Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

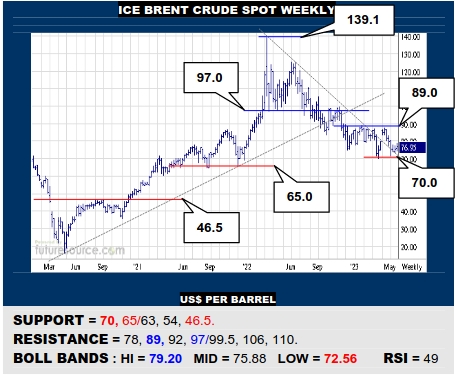

ICE BRENT CRUDE OIL SPOT WEEKLY

A second early May catch near 70 seems to reassure the previous year-long downtrend escape so there is an improved vibe but Brent must seal this up by clearly crossing the 77’s. If so, focus could rise onto 89 again seeking a new ’23 base that could revive the B-Berg. Alas, if 70 gave way, base hopes would fade and a delve to 46.5 would loom.

NYMEX NATURAL GAS 2ND WEEKLY

Another bid to swerve higher from early ’23 basing suggestions has faltered in the high 2’s and this is changing the context of Q2 to more of a corrective interlude for Nat Gas. Back on watch over the 2.11 lows then as a trapdoor on down to 1.50. Otherwise it will take a concerted recovery across 3.16 to deliver a base after all and point to the 4.40’s.

COMEX GOLD 2ND WEEKLY

A third peak in the 2075 realm during the ‘20’s has intensified with loss of the 1965 ledge and Gold is nearing its mid term uptrend (1930). If it can mop up here and quickly resurface over 1965, so 2075 would stay in range. Break the trend as well though and those three peaks would really start to dominate and a deeper delve to 1730 would threaten.

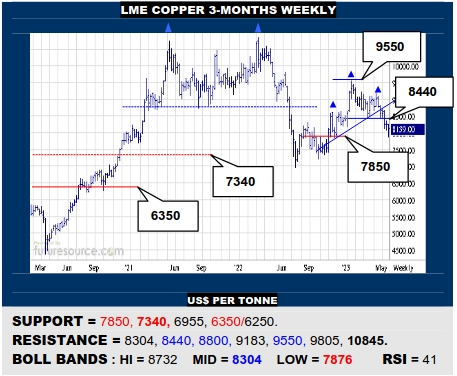

LME COPPER 3-MONTHS WEEKLY

Not a standout support on this scale but the 7850 prop has blunted the dive from the prior 6-month H&S to give Copper a chance for a breath of corrective air. Even so, it would have to react back over 8440 to make any lasting repairs while otherwise merely envisaging a short delay prior to a further breakdown through 7850 to the 7340 monthly base rim.

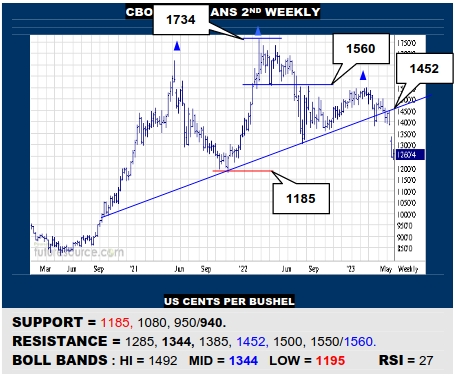

CBOT SOYBEANS 2ND WEEKLY

A massive ‘20’s H&S has resolved in Q2 and Beans have taken a first major step down from this. To rein in and stage a correction to this drop will demand clearing 1285, then having a chance to bounce to the mid band (1344). If held in check below 1285, keep watch on 1185 as the next main stumbling block to press on towards 1080 and even 950.

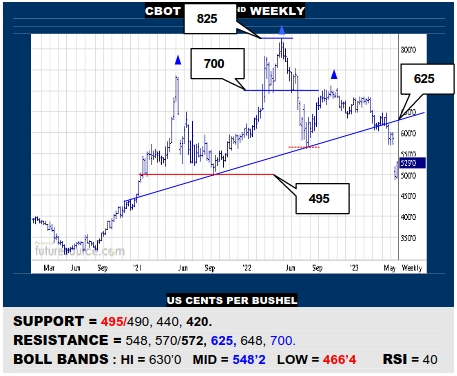

CBOT CORN 2ND WEEKLY

A similarly vast ‘20’s H&S has prompted a dive to rattle the 495 next main rung downwards but Corn has reacted back off this. Duly eying the mid band (548) as a possible trigger for additional corrective gains to the 570 area but dubious beyond there and if 495 were to instead give way, be ready for a subsequent step down to the better 440-420 support.

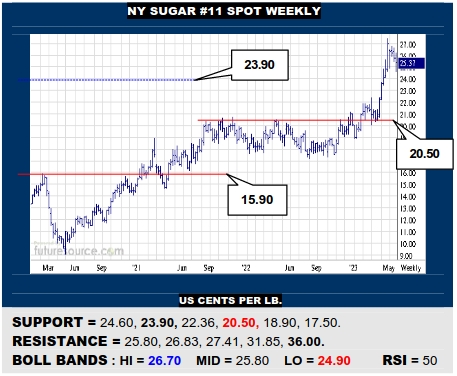

NY SUGAR #11 SPOT WEEKLY

A much twitchier Q2 for Sugar has slipped off the mid band so beware a phase of corrective action that could test the prior 10-year apex of 23.90. If able to consolidate above, another leg higher to the low 30’s could still follow. Veering under 23.90 would pull out the rug however and warn of testing 22.36 and maybe even pressing back to the main 20.50 prop.

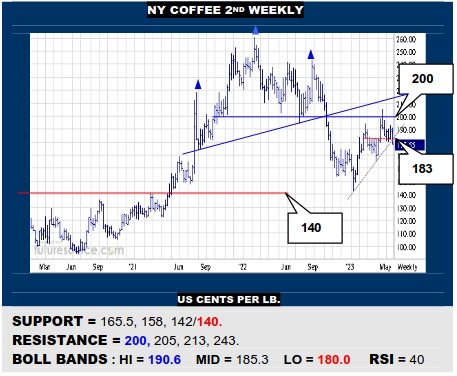

NY COFFEE 2ND WEEKLY

Quick rebuke from the H&S above 200 has since led to the erosion of support at 183/182 to generally undermine the ’23 revival. Coffee duly looks at risk of a further step down to 165.5 and perhaps even a total retracement to the low 140’s again. Needing the Dollar to falter shy of 105.6 and swerve below 102 to give any chance to see the 200’s again.

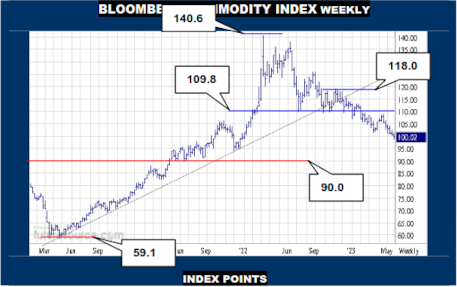

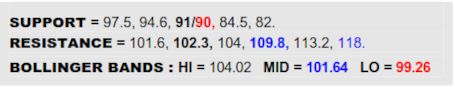

BLOOMBERG COMMODITY INDEX WEEKLY

Notwithstanding a whiff of pre-holiday mitigation, Q2 has been dominated by the Dollar while the B-Berg floundered shy of 109.8 previously to now be needling the upper 90’s. Subsequent supports on through the 90’s look pretty sparse so these Q2 events are warning of broader scope on down to the next main buffering rung at 91, mindful that the 90 figure meanwhile marks a full 61.8% Fib retracement of the prior ‘20’s upmove from 59 to the low 140’s when the Ukraine war began. Only if Brent could thrust aside the $77’s to train sights on $89 and tug the commodity index back over 102.3 would there be suggestion of a false breakdown here that could bring 109.8 back into view.

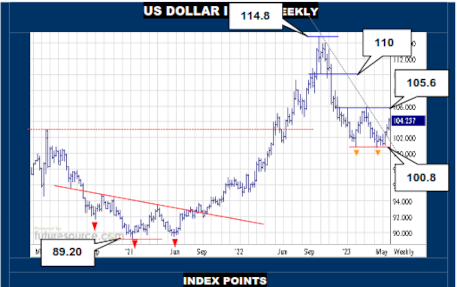

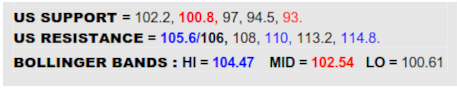

US DOLLAR INDEX WEEKLY

Near identical holds at 100.8 early in Q1 and then again in Q2 set the stage for a Dollar comeback in May that has ripped free of the preceding half-year downtrend. This implies that the simplistic impression of Fed rate hikes fading from the playing field isn’t the only force (or reduction thereof) at work in the Forex arena. However, the key henceforth is whether this trend escape can be truly solidified by proceeding on out across the 105.6 and shadowing 106 lesser (38.2%) Fib retracement. If so, a robust new base would bode very ominously for commodities. Only if this revival was headed off shy of 106 and 100.8 later gave way would the macro get a major shot in the arm.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.