Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

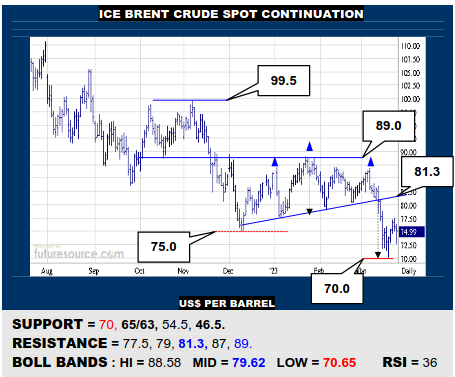

ICE BRENT CRUDE OIL SPOT

After an accurate H&S projection down to 70, Brent bounced but the initially clear skies clouded over fast at 77.5 as that prior top came back into play. Only a junior corrective star so far then and would have to labor out across the 81.3 neckline to make a real impact. Otherwise wary of tailing off and dropping on through 70 to the 65/63 area.

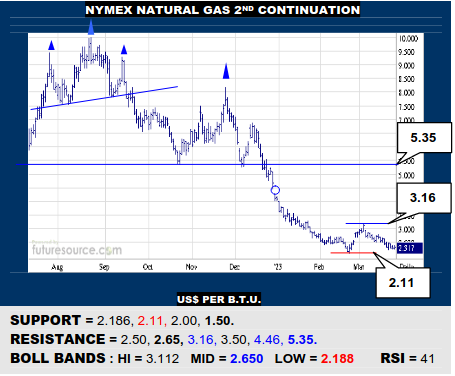

NYMEX NATURAL GAS 2ND CONTINUATION

The initial bounce failed early in Mch and Nat Gas has eased back towards its prior 2.11 low. However, that level has some shielding from the lower Bollinger (2.188) so watch first 2.50 and then the mid band (2.65) as successive triggers into a new rally for 3.16. Only carving through 2.11 would warn of whittling on down towards 1.50.

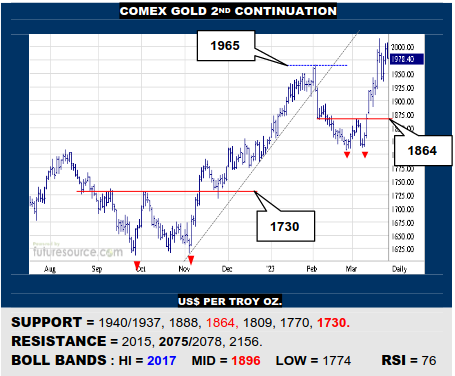

COMEX GOLD 2ND CONTINUATION

A sudden dip back from the 2K’s was still well parried at the 1940 initial support and Gold is on the 2K frontier again. A clean break of 2015 would thus post a bull flag and pave the way to the 2075/2078 long term peaks. Only several days wheelspin under 2015 and/or a quick reflex through 1937 would instead form a dual top to turn back towards 1864.

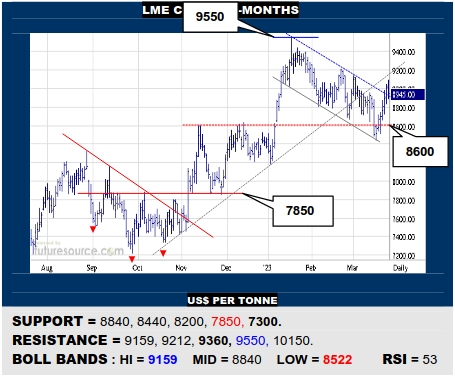

LME COPPER 3-MONTHS

A delve under 8600 was quickly retrieved as the Dollar fell and Copper has provisionally broken its Q1 downtrend. Needing a corresponding escape over 4.13 in Comex to reassure this, in which case implying the end of a corrective phase to start a new leg to the 10K’s. Wanting the mid band to prop up any nearby congestion to stay on the front foot.

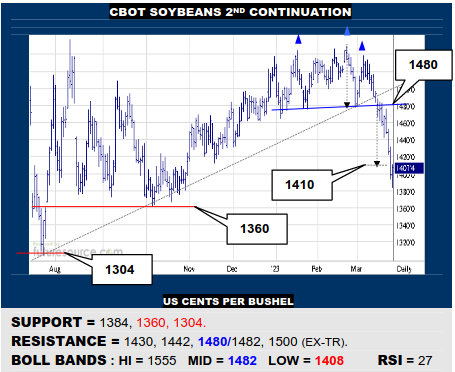

CBOT SOYBEANS 2ND CONTINUATION

Once the H&S above 1480 was resolved, Beans took swift retribution and exceeded the projection down to 1410, only getting a little air Friday. Premature to call a catch off this alone and mindful still of further reach towards 1360. Only a close back over 1430 would pique corrective ideas for a reaction back up towards that heavier clutter above 1480.

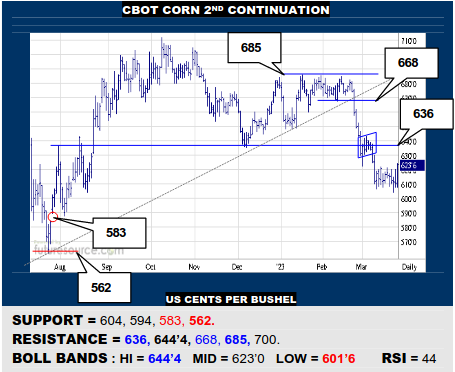

CBOT CORN 2ND CONTINUATION

After a fortnight of recuperative ranging, Corn managed a lunge back over immediate 620 resistance and the nearby mid band Friday. This suggests a corrective attempt on up to the 636 top frontier where going will get tougher, the upper Bollinger pulling in behind (644’4). Duly on guard for a new apex around 636/640 to swerve lower again.

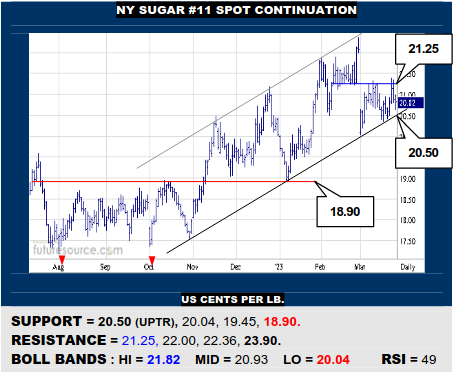

NY SUGAR #11 SPOT CONTINUATION

Still Sugar has been unable to vault 21.25 to link the former Mch with the current May contract so there is the risk of stagnation that demands a keen watch of the mid term uptrend (20.50), a trapdoor back to 18.90. Must endure aboard the trend and finally rip through 21.25 to otherwise score a vital transition that could then spark a new flurry to 22.36.

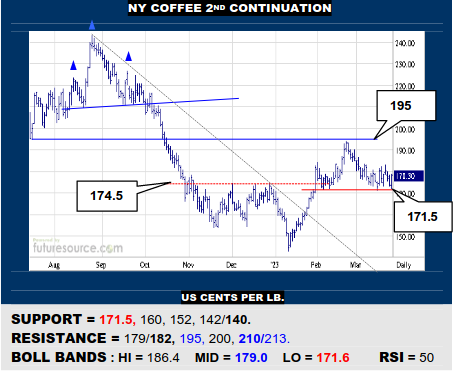

NY COFFEE 2ND CONTINUATION

Coffee continues to fight off delves towards key 171.5 support, which must hold to prevent a new Q1 H&S that could pull out the rug back into the 140’s. An outside day Friday meantime revives the threat to the 182’s resistance and a clean getaway would instead hail the end of a correction to set up a rally through 195 towards the 210+ H&S top.

B-BERG / US DOLLAR RATIO

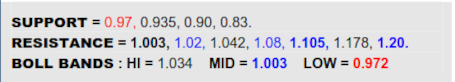

One day down but the Dollar has bounced back over 102.6 to keep the macro Ratio wavering as the B-Berg meantime struggles to find grip. Watch 103.5 on the Dollar index as a preliminary retrieval threshold and then its mid band (104.2) as the true escape hatch where the 0.97 low here could really be in peril to threaten a next step down to the Nov-Jan tops’ projected goal of 0.935, by then even having to entertain the prospect of longer term reach to the 0.83/0.82 region. Must alternatively see the Dollar flinch under 103.5 and steer lower again to have a better shot at the Ratio mid band (1.003) as a stepping stone to take on the 1.02 top rim to try to make a more persuasive upturn.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.