Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

See a sample of TechCom’s Sugar Technical Review by clicking ‘Download PDF’ above.

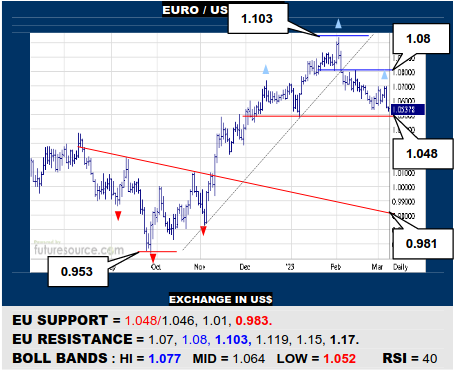

EURO / US DOLLAR

Despite a little mid band fraying, the EU remained well shy of a more important 1.08 hurdle and has now dropped back into the clutches of the 1.048 pivot. If this were cleanly broken, a scrappy H&S-like top would give access to some open terrain back down towards 1.00. Must spike back over 1.07 to at least fortify the footing up here.

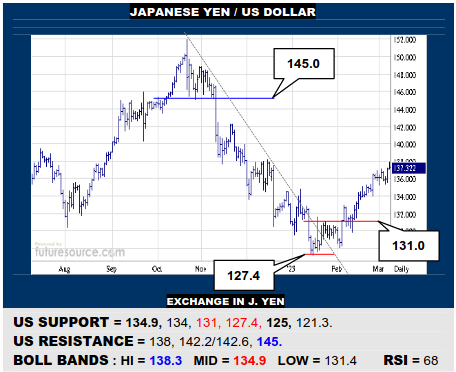

JAPANESE YEN / US DOLLAR

Not exactly swashbuckling progress but the US has pushed by the 38.2% Fib retracement at 136.8 to extend its Q1 recovery and keep the path towards 145 fairly well lit. Needing RSI to jog into the 70’s to reassure the advance however while meantime watching the mid band (134.9) for any disruption to suggest the move was faltering.

BRITISH POUND / US DOLLAR

The BP has slipped to begin fraying the 1.185 support so it is teetering on the very brink of forming a double top, ouster from the 1.18’s then warning of a next step down to 1.144 while 1.125 would be the actual top projection. Only twisting back up across 1.215 would dispel the toppy vibe and solidify grip for a third try at the 1.245 peaks.

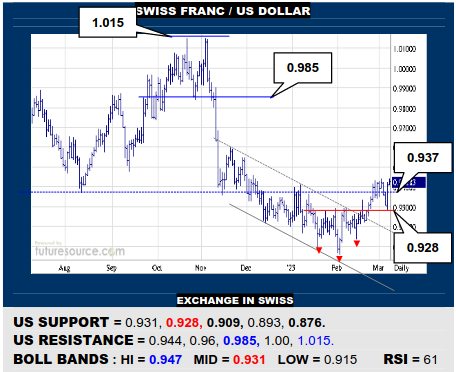

SWISS FRANC / US DOLLAR

A quick dip was steadied by the underlying inverse H&S rim at 0.928 and the US is back trying 0.944 as it bids to make a clearer getaway to first 0.96 but with 0.985 in the crosshairs a little later. Only renewed wheelspin at 0.944 and a reversal to actually break 0.928 would more seriously undercut the upturn and endanger 0.909 again.

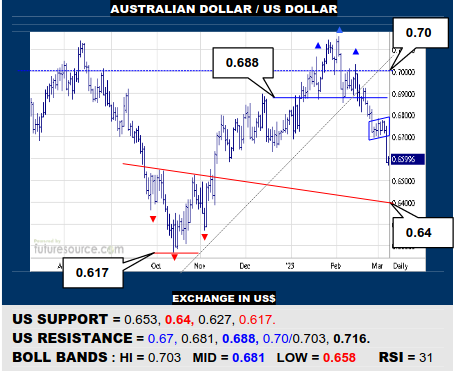

AUSTRALIAN DOLLAR / US DOLLAR

A spell of 0.67’s congestion has collapsed into a bear flag and the AD is now down into some relatively open space that leads on into the 0.64’s before a previous Q4 inverse H&S should start to provide some braking force. Otherwise it will take a prompt jolt to regain grip in the 0.67’s to dispel the flag and bring 0.688 top resistance into play again.

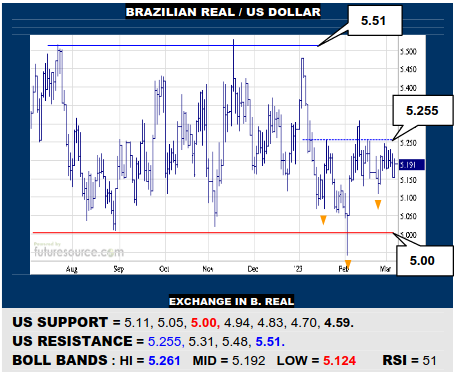

BRAZILIAN REAL / US DOLLAR

Scrappy nip and tuck across 5.20 still keeps the US in with a shot at a breakaway over 5.255 that would propose a Q1 inverse H&S of sorts to serve as a platform from which to launch a more extensive foray to test 5.51 again. However, while shy of 5.255, do keep tabs on 5.11 as a tripwire to dilute basing ideas and spotlight 5.00 once more.

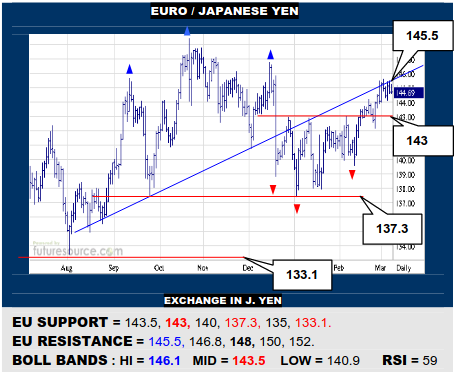

EURO / JAPANESE YEN

The EU has pushed on from a new sub-143 base but still looks to be having issues with the fairly steep neckline of a previous upright H&S (145.5). Needing to bust decisively beyond to infer resolving a bull flag and so zero in sights on 148. Meantime minding 143 as the primary underpinning to prevent tilting towards a toppier landscape again.

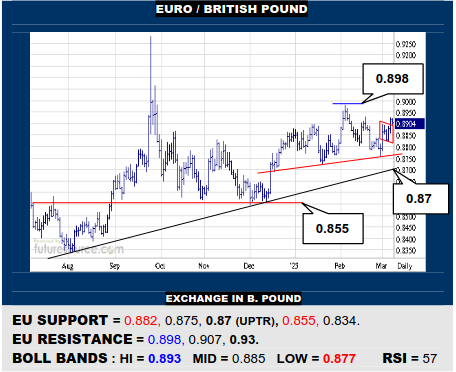

EURO / BRITISH POUND

The EU has shrugged off Feb’s setback and is hinting at a nearby flag escape to lift sights onto 0.898 resistance again. Release into the 0.90’s could find much clearer skies that would bring 0.93 into view while otherwise only a reflex back under 0.882 would dispel the flag and instead raise fears of a toppier threat to the uptrend (0.87).

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.