Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

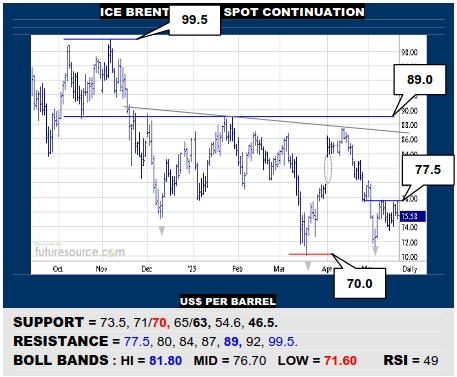

ICE BRENT CRUDE OIL SPOT

Brent parried the April backlash clear of the prior 70 trough but needs to defeat a nearby 77.5 resistance to really shore up this catch and bolster broader ideas of a large 6-month inverse H&S emerging that could become the backbone of a commodity rejuvenation. Watch 73.5 in the meantime as the trapdoor to fall back to 70 and possibly on towards 63.

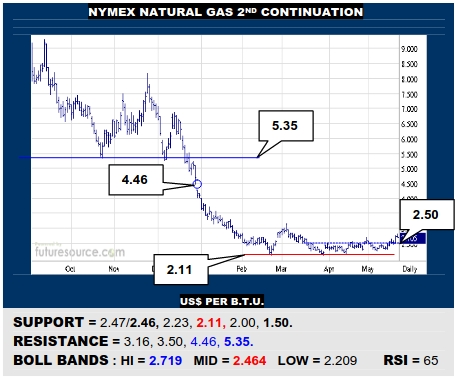

NYMEX NATURAL GAS 2ND CONTINUATION

A late April failed escape hasn’t deterred Nat Gas and it has punched out over 2.50 again to revive the case for a saucer-shaped base. This effort is steering the upper Bollinger band higher so it is looking all the more persuasive to take aim for 3.16 and later even the 4’s. Only a slump back through the mid band (2.46) would upend this breakout.

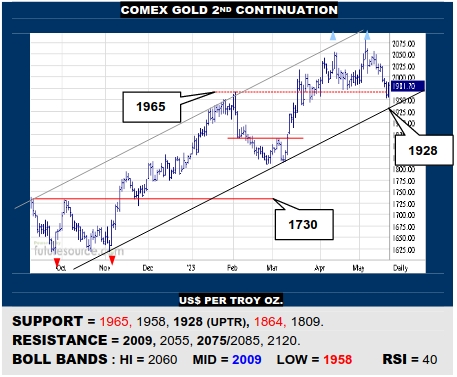

COMEX GOLD 2ND CONTINUATION

Pivotal times for Gold as it dices with the 1965 base rim to threaten a new Q2 dual top. This has initially been warded off but will demand a subsequent reflex back over the mid band (2009) to prove a successful catch to thus endorse the uptrend (1928). Successive breaks of 1965 and then the trend however would threaten a dive back to 1864.

LME COPPER 3-MONTHS

Copper managed some mainly 8200’s congestion this week despite the prior H&S and bear flag breakdowns. Alas, only a reflex over 8440 asthe mid band intersects would mark a substantive retrieval that could turn focus onto the H&S neckline (8800). Otherwise loss of 8090 would point on down to first 7850 and later to the monthly base border at 7340.

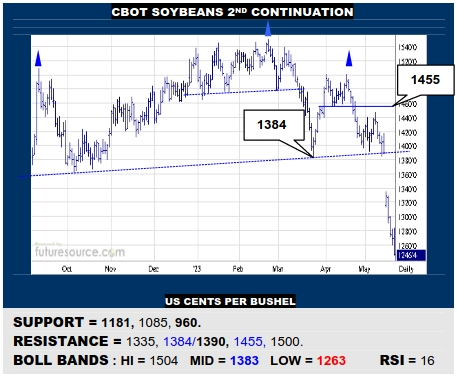

CBOT SOYBEANS 2ND CONTINUATION

Tipping over 1384 built both daily and weekly chart H&S patterns, which were exacerbated by the contract roll. Beans are duly tumbling towards an interim 1181 pivot and would even be wary of scope on down to 960 eventually. Only a bounce across 1283 would give warning of taking a corrective breather and trying back up into the 1335-1385 gap.

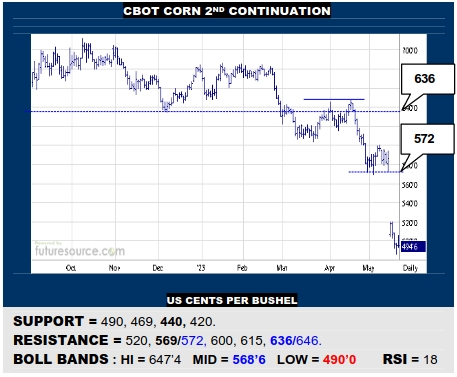

CBOT CORN 2ND CONTINUATION

Also compounded by the contract shift, a major weekly H&S has sent Corn tumbling and there still looks to be further downside risk to the 440 to 420 area before much better support should be met. In no hurry to stand in the way then while it would take a rebound over 520 to imply a corrective interlude where the 560’s could come back into range.

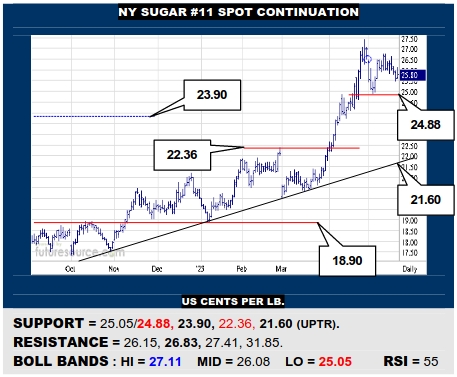

NY SUGAR #11 SPOT CONTINUATION

After the early May swell only filled a mid 26’s gap, Sugar has since slipped back to break its mid band this week. Increasingly frail conditions then warn to watch the 24.88 support for fear of a double top resolving and tripping an ongoing delve back to 22.36. Must jolt back over 26.15 to pull things together a bit and have a renewed shot at 26.83 or higher.

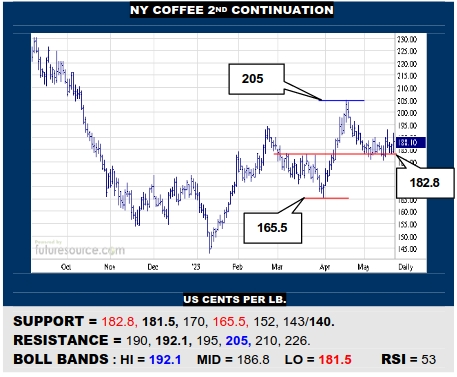

NY COFFEE 2ND CONTINUATION

Coffee is still attempting to pull back up off the 182’s base rim buffer but needs a close into the 190’s to enhance the turn and spark a potential next wave higher across 205 towards the 220’s. Meantime still relying on the 182.8-181 buffer remaining watertight or else the basing effort could unravel and a new delve down into the mid 160’s would loom.

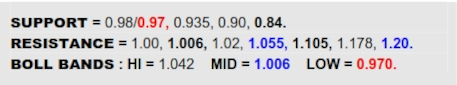

B-BERG / US DOLLAR RATIO

With Crude Oil still giving the B-Berg buoyancy above 100, it is helping to dab the brake on the Ratio just clear of the 0.97 trough from last Sep. This looks a pivotal divide for the macro as ’23 has brought a gradual leveling of the playing field but one where, for now, the Dollar is still looking dangerous. To tame that threat it must be blunted shy of 105.6 and some reshuffling of values performed such as to jog back over the mid band here (1.006), where yet a third major trough would insist a shift towards commodities was occurring. Alas, if instead the greenback popped 105.6 and 0.97 finally washed away, the ’21 to ’23 period would become a broad H&S and there is little below until 0.84.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.