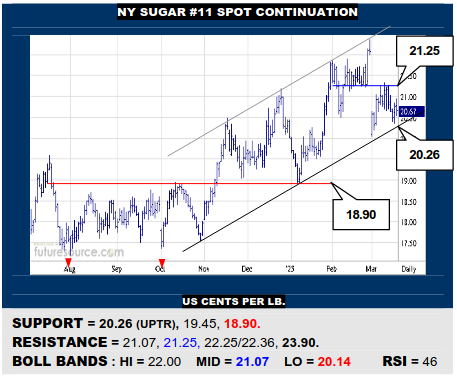

NY SUGAR #11 SPOT CONTINUATION

The baton pass from Mch hasn’t been tidied up yet as 21.25 resistance blocked the way back upwards and Sugar duly dipped towards its interim uptrend this week (20.26). If that trend can endure, 21.25 is still a prospective trigger for a rally to 22.25/22.36. Alas, if the trend snapped, more of a top would resolve and a delve back to 18.90 would threaten.

NY COFFEE 2ND CONTINUATION

The pivotal 171.5 support warded off a midweek attack but a bounce from there was promptly smothered by the mid band Friday (182). Still keenly eying the 171’s therefore as a potential trapdoor from a new Feb-Mch H&S type pattern, which would pave the way back to the 140’s. Must otherwise pop the mid band to score a more reliable turn higher.

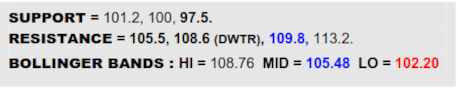

BLOOMBERG COMMODITY INDEX

Mainly Crude driven weakness Wednesday neared a potential channel restraint underneath but the B-Berg managed an inside day Thursday for a minor breath Friday. This helps to highlight the underlying channel but to truly bolster its’ relevance and start thinking more in terms of a false breakdown, it will take a reflex back over the mid band (105.5) and some coinciding damage to the Dollar, preferably breaking 102.6. In that case this could prove a brief delve but if instead the greenback held the 103’s and the mid band kept the lid on here, don’t be persuaded by the channel brace, the next weekly support not until 97.5 and a full Fib retracement of the ‘20’s climb (59-140) well south at 90.

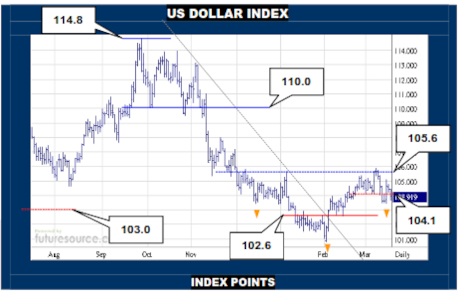

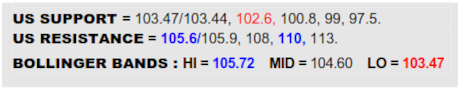

US DOLLAR INDEX

The Dollar has remained well confined within the Bollinger bands corridor of late but is paying little heed to the mid band, slashing back and forth across it. The quick cooling of Wednesdays’ outside day bounce and the upper Bollinger band being nestled in the 105.6-105.9 span is murmuring of the Feb upswing serving as just a spell of relief from the heavy losses suffered in Q4 but it would be premature to bet the farm on that, needing a further slip through the secondary support shelf at 102.6 to really hail the crest of a correction. Do stay mindful meantime to the inverse H&S potential if those upper 105’s could be overthrown, in which case a more extensive revival to 110 would be proposed.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.