Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

ICE BRENT CRUDE OIL SPOT CONTINUATION

Brents’ Dec revival faltered at new year on what had previously been a monthly base rim (86.7) so it missed the mid term downtrend (89). All told this leaves it looking like just a correction beneath the toppy action of ’22 and infers ongoing risk through 75 to the 65/63 area. Only cutting the downtrend would make more of an impact to suggest real relief.

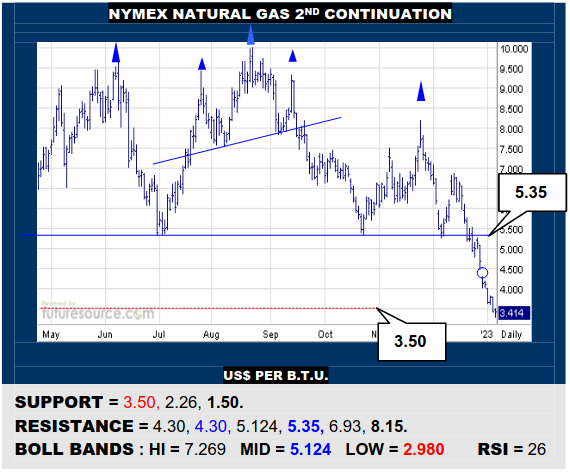

NYMEX NATURAL GAS 2ND CONTINUATION

Nat Gas tipped over that pivotal 5.35 divide during the holidays to forge ’22 into a major H&S top and has suffered further punishment to now be attacking the next main rung down at 3.50. If this were cleanly broken too, so the 1.50 area would beckon. Only a hop back over the 4.30-4.50 gap would imply a resilience currently not apparent.

COMEX GOLD 2ND CONTINUATION

Piercing a prior weekly H&S neckline in the 1830’s, Gold has lately met an 1857 double bottom projection. It then got a bit choppy early in ’23 but sustained the 1830 escape to continue towards the 1890 resistance. Be cautious of a divergent RSI though, which duly merits still keeping the 1830 to mid band (1815) span in mind as the tripwire back down.

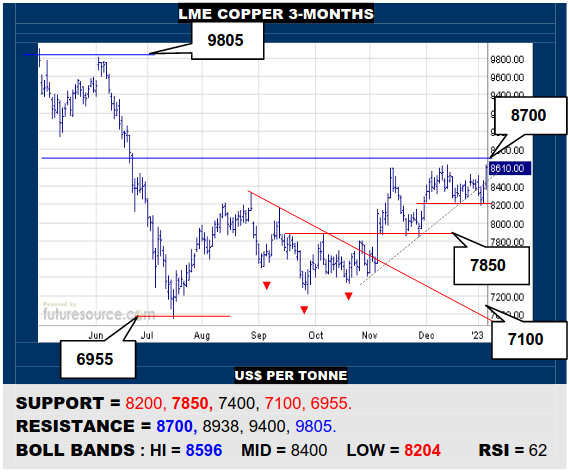

LME COPPER 3-MONTHS

Quickly retrieving a new year mid band and uptrend disruption, Copper again has its sights set on the 8700 weekly top frontier. If it could bust through here and soon see the Dollar index toppled through key 103 support, a further significant leg higher to 9800 could occur. Stay wary if the Dollar holds however, watching 8200 as a pivot back to 7850.

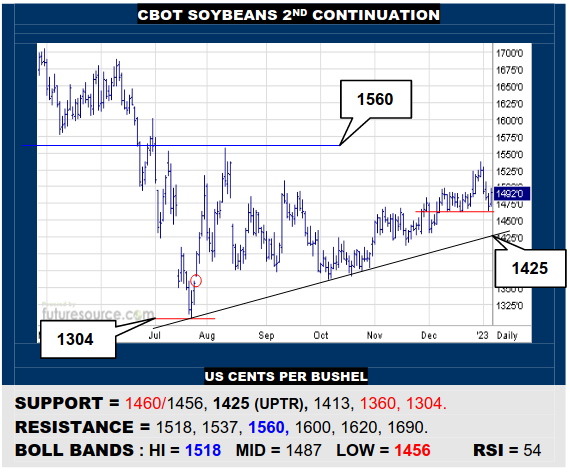

CBOT SOYBEANS 2ND CONTINUATION

Dec support at 1460 has initially caught the early ’23 stumble in Beans. Even so, watch the upper Bollinger band (1518) as the market tries to go back on the gas. If unfazed by the upper band, so the path up to test heavier 1560 resistance would beckon. If the upper band kept the lid on though, beware a toppier result to veer back to the uptrend (1425).

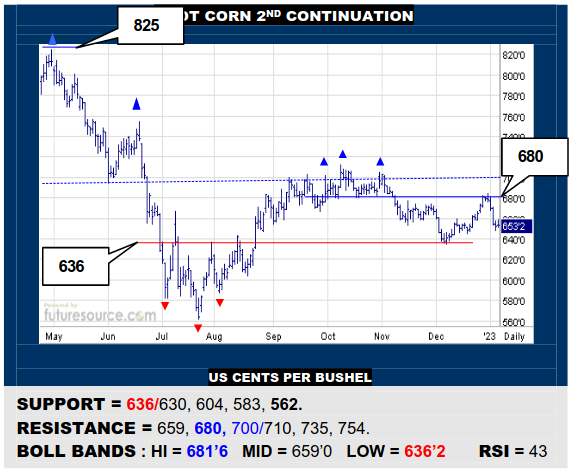

CBOT CORN 2ND CONTINUATION

Corn bounced off its 636 base rim in Dec but was then blocked by the more recent H&S top border at 680 at new year. Having swerved back under the mid band, must now cater for another dunk to the 630’s, their demise signaling more serious decay and risk on into the 580’s. Must bust clear of 680 to really perk up again and create scope to 735.

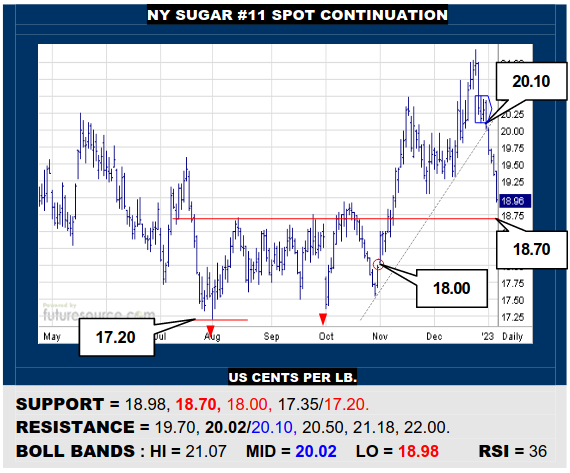

NY SUGAR #11 SPOT CONTINUATION

Once toppled from its Q4 uptrend and mid band in the low 20’s, Sugar has dropped away sharply in early ’23 and is pressing back towards the 18.70 double bottom border. What with the Dollars’ wobble, that marks the best opportunity to rein in this dive and have a chance to rebound to 20₵. If 18.70 also gave way, beware retracing to the lower 17’s again.

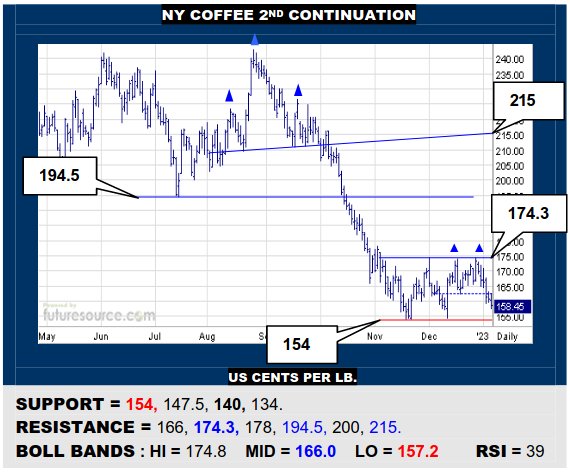

NY COFFEE 2ND CONTINUATION

Efforts to pull together a base in Q4 remained thwarted by the 174’s and Coffee has instead built a small new dual top. This now poses a threat to the 154 troughs and their demise would access one more step down to far better weekly support at 140. Otherwise it will take a reaction back over the mid band (166) to dilute the new top and just continue ranging.

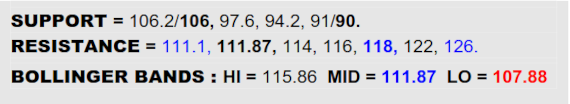

BLOOMBERG COMMODITY INDEX

A rough first week of ’23 for the B-Berg as Energies, Grains and several Metals clubbed together to turn the screws and crack the previous resolute will of the 109’s. The one hope in this situation lies with the ex-downtrend that is now intersecting a prior apex from late ’21 at 106.2. If somehow the gouge lower could be promptly intercepted there and a vigorous reply made back up over 111, suddenly things wouldn’t look so bad as a false breakdown would be implied. Given the slew of markets responsible for the drop however, it is far from a safe bet and pressing on through 106 would instead reassure the decline and warn of further losses towards a full Fib retracement at 90.

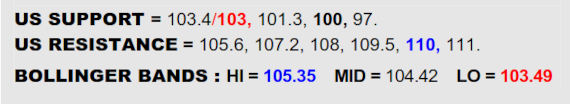

US DOLLAR INDEX

Having gradually applied the brake throughout Dec as it neared the pivotal 103 support, the Dollar hinted at a hopeful start to ’23 as it lunged into the 105’s Thursday in suggestion of a small new double bottom. Alas, Friday suddenly brought renewed jitters with an outside day lower so the greenback cannot claim to have won the war in the 103’s yet. If it still managed to pull this twitch together aboard 103, any next foray beyond 105.6 would be very likely to stick and reach into the 108-110 realm. Meantime however, the accessibility of 103 again at least gives the B-Berg a light in the tunnel, a break down through marking further serious decay here that could bring commodities oxygen at an unexpected time.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary