Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

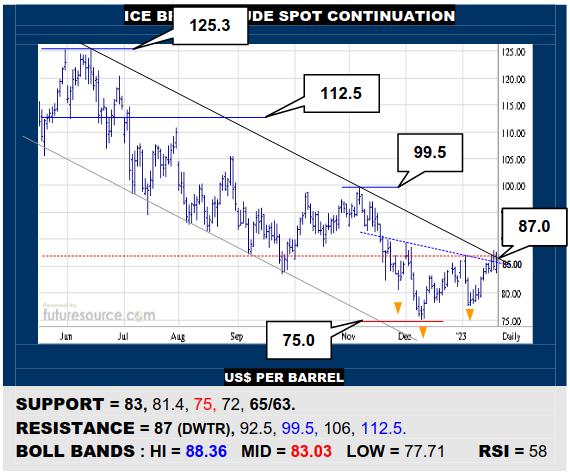

ICE BRENT CRUDE OIL SPOT CONTINUATION

Brent is right in the thick of it attacking its downtrend (87). A clean escape would also serve to confirm a two-month inverse H&S and so book passage to the triple digit frontier (99.5) and give the B-Berg a vital new shot of drive to extend on towards 118. Do just keep tabs on the mid band (83) for any signal of failure and backswing into the 70’s.

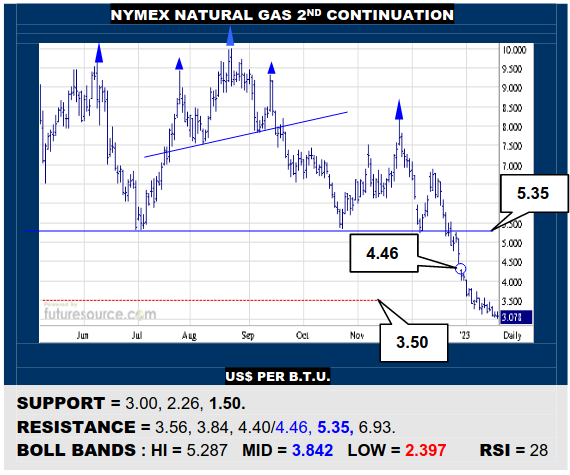

NYMEX NATURAL GAS 2ND CONTINUATION

Plainly a punishing six months for Nat Gas and eroding 3.50 leaves piecemeal support down to 1.50. However, RSI has lately diverged to pose some question about the far tamer Jan losses so corrective risk feels greater now which, though not eliminating scope to 1.50, does demand a watch on 3.56 as an initial trigger back into the 4.40’s gap.

COMEX GOLD 2ND CONTINUATION

Gold has gone marching on in Jan and there is little of substance in the way until 2000 now. Slightly twitchier action this week and initial RSI divergence does just merit an eye on 1900 for early warning of a flinch however, in which case minding first the uptrend (1875) and then mid band (1861) for any more serious signs of losing the upside scent.

LME COPPER 3-MONTHS

Copper has driven higher from the 8600 Nov-Dec base rim to reach the 9360 Fib retracement of last years’ decline (10845-6955) where a few murmurs from the Dollar have cooled momentum. If able to still force its way by, the path on into the 10K’s would beckon. Do meantime watch 9026 as an initial tripwire to instead swerve back to the 8600’s bracing.

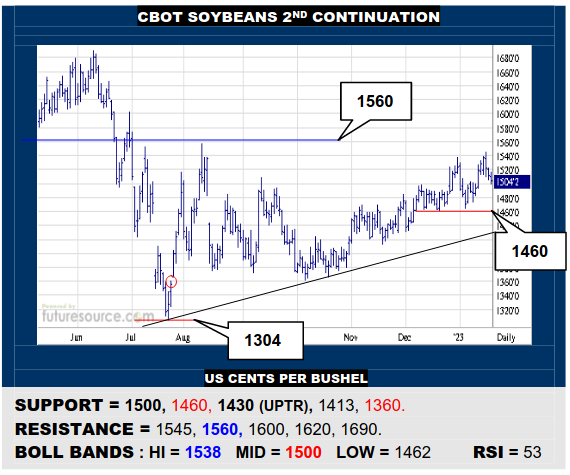

CBOT SOYBEANS 2ND CONTINUATION

Another foray higher has stumbled shy of the next main 1560 resistance and Beans have ducked back to loom over the mid band (1500). If 1500 gave way, this would likely become a sharper downturn to delve back to key 1460 support where a new double top could really tip the balance. Must hold 1500 otherwise to seed any new venture towards 1560.

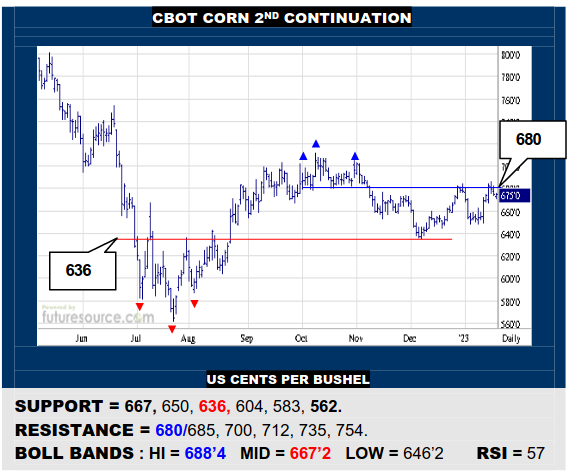

CBOT CORN 2ND CONTINUATION

Brief tags of the 680’s have still failed to make any lasting impact yet but Corn held tight above its mid band (667) Friday so it may have a chance for third time lucky, defeat of 685 scoring a flag that could enable a more enduring flurry well into the 700’s. Mind that mid band though, its demise deflating this latest effort and turning the tide back towards 636 instead.

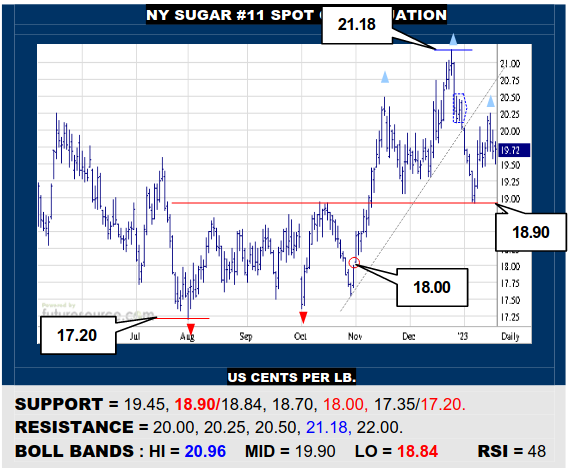

NY SUGAR #11 SPOT CONTINUATION

Sugar was again denied any footing in the 20’s this week but did at least hang on at a 19.45 ledge Friday. That is crucial to prevent a clearer crest to this Jan bounce, wherein the overall H&S impression would intensify and the revised 18.90 former base rim would be in peril. Must reach and grip in the 20’s to instead propose resumed scope to 21.18.

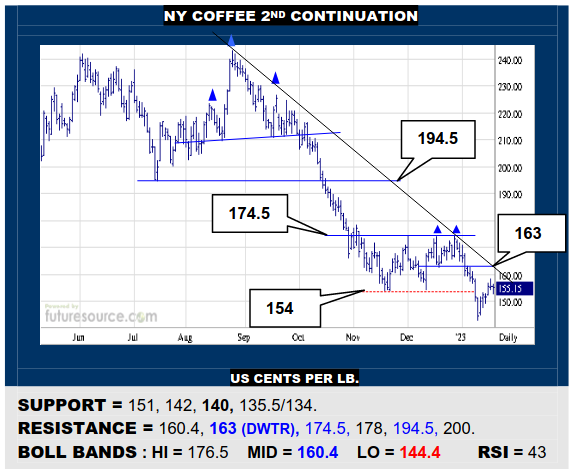

NY COFFEE 2ND CONTINUATION

Coffee rebounded from a close approach to the bigger weekly support at 140 and piercing 154 creates added corrective space towards 163. That figure is the pivotal one to cross to make have an enduring impact by overcoming the downtrend, where the 190’s would look attainable. If foiled shy of 163, be ready for another delve down to test the 140 area.

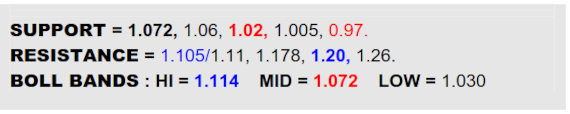

B-BERG / US DOLLAR RATIO

An early Jan trough at 1.02 on the Ratio actually marked quite an accurate Fib retracement of the preceding Q4 upswing and the rebound from it sets it up hopefully as a slightly stunted right shoulder to a potential broad inverse H&S. Needing a decisive escape over 1.105 to hone this pattern and propose a more enduring turn back to the upside for the macro monitor, in that case suggesting a rally to engage the 1.20 border of the previous early ’22 top structure at 1.20 before next taking a breather. Only persistent wheelspin shy of 1.105 (and in both Crude markets) would raise fears of fumbling this effort, then watching the mid band (1.072) to warn of reversing south again.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary