Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

ICE BRENT CRUDE OIL SPOT WEEKLY

Failure to resurface in the 100’s has instead given new definition to a ’22 downtrend and Brent has gnawed away the 86.7 monthly base rim again. Loss of the 83’s would thus confirm a triangle-like top to reiterate the prior uptrend collapse, opening the door down to 65. Must otherwise jolt back over 92 to start repairing this teetering scene.

NYMEX NATURAL GAS 2ND WEEKLY

An implied base exit over 7.52 has been instantly reeled back, posing a serious doubt about the Nat Gas revival. Must thus watch 6.85 as the mid band draws in for a signal of really dismantling this Q4 swell and turning focus back to 5.35. Only mopping up in the high 6’s and ending a week above 7.52 would reassure a new base and scope up to 10.00.

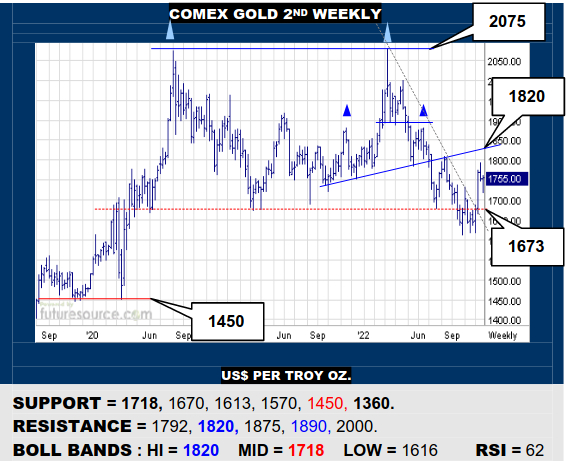

COMEX GOLD 2ND WEEKLY

Gold fought off a huge double top and shed its ’22 downtrend to make a useful comeback in Q4, recouping a corrective dip aboard its mid band this week (1718). This hints of a bull flag possibility and scope to attack the former H&S neckline (1820) in search of 1890 beyond. Only breaking back under the mid band would derail this rejuvenation.

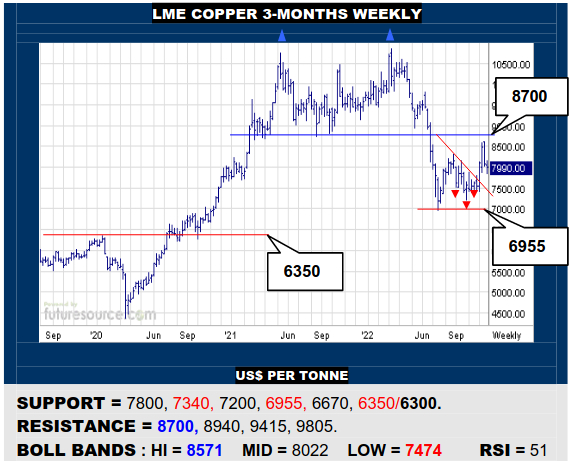

LME COPPER 3-MONTHS WEEKLY

Copper lunged for the 8700 weekly double top border in Nov but was bluntly rebuked. This hasn’t totally nullified chances to try for 8700 again but the market needs to stabilize aboard 7800 meantime to keep its footing. If 7800 succumbed, the inverse H&S neckline (7340) would beckon, by then leaving the 8700 frontier a long way overhead.

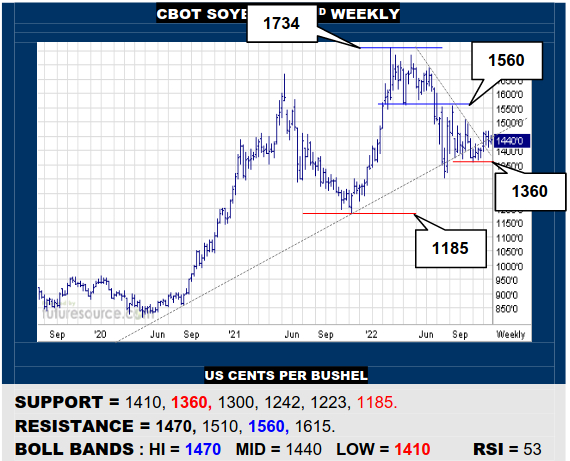

CBOT SOYBEANS 2ND WEEKLY

Another fine mess Stanley as both the mid year downtrend and broader ‘20’s uptrend have both frayed. Beans must bust clear of 1470 to repair the uptrend and resume course towards 1560. Alternatively, falling back under 1410 would reiterate the uptrends’ disruption and warn of a new dunk to 1360, still the tripwire for a heavier dive to the 1180’s.

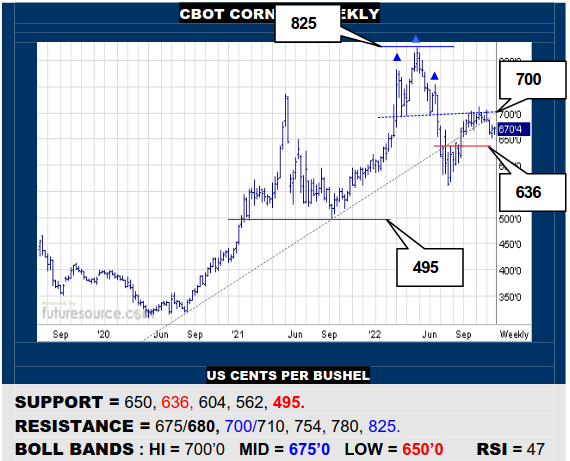

CBOT CORN 2ND WEEKLY

Corn tailed away from the 700+ H&S but still hasn’t pressed back to the next main support rung at 636 as this week became an inside week rebellion. Duly minding 680 as the trigger to take another swipe higher, conquest of 710 creating far more space towards 825. If hemmed in under 680 still, don’t yet rule out that additional delve to 636 yet.

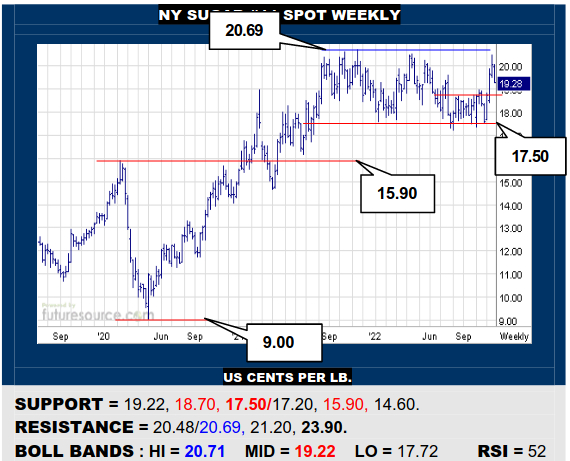

NY SUGAR #11 SPOT WEEKLY

Another crest just shy of the 20.60’s has seen Sugar veer back through a 19.40’s daily gap to threaten its mid band (19.22). Tough for it to ward off this backlash so if the mid band cracked, look for an ongoing retreat to the prior 18.70 interim base border. If the mid band held up though, a new rally at 20.69 could yet pry open clearer skies towards 23.90.

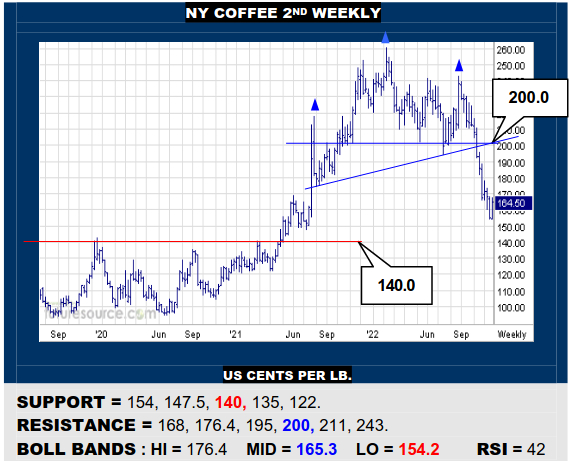

NY COFFEE 2ND WEEKLY

Finally an inside week is contesting the steep dive from the big weekly H&S in the 200’s as Coffee tries to find its feet. A jog back over 168 would reassure this insider and at last present corrective scope back into the 190’s, even if $2+ looks difficult. If blocked by 168 however, still make room for that additional slide on back to the bigger 140 base rim.

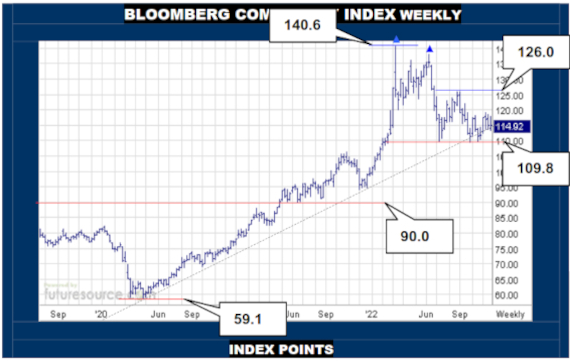

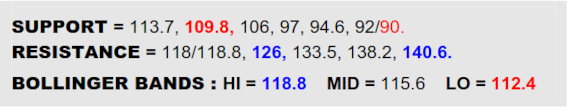

BLOOMBERG COMMODITY INDEX WEEKLY

The weekly view of the B-Berg emphasizes the importance of the near term wranglings in Nov as the Index is battling to repair the early Q4 fraying of the main ‘20’s uptrend. It has this chance to make good because of course adjacently the Dollar derailed from its own ’22 uptrend in a far more decisive manner, offering commodities a way back. Even so, a clean thrust over the 118’s is needed here to reassure the patching up of the uptrend so as to sharpen the view ahead to 126 and the chance for a fully revitalizing new base to be created. Watching 113.7 closely meantime though as the upending tripwire down to 109.8 where the bough could break and the cradle could truly fall.

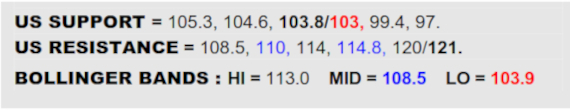

US DOLLAR INDEX WEEKLY

Finally seeing a chink in the Dollars’ Fed armor in Nov has led to a hard slump from the former steep ’22 uptrend. A minor breath of air since doesn’t yet give any suggestion of useful repairs however and indeed currently plays more in a bear flag light in the wake of the trend derailment. Would accordingly still be foreseeing the prospect of returning to prior long term peaks in the 103.8-103 vicinity that present the best opportunity if the Dollar is to hold altitude and ultimately have a chance to recover and make new headway beyond 110. On the other hand, if even the 103’s succumbed, the 93’s would come into sight, surely giving the B-Berg a major shot in the arm.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary