Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

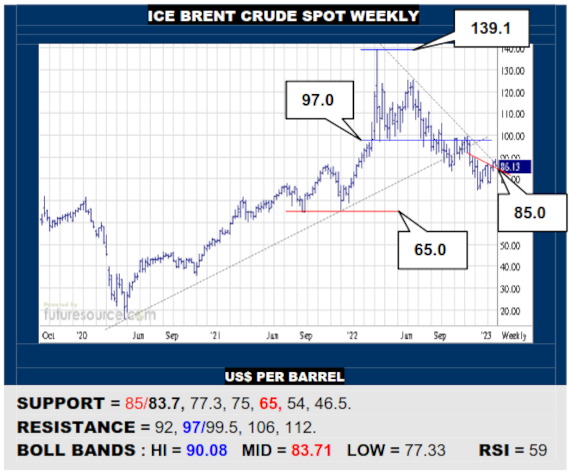

ICE BRENT CRUDE OIL SPOT WEEKLY

A key stage for Brent as it seeks a foothold aboard its new inverse H&S neckline (85) to solidify the recent fraying of the ’22 downtrend. Success would pave the way on up to 97-99.5, seeking triple digits to hone the recovery. Alas, if swept back beneath 85 and the nearing mid band (83.7), the base would dissolve to turn back towards 75.

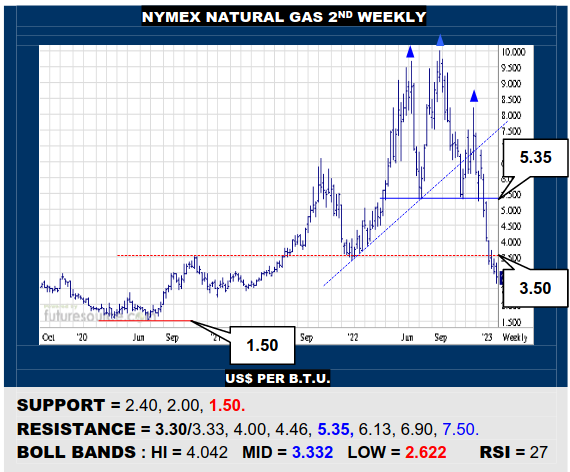

NYMEX NATURAL GAS 2ND WEEKLY

Forming a massive H&S top in ’22 above 5.35, Nat Gas has cascaded on down through the next 3.50 weekly rung to present a view down to 1.50. However, momentum has cooled in Jan and RSI has started diverging so while yet to stem the southerly flow, do still watch a 3.30 pivot as initial warning of a correction back to 4.00, if not a 4.40’s gap.

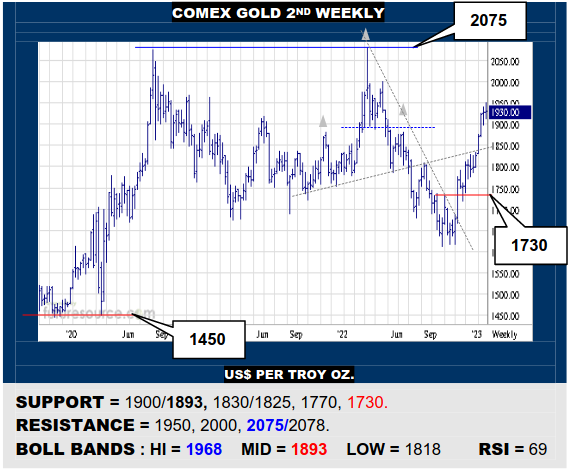

COMEX GOLD 2ND WEEKLY

Golds’ Q4 rejuvenation bust over the prior H&S neckline as ’23 began to give the market a fresh shot of impetus. However, this has lately started to cool as RSI begins to signal divergence so corrective strain appears to be growing. Duly watching a tightening niche between 1900 and the arriving mid band (1893) to warn of a setback to 1830.

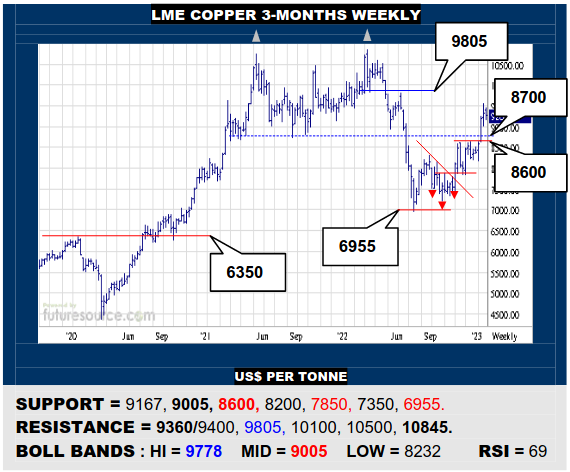

LME COPPER 3-MONTHS WEEKLY

Copper overthrew its 8700 top frontier as ’23 began and has rattled on up to a 9360 Fib retracement of last years’ decline. Wary that the trail has suddenly cooled here however and brought an inside week so be on watch for a correction, a slip back through the mid band (9005) then warning of delving back to the 8600 launch platform for the recent rally.

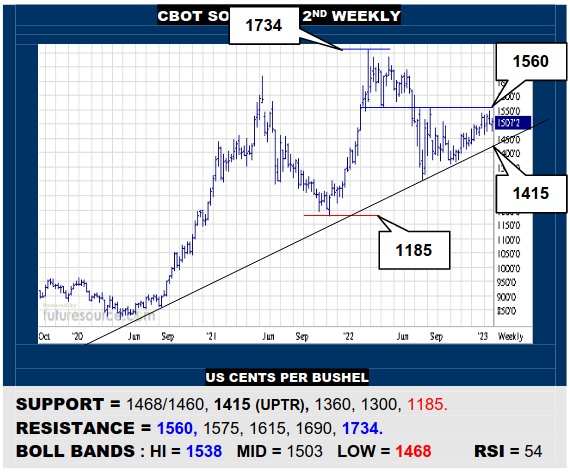

CBOT SOYBEANS 2ND WEEKLY

Q4’s upswing has merited redrawing the overall weekly uptrend but Beans have nonetheless shown signs of fatigue upon nearing the next 1560 top frontier from early ’22. Must punch through there to generate any new verve while meantime keeping tabs on 1460, a twist beneath there instead warning of actually testing the revised trendline (1415).

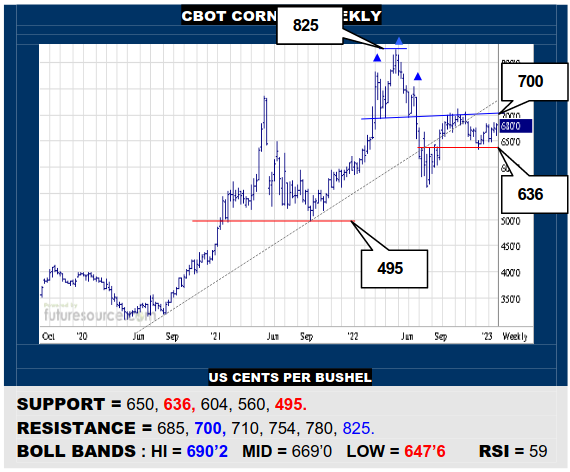

CBOT CORN 2ND WEEKLY

Corn clearly derailed from its weekly uptrend in Q4 when faced by the 700+ H&S formation but it has since stabilized on an interim 636 base rim. That 636 to 700 band thereby represents the gray zone in Q1. If the market can lunge over 700 to dispel the top, the 800’s would beckon. On the other hand, breaking 636 would open a hole back to 560.

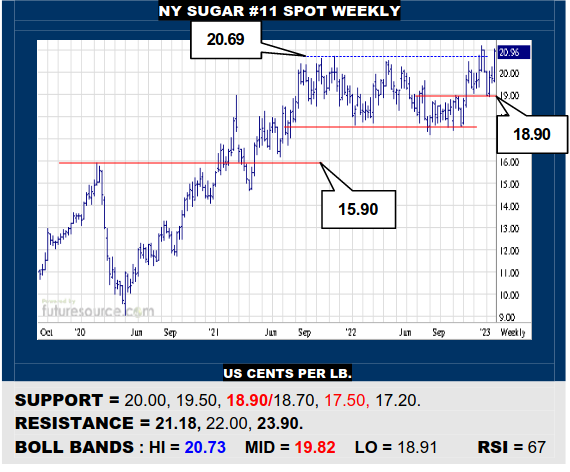

NY SUGAR #11 SPOT WEEKLY

Sugar retrieved its early ’23 dip aboard the prior base, padding the base rim to 18.90/18.70 and grappling back up towards the 21.18 Dec high. This casts the Jan setback as just an abrupt correction so escape over 21.18 would reassure the climb to target the 23.90 ten year high. Can’t pause under 21.18 for long though without risk of veering back to 20₵.

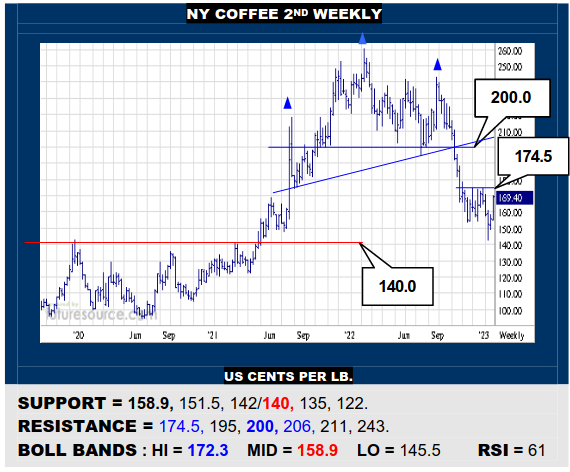

NY COFFEE 2ND WEEKLY

The weekly support at 140 has been verified in Jan, prompting Coffee to react smartly back up over its mid band and daily downtrend. That sets the stage to take on the 174.5 resistance with better odds of success to bust through into the 190’s. Only several new fumbles in the 174 region could tame urgency and create risk of another dip into the low 140’s.

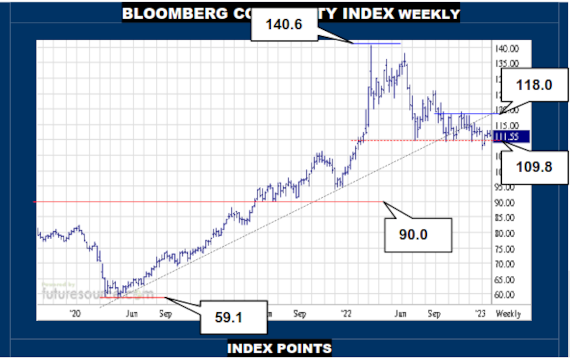

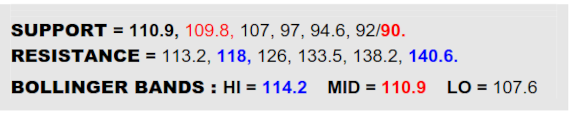

BLOOMBERG COMMODITY INDEX WEEKLY

The B-Berg dug itself out of a new year scare as it briefly ducked through the 109.8 support but the rebound has faded in the low 113’s, leading now to a very marginal inside week, which illuminates the caution light and requires watch over the 110.9 mid band. A backlash through it while Brent was swatted from the 85’s would raise doubts about the substance of the Jan recovery and the 107’s could be subject to another look, becoming all the more ominous if the Dollar meantime managed to lunge back into the 103’s. Must otherwise balance on 110.9 while currency stayed quiet and then pop 113.2 to reaffirm the commodity revival and pave the way on ahead towards 118.

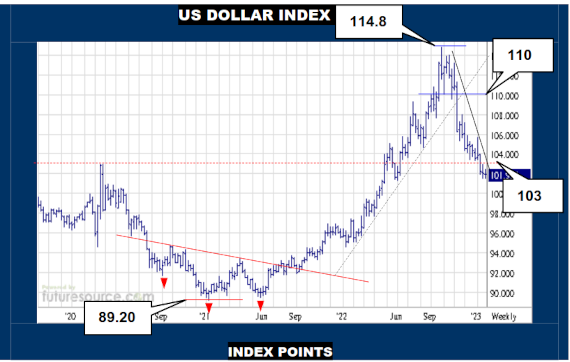

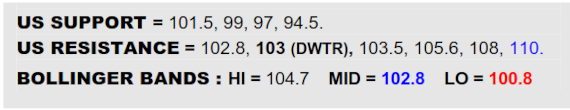

US DOLLAR INDEX WEEKLY

Wouldn’t liken it to a scuffing bull exactly but despite breaking its 103 weekly support early in ’23, the Dollar has since dabbed the brake at 101.5 in the past couple of weeks. It isn’t a level that previously showed any technical value but the simple fact that pressure has abated there and RSI has made a noteworthy swerve higher warns to be more cautious. Would thus now have a watchful eye on the 103 figure going back the other way as that would vault both the mid band and the interim downtrend to suggest scope into the 108-110 region, potentially very disruptive to commodities. Must otherwise drill on through 101.5 to be much more cooperative to the B-Berg.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary