Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

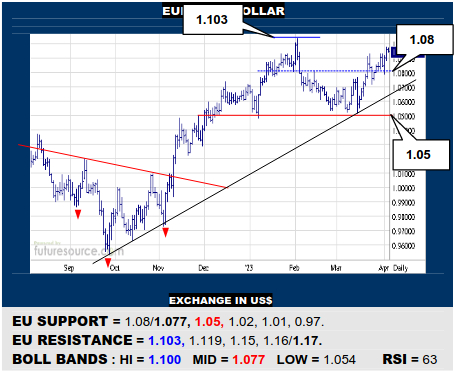

EURO / US DOLLAR

The EU has sustained its break over 1.08 and the crosshairs are now on the 1.103 early Feb apex as a potential springboard on towards ’21 top resistance at 1.16/1.17. Only stagnating shy of 1.103 and veering back below 1.08 just as the mid band intersects there (1.077 now) would seriously undercut this effort and turn focus back to 1.05.

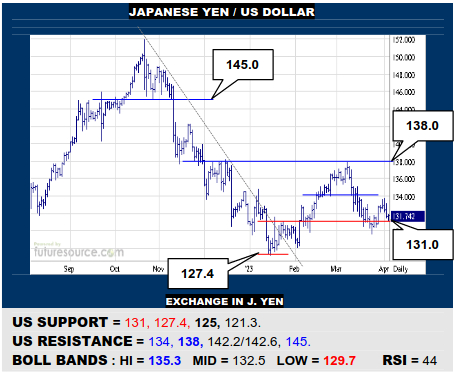

JAPANESE YEN / US DOLLAR

The small early ’23 base under 131 has hung in there so far but is still under scrutiny. If it truly succumbed by breaking 130, beware ongoing fallout through 127.4 to challenge the main 125 weekly prop where a major year-long top could cause intensifying losses to 115. The US must jolt back over 134 to stabilize and have a new shot at 138.

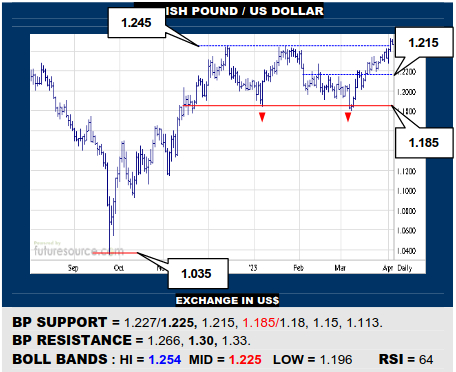

BRITISH POUND / US DOLLAR

Third time trying and the BP has made a preliminary impression over 1.245 to propose a four month double bottom resolving. Must hammer in some hooks to confirm this base, in which case there is a relatively open road to 1.30. Meantime minding Mondays’ 1.227 trough in the event of any backlash that could turn the tide away to 1.185 again.

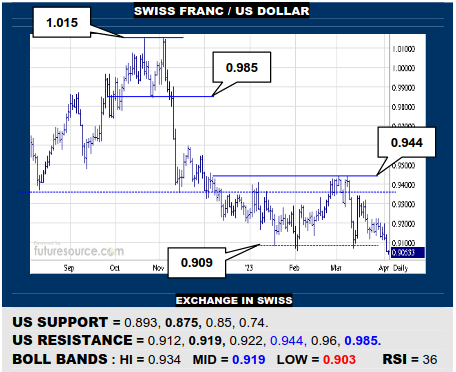

SWISS FRANC / US DOLLAR

A break of 0.909 is rendering Q1 as a new top while meantime also snapping a major decade long shallow uptrend. Duly on alert for a continued drop to the early ’21 low at 0.875, a last line of defence for the US to try to avert major losses into the low 0.70’s. Must meantime react back over 0.922 to retrieve this slump and stabilize.

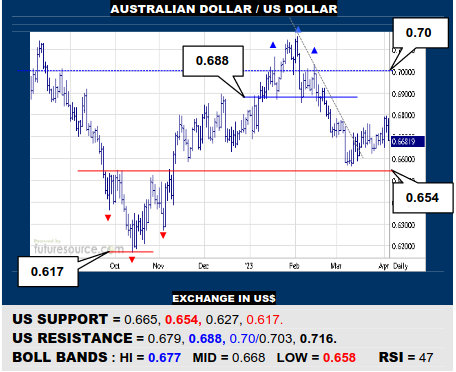

AUSTRALIAN DOLLAR / US DOLLAR

Another AD bid to rally has been quickly extinguished while still shy of the 0.688 Q1 H&S border. The past month of mild rising channel type action thus has a bear flaggish vibe from a broader perspective so beware breaking 0.665 could quickly lay siege to the former 0.654 Q4 base border, a potential tripwire for further fallout to 0.617.

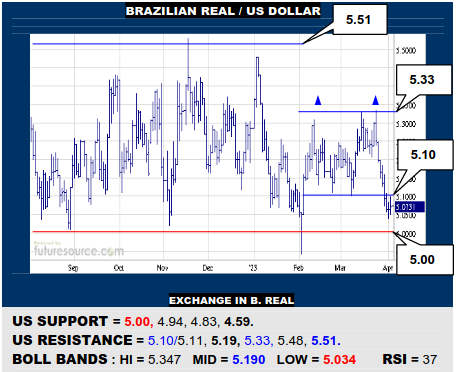

BRAZILIAN REAL / US DOLLAR

Attempts to build Q1 into an inverse H&S unraveled and loss of 5.10 has instead formed a double top. This now poses a threat to the main 5.00 support and breaking through there would develop a far larger top zone, pointing well down into the 4.50’s. The US must claw back over 5.11 to dispute the top and turn focus onto the mid band (5.19).

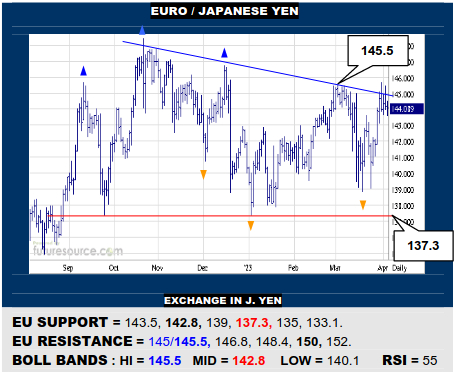

EURO / JAPANESE YEN

The EU leapt back up from 139 to be contesting the 145’s again. The outcome of this attack looks pivotal as finally piercing 145.5 would build the past five months into a hefty new inverse H&S that would disperse a prior upright version and set the sights on the low 150’s. Minding the mid band (142.8) meantime for any sign of faltering.

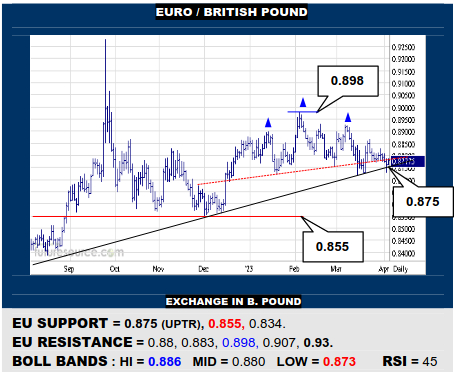

EURO / BRITISH POUND

A Q1 H&S is locked in battle with the shallow mid term uptrend (0.875). If the trend buckled, be ready for the EU to quickly drop back to 0.855 where a larger top would threaten to twist the thorn further. Otherwise needing to see a hike back over 0.883 to vault the mid band and dispel the H&S, thereby hailing victory for the uptrend.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.