Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

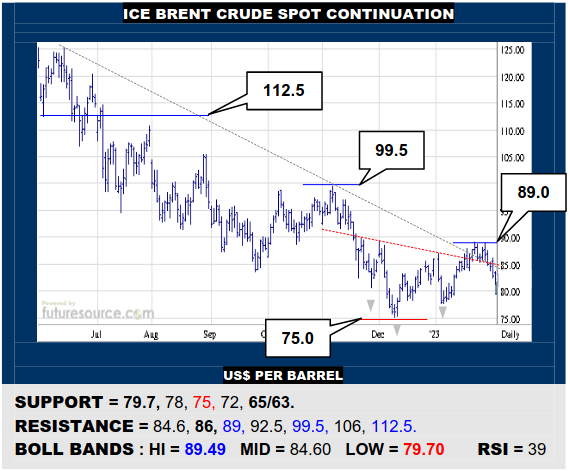

ICE BRENT CRUDE OIL SPOT CONTINUATION

Brent has fallen back through the ex-trend and inverse H&S neckline convergence at 85 to dilute a previously hopeful pattern, undercutting the B-Berg before the Dollar twisted the dagger Friday. Unless able to quickly pivot off the lower Bollinger (79.7) back over 86, this threatens a new look at 75, a further $10 step down to 65 looming beneath.

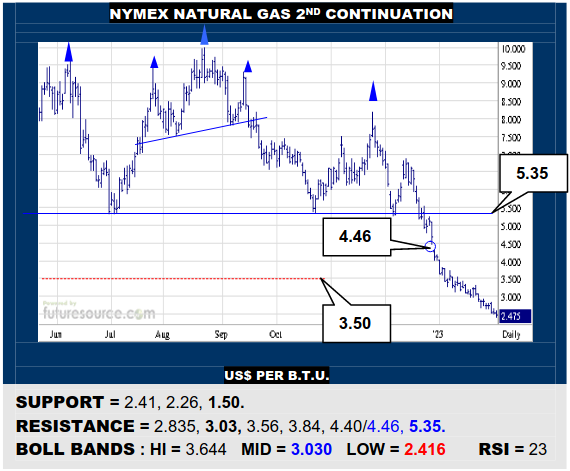

NYMEX NATURAL GAS 2ND CONTINUATION

Far more tentative downward stepping since the new year but Nat Gas still can’t seem to find the brake, now needing at least a reflex over the immediate 2.835 pivot to signal a swerve into a correction that could gain steam by popping the mid band (3.03). Otherwise, in spite of the cautious drop, the road to 1.50 will keep beckoning.

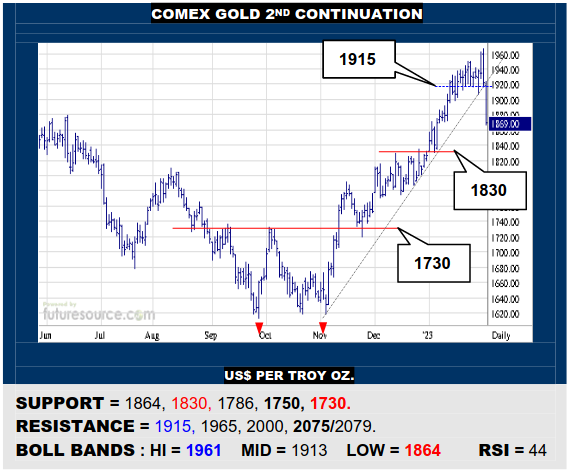

COMEX GOLD 2ND CONTINUATION

As the Dollar finally showed some fight, so Gold posted an outside day reversal Thursday to promptly snap its uptrend Friday. This infers initial corrective reach back to 1830 but, if unable to hold there, make way to a Fib retracement (1750) and maybe even 1730. Only a shock rebound over 1915 would propose a much quicker retrieval of this stumble.

LME COPPER 3-MONTHS

Copper ran out of gas at the 9360 Fib retracement and has swerved down through its mid band this week. With the Dollar now vaulting its downtrend, would be wary of further inversely correlated losses here to examine the pivotal 8600 support shelf. Hold there and gains could resume but break 8600 and the decline could compound to 7850.

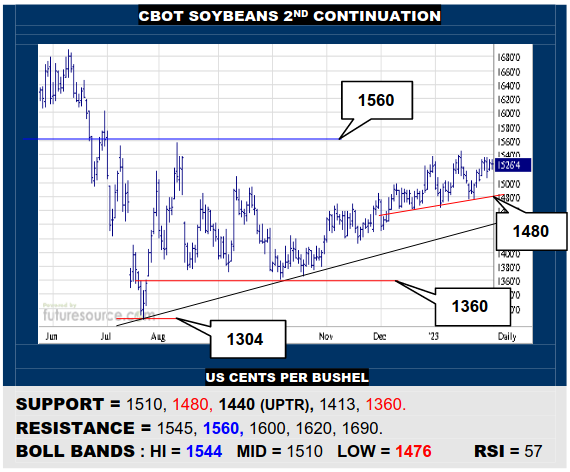

CBOT SOYBEANS 2ND CONTINUATION

This looks like a ‘now or never’ third upside foray to the 1540 area for Beans. This one must bust through broader weekly resistance at 1560 to rejuvenate upside impetus into the 1700’s. If foiled a third time shy of 1560, beware more of a H&S top evolving, then swaying focus back onto a 1480 neckline tripwire that could precipitate a retreat to 1360.

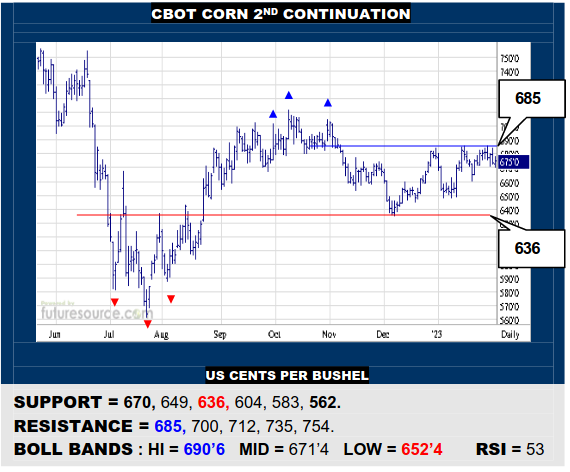

CBOT CORN 2ND CONTINUATION

Yet more fumbles at 685 by Corn have it teetering on a 670 ledge, a break below clarifying the demise of the mid band and opening passage back towards the 636 base rim again, still the pivotal longer term tipping point. Only finally blazing a trail clear of 685 could persuade of renewed upside momentum and a better chance to get free beyond 712.

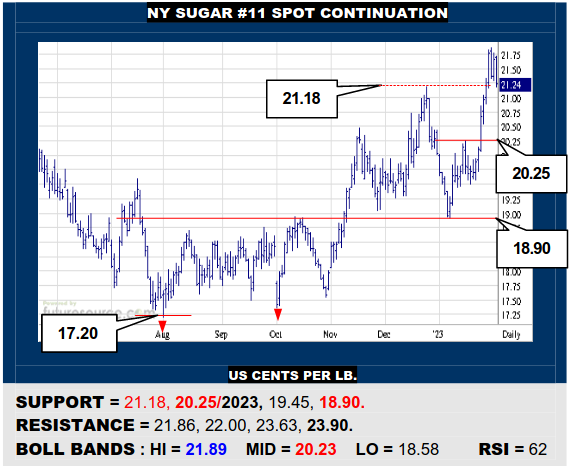

NY SUGAR #11 SPOT CONTINUATION

The Dollar rejuvenation threatens to throw a wrench in Sugars’ escape over 21.18. While it can hold on, there might yet be a chance for a bull flag, in which case piercing 21.86 would project on to 23.63. The macro is under duress though so if 21.18 failed to hold up here, do then be ready for a backlash towards 20.25 where the mid band is arriving.

