Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

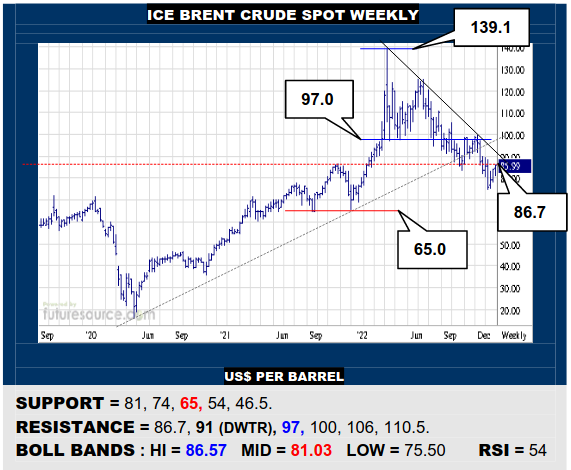

ICE BRENT CRUDE OIL SPOT WEEKLY

Brent has managed a breather in Dec to jog back up towards a prior 86.7 base rim. Alas, this bounce must go on to pop the ’22 downtrend (91) as well to make more significant headway where the 97 top border could come into play. If the market falters at the trend, don’t trust the swell as more than a correction and beware a new lash south.

NYMEX NATURAL GAS 2ND WEEKLY

Over the edge and far away for Nat Gas as Dec saw the main 5.35 prop collapse to build ’22 into a major H&S top from which the market has continued to tumble. Now keen to find out what buffering 3.50 can offer. If it held during early ’23, perhaps a bounce could be mulled. If 3.50 also gave way though, be prepared to cascade on down to the 1.50 area.

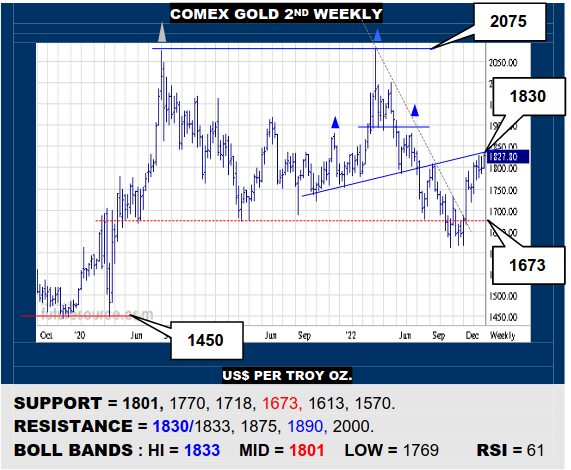

COMEX GOLD 2ND WEEKLY

Gold has eked out modest gains in Dec but the weekly view shows this effort is fighting against the neckline of a large ‘21/’22 H&S (1830). It will need a bolder shove to dispatch all of the 1830’s to persuade of a breakthrough to reach on to 1890. Very cautious of any twist below the mid band (1801) meantime tripping a delve back into the 1600’s.

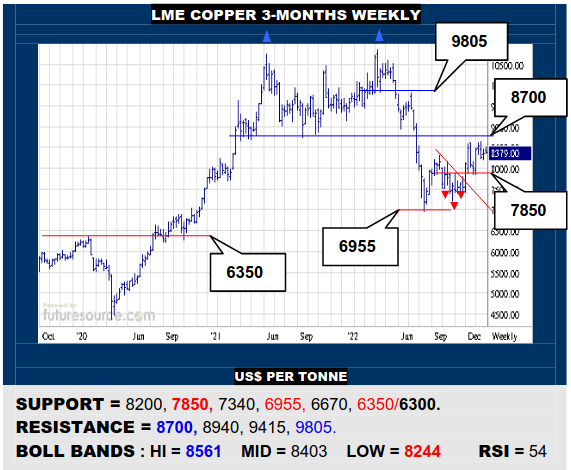

LME COPPER 3-MONTHS WEEKLY

Copper revived from an inverse H&S in Q4 but has since struggled in the face of the large weekly dual top above 8700. It must overthrow this soon alongside a Dollar break of 103 to underline the rebound and pave a path to 9800. Watch 8200 meantime as a tripwire back to 7850 where all the second half efforts could crumble to infer the crest of a correction.

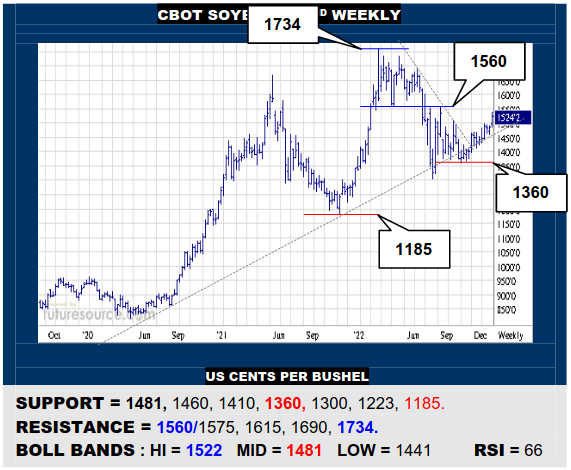

CBOT SOYBEANS 2ND WEEKLY

After 1360 fended off some Oct uptrend erosion, Beans shed a second half downtrend and have grappled on back up towards the first half top that lurks above 1560. How the market handles 1560-1575 should duly be telling. Punch through and the 1700’s would be in view but minding the mid band (1481) meantime for any sign of veering south anew.

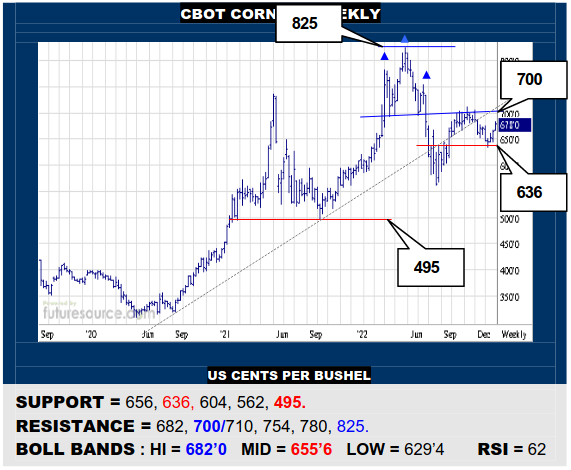

CBOT CORN 2ND WEEKLY

The sub-636 base stepped in to catch Corns’ Q4 dip and it is battling back up towards the 700 former H&S frontier once more. If this time able to really bust into the 700’s, that top would be dispelled and 825 would look a plausible goal. Beware resumed wheelspin at 700 though, then on guard for a new downturn to potentially break 636 next time.

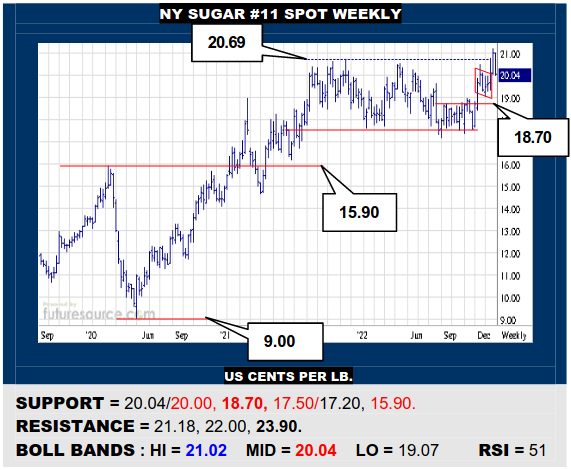

NY SUGAR #11 SPOT WEEKLY

Sugar got a brief glimpse of the 21’s but has abruptly swerved back to its mid band and prior flag edge near 20₵. The task is thus to sustain the 20’s early in ’23 if the upside path is to be resumed with an eye to the decade high at 23.90. Topple from the 20’s however and a new apex would warn of pulling back to the 18.70 underlying base border.

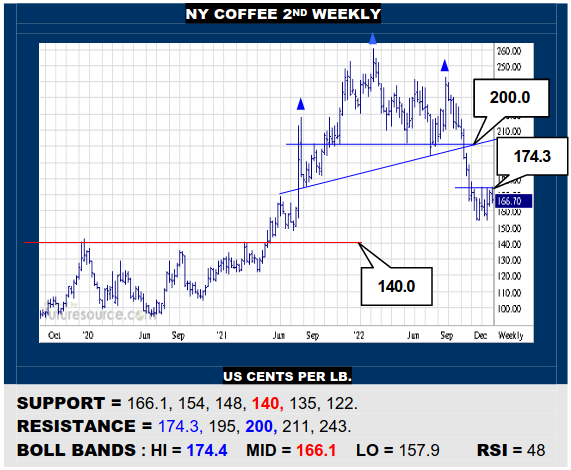

NY COFFEE 2ND WEEKLY

Coffee has made several bids to exceed the 174’s so as to open up a corrective path towards 200 but just can’t score a breakthrough, then swerving down to its mid band again Friday (166). If it cannot hold here, the upside effort would fizzle and resumed scrutiny of the 154 troughs could pry open a path on towards the tougher 140 base support.

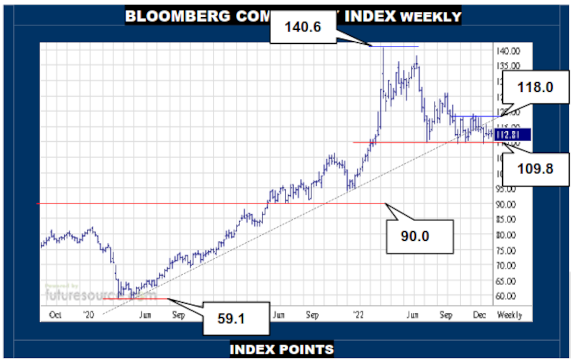

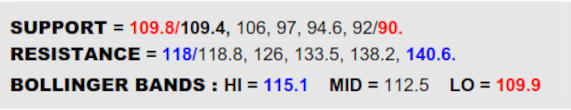

BLOOMBERG COMMODITY INDEX WEEKLY

Neither the B-Berg nor Dollar are looking especially sprightly as ’23 arrives, both derailing from major uptrends in Q4. A rather more muted trend disruption here has seen the 109’s come to the fore as the key brace (109.4 a 38.2% lesser Fib retracement of the 59.1-140.6 prior upmove) trying to repair the damage but the energy sector isn’t making this easy. The task then is to boost clear of 118 to emerge back aboard the prior trend with a new base foundation from which to reach for 126. Could badly use a Dollar break of 103 to assist in this however whereas renewed strength there and loss of the 109’s here could miss the Index fund window and threaten further substantial decay towards 90.

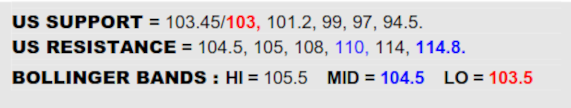

US DOLLAR INDEX WEEKLY

The perception of a more restrained Fed henceforth toppled the Dollar from its ’22 uptrend in Q4 and it has peeled back to the 103’s marking preceding major peaks from early ’17 and ’20. This should be the proving ground therefore and the setback has indeed shown signs of some cooling as it nears 103. If the greenback can dig in and react away over 105, it would duly start to suggest that an admittedly sharp correction had been arrested and that a road back up to 110 was opening, clearly more of a problem for commodities. However, if the Dollar were toppled from the 103’s, look for further fallout in Q1 of ’23 to at least 99 to aid in getting the B-Berg back on the horse.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary