Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

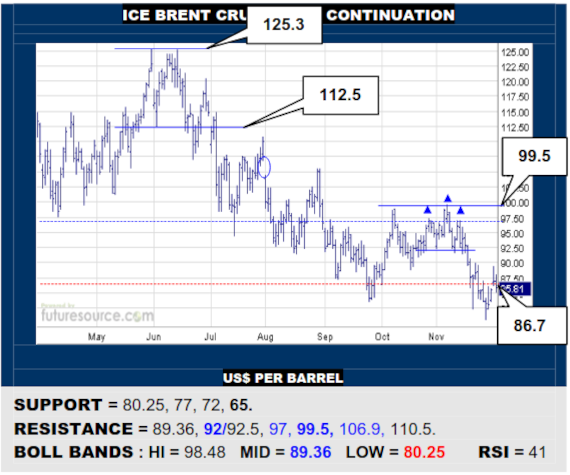

ICE BRENT CRUDE OIL SPOT CONTINUATION

Jittery action in Brent and a small overhead H&S also marks the point where it more definitively derailed from its overall weekly uptrend. Dangling over the edge here then with only piecemeal support down to 72 and 65 providing the next main shelf. Must jolt back over the 92’s to even begin repairs and clear 99.5 to pull a white rabbit out of the hat.

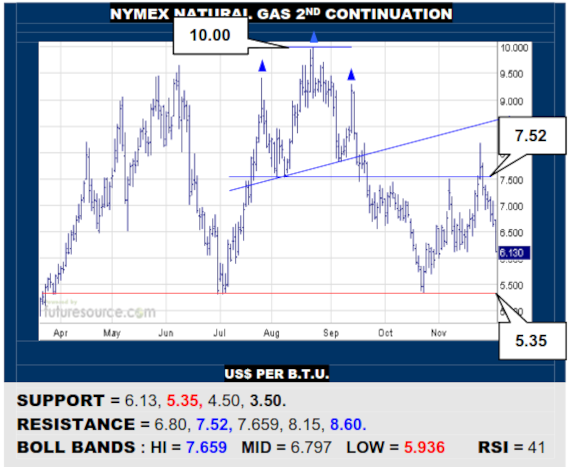

NYMEX NATURAL GAS 2ND CONTINUATION

A false breakout over the 7.52 top border was reeled back down and Nat Gas has fallen away to an early Nov ledge at 6.13. Looking prone to tipping over this, in which case facing a potential third dice with 5.35 where a vast new H&S could envelope much of ’22. Must quickly rebound over the 6.80 mid band to give any fresh signs of life.

COMEX GOLD 2ND CONTINUATION

A mid Nov dip was mopped up by the sub 1735 base and mid band and as become a bull flag as Gold proceeds higher. The $175 flagpole duly now projects beyond the 1855 base measurement to the 1890 area before needing more of a breather. Otherwise only veering back under mid band (1750) and 1735 base rim would upend this recovery.

LME COPPER 3-MONTHS

Gathering up in the 7850’s, Copper is back on the offensive in search of the bigger weekly top frontier at 8700 again. Conquest of that divide would mark an important transition of the second half recovery effort to light a path to 9805 if the B-Berg meantime overcame the 118’s. Watch 8100 though for any sign of distress that could turn focus back to 7850.

CBOT SOYBEANS 2ND CONTINUATION

A glimpse over 1470 was still largely restrained by the upper Bollinger band so the early Nov downtrend escape just isn’t catching fire. So only a clean cut punch beyond the 1470’s could rekindle belief in the upturn whereas, if Beans broke 1413, look for a return to the 1360 gap and even more extensive fallout to the 1180’s if it succumbed.

CBOT CORN 2ND CONTINUATION

Some idling sideways during Nov never troubled the 680 neckline of a prior H&S and Corn has broken on down as if departing a somewhat long in the tooth bear flag. Finally now looking at a test of the former 636 base rim and how the market fares in the 630’s should determine if it can try a new revival or surrender to more extensive decay to the 580’s.

NY SUGAR #11 SPOT CONTINUATION

The mid Nov retreat retains a broadly flag-like vibe but Sugar must soon peg a close into the 19.80’s to polarize that impression and so bolster chances to dispatch the 20.60’s and reach towards 22₵. If denied the 19.80’s breakout early next week though, faith in the flag possibility would wane and would instead then cater for testing the 18.70 base rim.

NY COFFEE 2ND CONTINUATION

A small Nov inverse H&S finally implied Coffee needed some corrective air but Thursdays’ outside day lower is immediately disputing the new base. Could forgive the ‘wobble’ if quickly back over 165 next week, still then eying scope to try for the 190’s. Breaking 160 would just dissolve the base though and threaten a further dunk to the 140 weekly support.

BLOOMBERG COMMODITY INDEX

Try, try again still for the B-Berg as its latest swell has again come up shy of the 118’s resistance and it has spent enough time in the mid teens that the Bollinger bands corridor has closed in around the range (118-114), now requiring that extra shot of urgency to poke free. As lately noted, in shedding the mid-year downtrend and holding tight thereafter, the pattern still has a generally constructive tone but very wobbly Crude action is denying that crucial escape over the 118’s to complete a base and thus pull in further buying to set sail for 126. Would duly still be troubled by any close under 113.7, fearing it could precipitate a fourth teeter on the main cliff edge at 109.8.

US DOLLAR INDEX

Further hints by the Fed of taking a milder approach henceforth quickly smothered the Dollars’ second bounce from 105.3 and it has slid on down towards the 103.8-103 span marking prior peaks in early ’17 and ’20. If Q4 is ultimately going to transpire to only be a larger correction, this is where the greenback should show more resilience to steadily come in for a landing, potentially if any future inflation data started to get a bit feisty again, in which case attention would return to the mid band (107) as the first main trigger back upwards. If instead though the 103’s were carved away, it would propose a more enduring reversal and subsequent loss of 100 would point back down to the 90/89 region.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary