Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

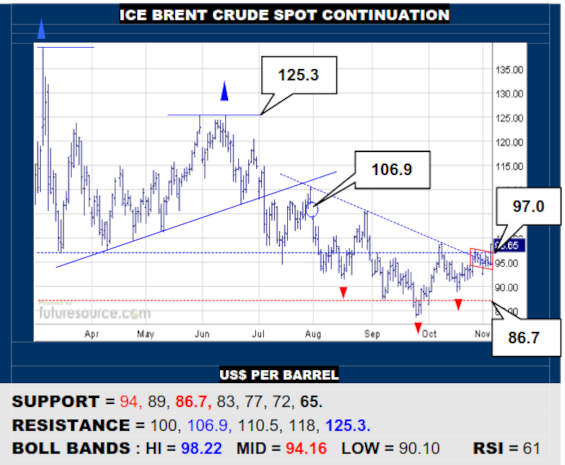

ICE BRENT CRUDE OIL SPOT CONTINUATION

Brent has stabbed back into the top over 97, suggesting a flag escape that is meantime shoring up the emergence of a new Aug-Oct inverse H&S base. Alongside the post-Fed Dollar flinch, this looks encouraging but must soon emerge in the 100’s to verify and next target the 106’s with an eye to 125. Only a backlash under 94 would tear it down again.

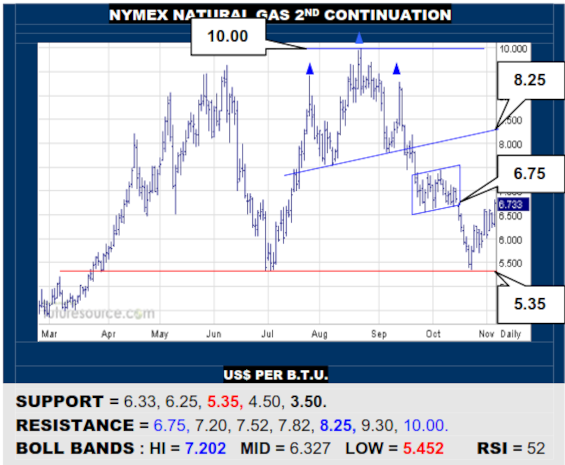

NYMEX NATURAL GAS 2ND CONTINUATION

Nat Gas has revived from the vital 5.35 catch to be engaging the 6.75 edge of the prior bear flag. Busting through and holding beyond would be a promising next step, paving the way on towards the former H&S neckline at 8.25. Beware however of any 6.70’s wheelspin and reaction back under 6.25, in that case turning focus onto 5.35 again.

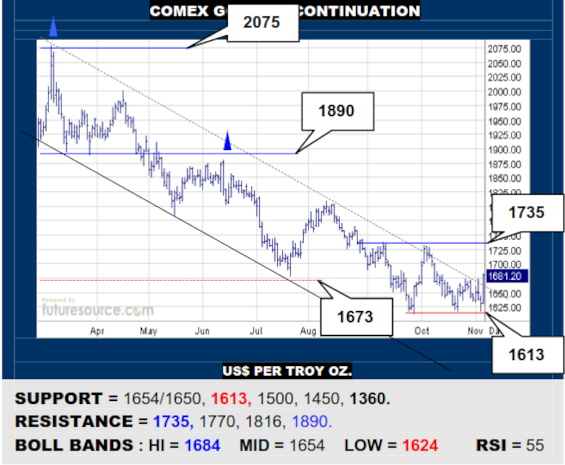

COMEX GOLD 2ND CONTINUATION

Gold toughed it out aboard a near term 1613 ledge and has reacted back over the 1673 resistance to again question the very large monthly double top. Must still secure this 1670’s vault early next week but, if able, it would pave the way on to 1735 where a bona fide base could form. Only veering back under 1650 would undo this hopeful bounce.

LME COPPER 3-MONTHS

Playing its leading indicator role, Copper really shored up its inverse H&S base Friday as it bust clear of 7800. This lights a path to the 8700 border of the weekly top, which looks a hefty foe but could be far more permeable if the Dollar meantime broke 109.5. Only veering back under 7600 would dissolve the base and signal a failed turnaround attempt.

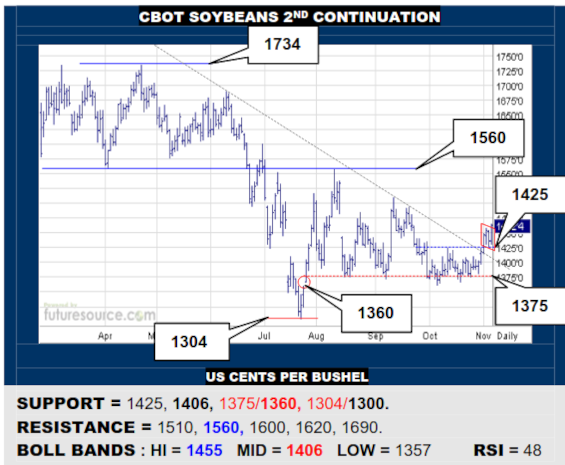

CBOT SOYBEANS 2ND CONTINUATION

Beans have broken free from the midyear downtrend and now seem to be tacking on a bull flag to emphasize the point. This opens up a path towards the former top frontier at 1560 but could use a Dollar break of 109.5 to really aid the cause. Meanwhile only veering back under 1425 would undermine and signal a warning to the mid band (1406).

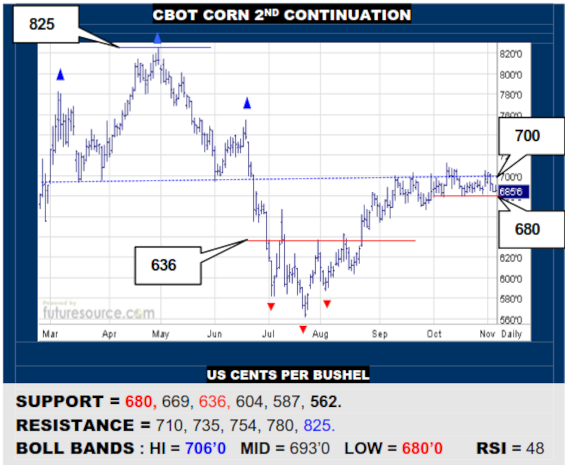

CBOT CORN 2ND CONTINUATION

Corn has stagnated on the 700 frontier for about two months now but still refuses to take ‘no’ for an answer. While 680 is intact then, keep an open mind to a vault of 710 instilling new impetus to the 760’s. Alas, on the other hand, breaking 680 would polarize the fatigue and probably pull out the rug back to the preceding base border at 636.

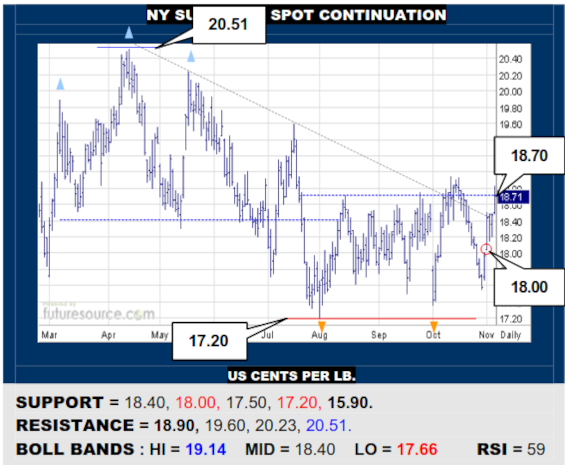

NY SUGAR #11 SPOT CONTINUATION

Sugar keeps grappling back from the mid 17’s and the improved macro backdrop gives it a fresh shot at 18.90. Breaking clear would finally dispel the first half H&S top and install a new raggedy double bottom in its place to expand sights into the lower 20’s. Meanwhile minding the mid band (18.40) though as a pivot back to the 18.05-18.00 gap.

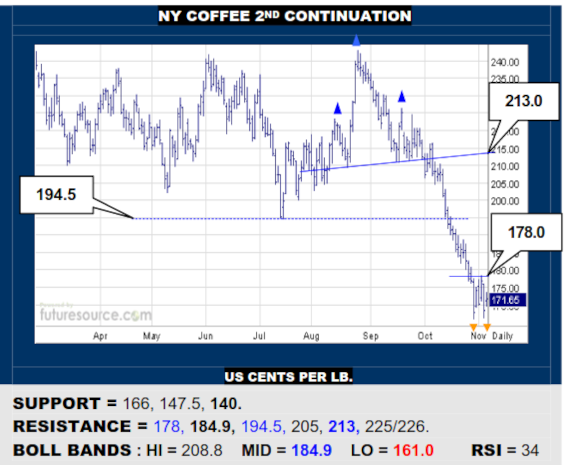

NY COFFEE 2ND CONTINUATION

Having well exceeded its H&S projection of 176, Coffee finally took note of the improving macro scene Friday to post an inside day. This implies a bid to shake off the hefty decline but demands closing over 178 to do so, wherein a small dual bottom would point back up towards 194.5. If held in check under 178, don’t be too sure of the 166 troughs support.

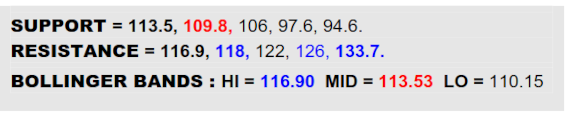

BLOOMBERG COMMODITY INDEX

While the Dollar quickly reeling back its prior mid band vault and Brent probing its $97 top frontier once more, the B-Berg lunged into the 116-118 resistance of the Q3 H&S. This is already pulling free from the downtrend of the past five months but for clarifying purposes needs that crossing of 118 to truly defeat the H&S and pin a new replacing double bottom. That’s easier said than done with the upper Bollinger band also in play (116.9) so, as ever, one would be seeking a Dollar backlash under its uptrend pivot to really give assurance. If not and the upper band tamed the revival shy of 118, watch the mid band (113.5) for any sign of the swell cresting and turning focus onto 109.8 again.

US DOLLAR INDEX

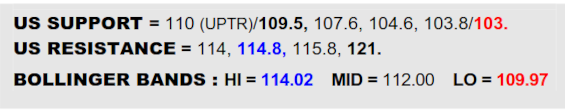

The Dollars’ uptrend catch late in Oct brought a spike over its mid band (112) Thursday but it was quickly relinquished again Friday. So clearly opinion about future Fed action is being hotly debated and the greenback would have to hammer in some hooks above 112 to solidify the recent upswing where the 114.8 apex could come into view again as a weekly bull flag exit to continue the quest for the 121 millennium high. Meantime the grip is clearly very sketchy and so the ’22 uptrend and its lately confirmed 109.5 pivot remain prone. A derailment through there would also apply a more persuasive top, opening a deeper cavern underneath back into the 103’s and giving commodities a much freer rein to rally.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary