Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

EURO / US DOLLAR

The 1.10’s have continued to impede and the EU has slipped back to now be on the very brink of a small H&S so loss of 1.095 would warn of a clash with the main uptrend (1.084) where there would be risk of more enduring damage being done. Otherwise needing to grit its teeth in the mid 1.09’s and pop 1.11 to pull through this struggle after all.

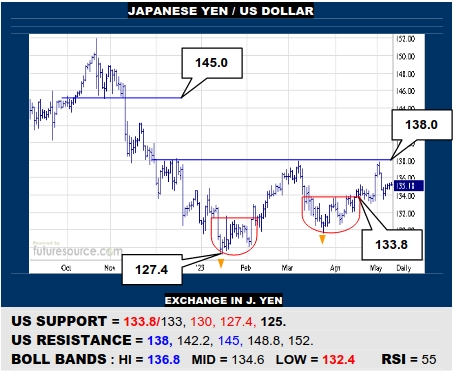

JAPANESE YEN / US DOLLAR

A second ’23 rebuke from 138 continues to deny the US a much more substantial base but the dip back from there has provisionally been held at bay by a nearby small base beginning at 133.8. While able to balance in the 133’s, so a third try for 138 could occur. However, if the 133’s unravel to dilute the base, beware a new delve towards 127.4.

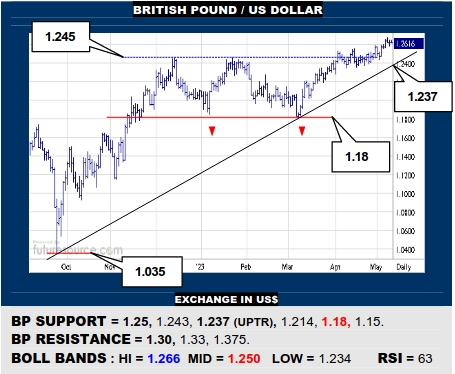

BRITISH POUND / US DOLLAR

The BP has taken all of Q2 thus far to finally grapple away from a new double bottom pattern and pull some distance on its overall uptrend (1.237). The road looks reasonably clear up to 1.30 now but not so surprisingly RSI remains in divergence. Looking higher then but with one eye on the mid band (1.25) as a tripwire back to the trendline.

SWISS FRANC / US DOLLAR

Jabs south continue to be warded off in Q2 and RSI is showing quite pronounced divergence like a base. There is duly the vibe of a turn for the US and 0.90 would be eyed as a trigger to attack the downtrend (0.908), escape paving the way up to 0.944. Only another refusal at 0.90 would quell basing ideas and pose more threat to the 0.875 low.

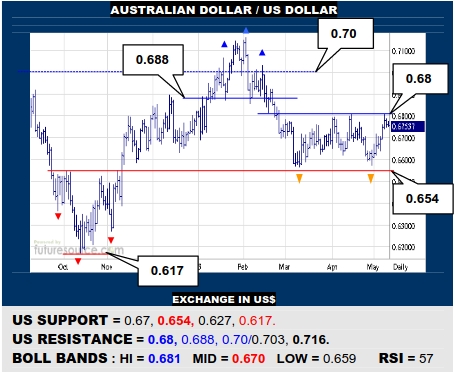

AUSTRALIAN DOLLAR / US DOLLAR

The AD has rebounded from the 0.65’s again to challenge the 0.68 resistance. Piercing 0.68 would build a useful new dual bottom that would immediately present a chance to punch into the prior H&S top (0.688) and create room to invade the low 0.70’s again. Must hold 0.67 meantime though or else wary of falling away to 0.654 again.

BRAZILIAN REAL / US DOLLAR

An April revolt by the US was blocked at its 5.10 resistance and it has faded back into the 4.90’s. This maintains dominance of the broader 5+ top structure so keep minding 4.90 as a trigger for heavier losses to a decade long uptrend at 4.50. Must otherwise defeat 5.10 to make persuasive repairs and turn focus back up towards 5.33.

EURO / JAPANESE YEN

An abrupt setback for the EU after briefly tagging the 150’s now has the mid band fighting for air (148). If able to hang on aboard it, another run at the 151’s might yet ensue. Alas though, breaking back below would instead suggest a nearby bear flag following the prior crest and would warn of delving to test the inverse H&S neckline (144.4).

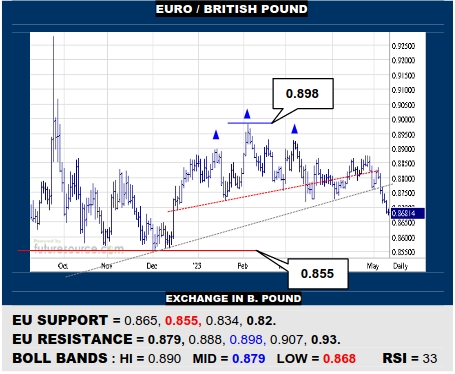

EURO / BRITISH POUND

Ultimately the Q1 H&S prevailed over the EU’s shallow uptrend and it has broken down out of the 0.87’s. The victory for the top thereby suggests a further setback to examine the pivotal next support at 0.855. If unable to take a stand there, a much broader offset double top would be created, pointing to the early ’22 low at 0.82.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.