Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

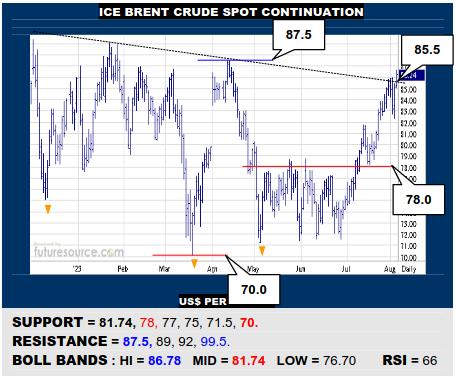

ICE BRENT CRUDE OIL SPOT

Brent initially dipped back from the 85.5 neckline this week but has quickly gathered up without troubling its mid band (81.74) to press the attack once more. Busting across the full 85.5-87.5 span would thus finish a large inverse H&S to aim at the 100’s. If denied by 87.5 and steered down under the mid band though, watch for a backlash to 78.

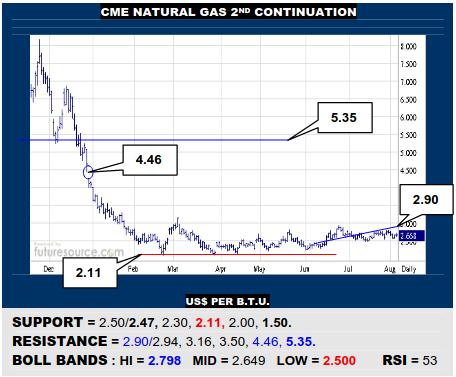

NYMEX NATURAL GAS 2ND CONTINUATION

Late Jly failures (2.80) at the neckline of a prior small H&S leave Nat Gas facing the same old challenge, ‘reach the 3’s or bust!’ A multitude of previous stumbles in the upper 2’s mean escape into the 3’s could reset the circuit and there is virtually nothing in the way until 4.46 then. Minding 2.50/2.47 as a key net meanwhile for retrieving nearby dips.

COMEX GOLD 2ND CONTINUATION

An outside day recovery from a delve into the small inverse H&S under 1940, aided by the lower Bollinger (1931), should inject new fire into Gold. Must verify this by breaking the mid band (1960) though, in which case look for a pivotal try on 1990 seeking a broader summer base. If blunted by the mid band though, then beware more extensive losses.

LME COPPER 3-MONTHS

Coppers’ poke over 8712 still soon faltered shy of the true H&S neckline (8935) so a nearby uptrend (8450) needs close watching as a possible tripwire to end a summer corrective swell and spark new losses towards 7850. Only safe handling aboard that local trend and the Dollar falling back out of the 101’s would infer a more enduring trend developing.

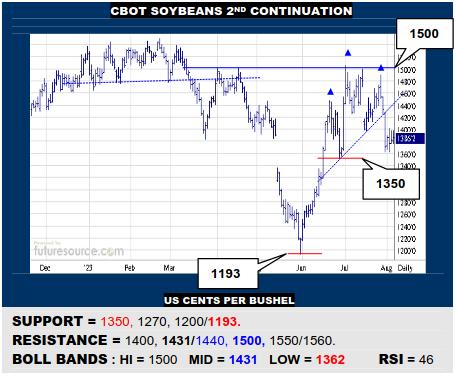

CBOT SOYBEANS 2ND CONTINUATION

Repeated fumbles in the face of 1500 resistance have led to a modest new H&S forming that sits under Beans’ massively bigger weekly chart version. Toppy conditions then and must watch 1350 as a tripwire to add a small bear flag that could hasten losses towards 1200 again. Must jolt back over 1440 to make headway against the new top shape.

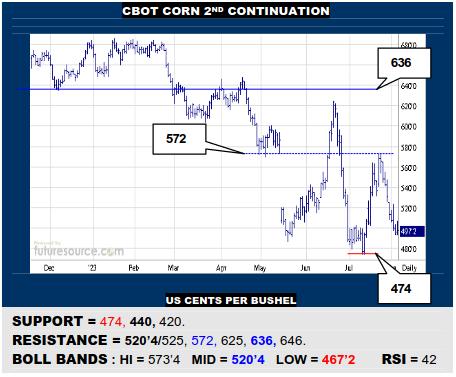

CBOT CORN 2ND CONTINUATION

A new downturn from the 570’s just seems to emphasize the big weekly H&S dominating Corns’ ’21-’23 landscape so a prior 474 trough doesn’t look like much of a defence and would be wary of pressing through into better 440-420 monthly based support before expecting firmer grip. Only a jolt back over 525 could otherwise stir a hastier resuscitation.

NY SUGAR #11 SPOT CONTINUATION

The post-Jly contract revival has gradually derailed in the past fortnight and Sugar has now installed a small new H&S top that sounds the alarm at the ’23 uptrend (23.25). If that gave way in response, the bigger Q2 top would restate its command and the path down to 20.50 would beckon. Must bounce off the trend to pop 24.60 to revive this market.

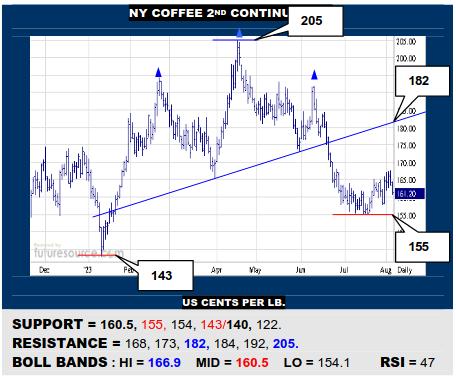

NY COFFEE 2ND CONTINUATION

What originally looked like a Jly basing effort simply petered out as Aug jabs over 165 lacked stamina and Coffee has veered back to loom over its mid band (160.5). If that mid band succumbed, it would imply the crest of just a corrective phase and there would be further risk beneath 155. Must grip at the mid band to suggest residual signs of life here.

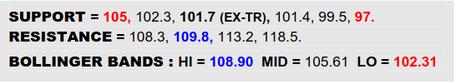

BLOOMBERG COMMODITY INDEX

Initially the B-Berg has grabbed on at the initial 105 outcrop but the situation still feels tenuous after the Dollars’ recent strong comeback from the 99’s. Looking to Crude Oil especially as a key pillar in propping up that 105 level to therein preserve the prior casting of the ’23 undulations as a rather ragged inverse H&S, ultimately seeking escape beyond 109.8 if commodities are to truly round the corner onto a sustained upside path. However, if the Dollar makes further gains and 105 gave way here, then beware a pocket of open air back to the ex-downtrend (101.7) before maybe getting one final chance to gather in and prevent a more enduring return to the downside.

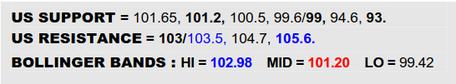

US DOLLAR INDEX

Some cooling of the Dollar Friday after a vigorous rebound from the mid-Jly dunk into the 99’s. The prior trough almost met a long term Fib retracement of the ‘21/’22 advance (99) and the manner in which values recovered across several hurdles has implied retrieving a false breakdown. In lately nearing the upper Bollinger band (103) however, perhaps a breather is required and the key prop during this will be the mid band (101.2). Hold safely clear of it and the previous false breakdown notion would be endorsed, keeping the upside path beckoning. A sharp twist back under the mid band though would instead argue the case of just an abrupt corrective bounce cresting to return focus to the 99’s.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.