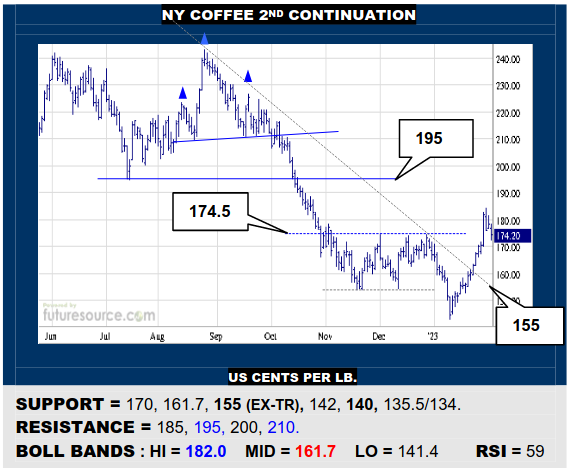

NY COFFEE 2ND CONTINUATION

Coffees’ reaction back up from 140 weekly support shed its downtrend but it also seems to have felt the Dollar revival and slid back from an inside day Friday. If this broke 170, beware at least a quick correction to the mid band (161.7), if not back to the ex-downtrend (155). Only while holding 170 might a vague flag chance deliver a further lunge at 195.

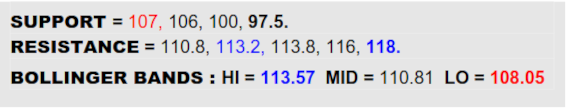

BLOOMBERG COMMODITY INDEX

The B-Bergs’ hopes for an inverse H&S were already suffering from some Crude oil decay this week but then felt the added pinch from the Dollar reacting to the jobs report by shedding its downtrend Friday. That effort will need securing with a foothold over 102.6 but meantime it already intensifies the strain here as the 107 new year trough comes under renewed attack. If the greenback took hold over 102.6, it is hard to see how 107 can be preserved and breaking it would reiterate the prior demise of the big 109.8 support to threaten more extensive losses towards 97.5. Only if somehow able to hang on at 107 would there remain a glimmer of hope for a dual bottom.

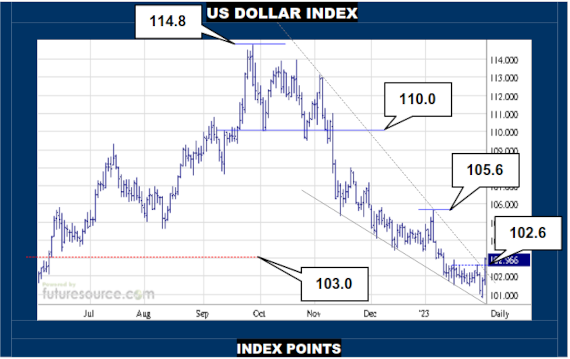

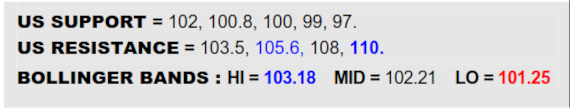

US DOLLAR INDEX

A failed bid to shed the downtrend was made only early this week but while the Dollar delved to new lows just after, it then retrieved that dip quickly and hustled back up to score the trend escape Friday. This is consistent with the recent chop in the water being far more typical of a move concluding as opposed to intensifying and if able to soon hone the getaway with some consolidation beyond 102.6, there would be expectation for a further quick sortie to 105.6 as the road to 110 started to beckon. Only if the trend disruption was very promptly and surprisingly surrendered to duck back under 102 would it keep it all in fluxwhere there might still be risk of expulsion from triple digits.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary