Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

See a sample of TechCom’s Sugar Technical Review by clicking ‘Download PDF’ above.

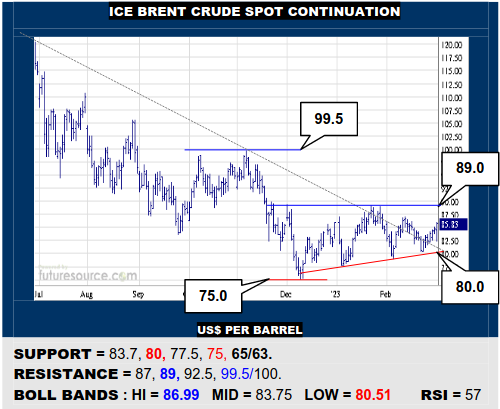

ICE BRENT CRUDE OIL SPOT CONTINUATION

A third downtrend escape attempt for Brent in Q1 and it will be graded by whether the 89 resistance is defeated or not. If it were, a three month base would emphasize the trend reversal and the next rung up at 99.5 could be sought. Still always keeping an eye on the 80 ledge underfoot meantime as it continues to mark a new H&S tipping point instead.

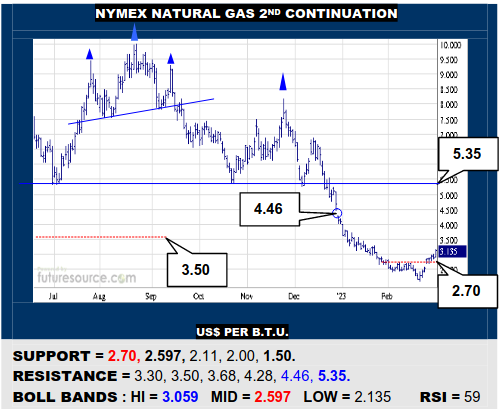

NYMEX NATURAL GAS 2ND CONTINUATION

The decline leveled out finally in Feb and Nat Gas has at last twisted back over its mid band into preliminary corrective mode, eying an immediate path to 3.50 but even mindful of a prior gap in the 4.40’s. Only a stumble and swerve back under new 2.70 support and the mid band (2.60) could suddenly end this upturn and spotlight 2.11 again.

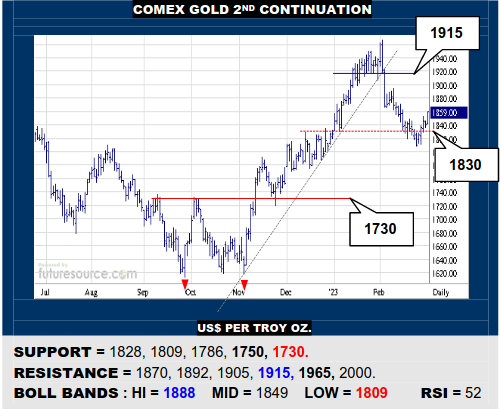

COMEX GOLD 2ND CONTINUATION

A little Dollar cooling shy of 105.6 this week sparked new life in Gold to hop back over its mid band. Would accordingly give the market room up towards the 1892 to 1915 span but be more wary of fading in there. Only if the Dollar fell from the 104’s would there be better odds of defeating 1915 and stretching on up to revisit the prior 1965 apex.

LME COPPER 3-MONTHS

The wavering Dollar has helped Copper rebound from a near miss of 8600 so it is challenging its recent downtrend (9135). Breaking beyond while the Dollar was ousted from the 104’s would signal the end of a Q1 correction and scope for a next leg up to 10K. However, if the Dollar rallied over 105.6, be prepared for 8600 to come under heavier fire.

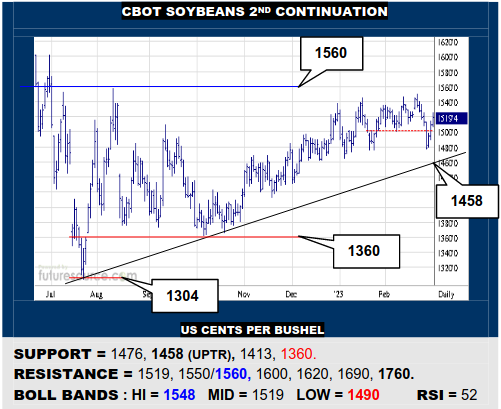

CBOT SOYBEANS 2ND CONTINUATION

A dip out of the 1500’s was still intercepted clear of the shallow main uptrend (1458) and Beans have rebounded well. Watching the mid band now (1519) to gauge the next step. If foiled in that 1519 vicinity, be ready for another setback that could yet stress the trendline. Busting clearly into the 1520’s would instead set up a new bid to dislodge 1560.

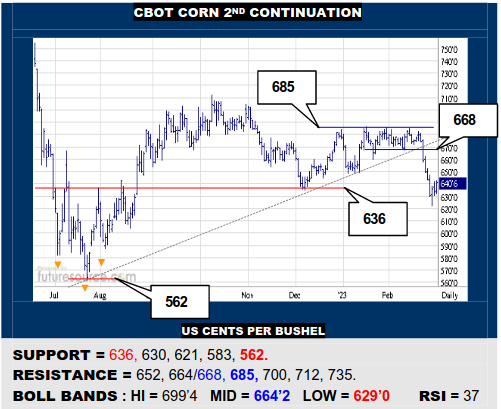

CBOT CORN 2ND CONTINUATION

After multiple rebukes at 685, Corn derailed from its uptrend and has fallen back to jab at the sub-636 Jly-Aug base. The base has initially deflected this drop but it is far from a proven footing yet. Duly mindful of bear flag risk where closing under 630 would dilute the base and point on towards 562. Must react back over 668 to make any useful repair.

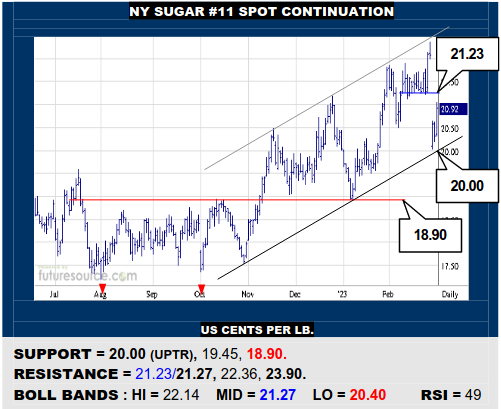

NY SUGAR #11 SPOT CONTINUATION

The Mch-May hand-off caused a sharp setback in Sugar but it appears to have mopped this up aboard the mid term uptrend (20.00). Even so, to prove that will now require overhauling the 21.23 resistance and mid band nearby (21.27). Success would resume the broader climb towards 23.90 but if foiled in those 21.20’s, watch for another delve to 20.00.

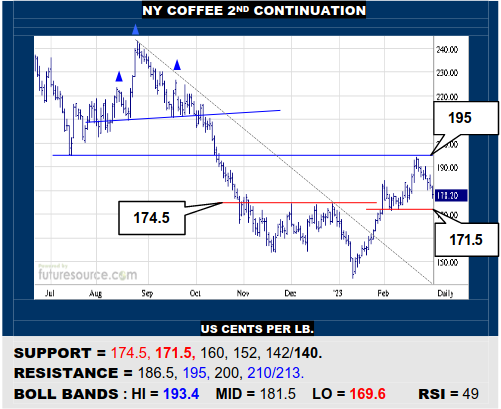

NY COFFEE 2ND CONTINUATION

An upswing from the 140’s approached the heavier clutter in the 200’s but Coffee has since fumbled and veered back under its mid band on Friday. Now watching what happens at the 174.5-171.5 support. If able to hold there, a new run for 200 could yet be made. However, if 171.5 gave way, there would be little left to prevent another delve towards 140.

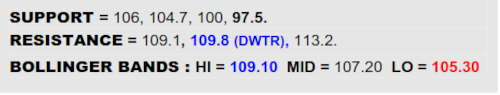

BLOOMBERG COMMODITY INDEX

An inside day to start the week and some cooling of the Dollars’ bounce gave the B-Berg opportunity to pull out of the Feb decline and it broke its mid band Friday while RSI has made a hopeful turn higher. Positive rumblings then but it is critical that the Dollar continues to waver shy of its next main hurdle at 105.6. If so or better still if the greenback was dismissed from the 104’s, the mid band crossing here could be solidified and there would be a genuine shot at the 109’s in a bid to unlock the main resistance frontier and intersecting downtrend (109.8) that could really tip the balance. Meanwhile would want to see Brent dial in focus on $89 to further bolster hopes of that all important 109.8 escape.

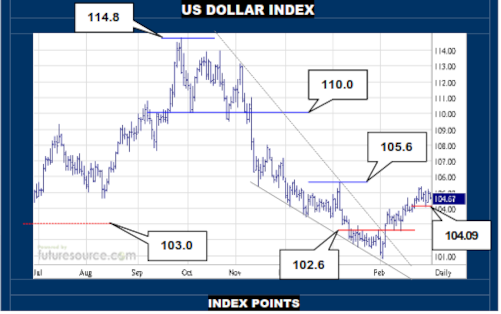

US DOLLAR INDEX

Though pulling back up Thursday in response to the mid band drawing in ever closer, the Dollar still hasn’t been sparked into any significant new step, needing to break free over 105.6 to really push on into clearer skies that could then lead to 110 and really make life hard for commodities. Meanwhile due to the mid bands’ arrival on scene, the midweek trough at 104.09 grows in importance. If it gave way, the Feb swell would have stumbled shy of a lesser 38.2% Fib retracement in the low 106’s and thus would generally look like a fairly uneventful corrective interlude that could later be verified as such by an ongoing break of 102.6, in which case the B-Berg could really be back in business.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary