Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

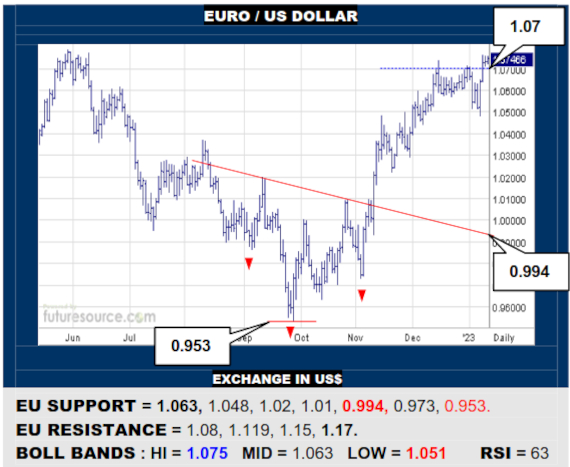

EURO / US DOLLAR

A new year twitch has been recouped and the EU is gnawing away the 1.07’s, making headway into a vast weekly top. Alas, with RSI in divergence, it must also pop a 1.08 apex from Q2 last year and press the $ Index through 103 to really hone this getaway. Watch the mid band (1.063) meantime for any reversal to warn of a false breakout.

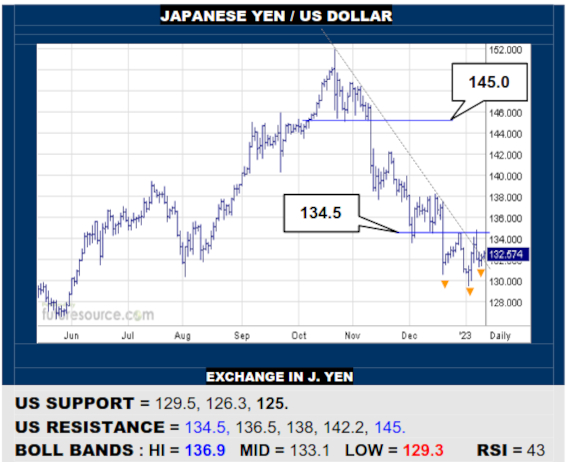

JAPANESE YEN / US DOLLAR

Though refused at 134.5 twice in close succession, the US is again showing signs of gathering up in and around its frayed ex-downtrend, which thus also gives hints of a small inverse H&S trying to form. That makes 134.5 a key escape hatch to turn the tide to the good. While denied there however, mind 129.5 as a trigger on down towards 125.

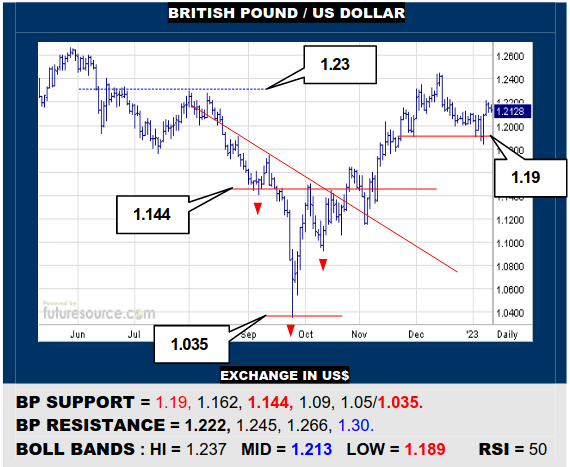

BRITISH POUND / US DOLLAR

An outside day retrieval Friday hints at concluding a Dec correction but the BP must invade the 1.22’s and skew the upper Bollinger back to the upside to persuade of the turn north to then target 1.245 with an eye to 1.30 beyond. If largely blocked from the 1.22’s, watch 1.19 as a tripwire to instead build an ugly duckling H&S and drop back to 1.144.

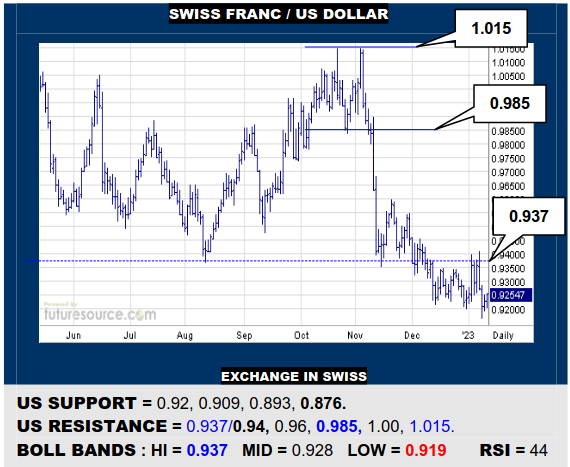

SWISS FRANC / US DOLLAR

Brief pokes through the 0.937 border of the big ’22 double top have failed to dilute it so for the time being it still dominates the landscape and loss of 0.92 would imply a bear flag to hasten decay back toward the 0.876 trough of early ’21. Diverging RSI has its doubts though so if the US reached the 0.94’s, it could spark a stronger rally to 0.985.

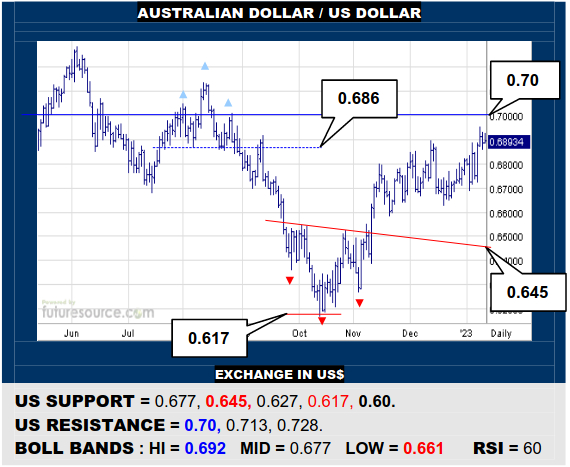

AUSTRALIAN DOLLAR / US DOLLAR

The AD has gnawed into the Q3 H&S over 0.686 but a diverging RSI is casting some doubt on this effort so it clearly needs to breach the bigger 0.70 weekly top frontier to impress and light a more enduring path higher to 0.728 next. Keep the mid band in mind (0.677) as the failure tripwire meantime to instead fall away to a prior 0.645 neckline.

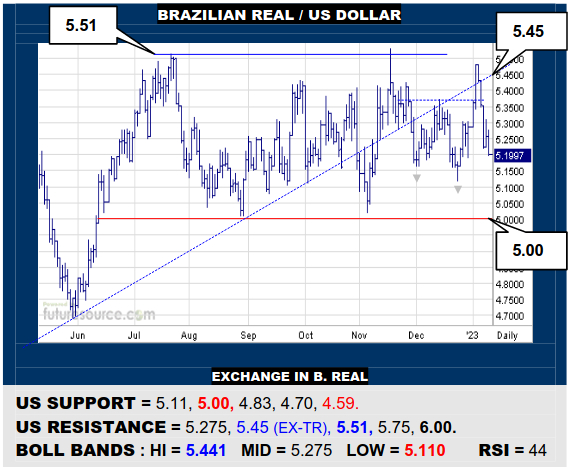

BRAZILIAN REAL / US DOLLAR

Briefly proposing a Dec dual bottom still couldn’t hurt the 5.51 peaks and another abrupt rebuke gives further credibility to the ex-uptrend (5.45). The past six months are quickly regaining their toppy lilt as a result so mind 5.11 as a tripwire to attack 5.00 where a large US top could really tip the balance for a more extensive retreat to the mid 4’s.

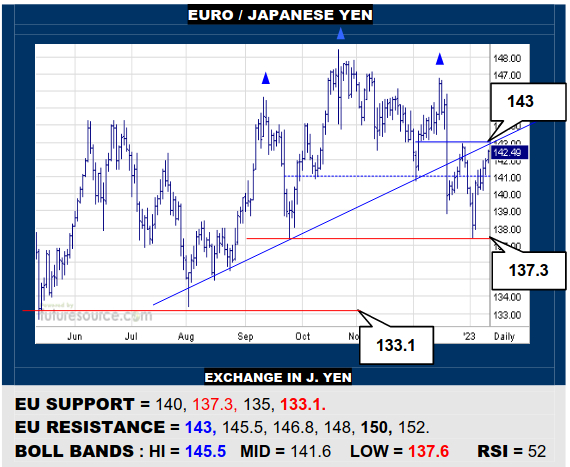

EURO / JAPANESE YEN

Support proved robust in the 137’s again and the EU is pulling back up towards the amended neckline of a second half ’22 H&S at 143. If able to bust through, it would look like a significant resuscitation and the 148 area would start to beckon anew. Only another 143 refusal would reassure the top structure and swivel sights onto 137.3 again.

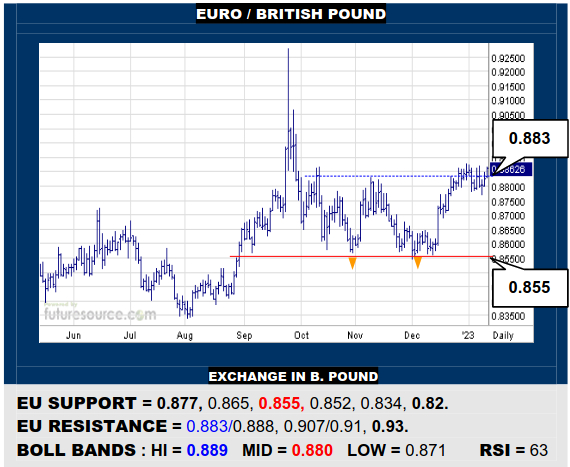

EURO / BRITISH POUND

The EU is once more bidding to make a cleaner getaway across 0.883-0.888, success then reassuring a Q4 double bottom and setting sail for a 0.91 base projection initially but with further potential towards 0.93. Do still keep tabs on the 0.877 pivot however to signal failure and risk of a backlash down to the 0.855 area.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.