Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

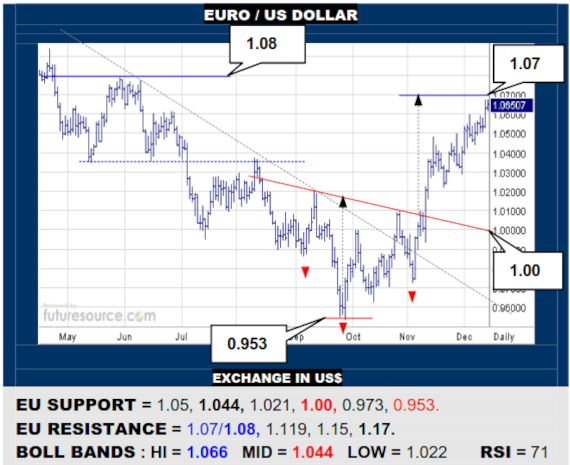

EURO / US DOLLAR

The EU is pushing on into the heavier 1.06-1.08 weekly resistance (103’s $ Index) and has all but met the 1.07 inverse H&S target. Popping 1.08 (103) would be a major step, suggesting an enduring upturn with scope back to the low 1.20’s. Mind the mid band (1.044) meantime for any sign of faltering and veering back to the base (1.00).

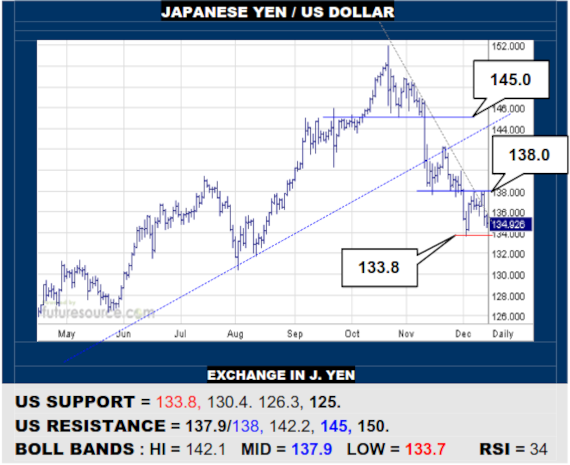

JAPANESE YEN / US DOLLAR

A brief downtrend disruption failed to hurt the mid band and the US has faded again as the CPI quells Fed fears. Must still keep watch on 138 for any fresh sign of resurgence but meanwhile if the 133.8 trough was broken it would signal entrenchment of the ’22 uptrend collapse, expanding the road south back to the 125 area.

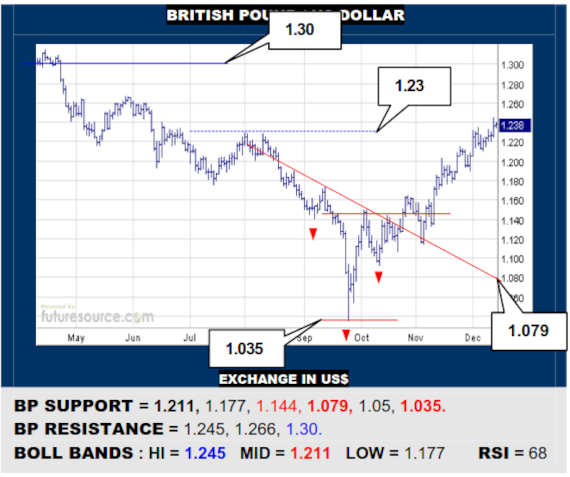

BRITISH POUND / US DOLLAR

Staying out ahead of its oncoming mid band (1.211), the BP has bust through the 1.23 resistance and there is only piecemeal hurdles from here on up to 1.30. Looking ever better then but needing to see 103 on the $ Index broken for true reassurance while meantime always minding the mid band as a tripwire to turn tail back towards the 1.14’s.

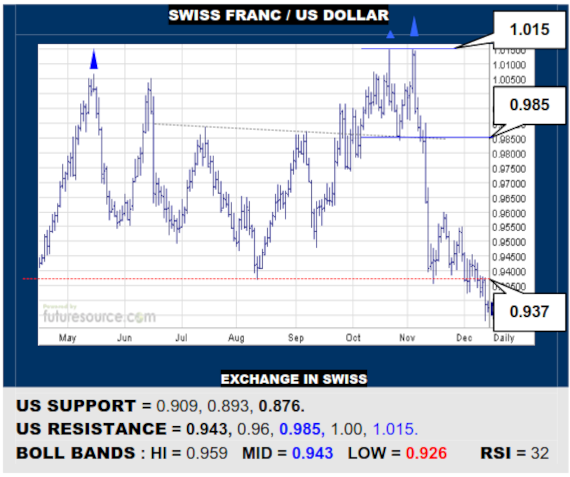

SWISS FRANC / US DOLLAR

The US has worn through a major 0.937 support shelf to build ’22 into a major weekly double top that opens a deeper hole on through 0.909 towards the early ’21 low at 0.876. RSI divergence is initially doubting the breakdown though so, while having to look lower, do always keep an eye on the mid band (0.943) as an escape hatch back up.

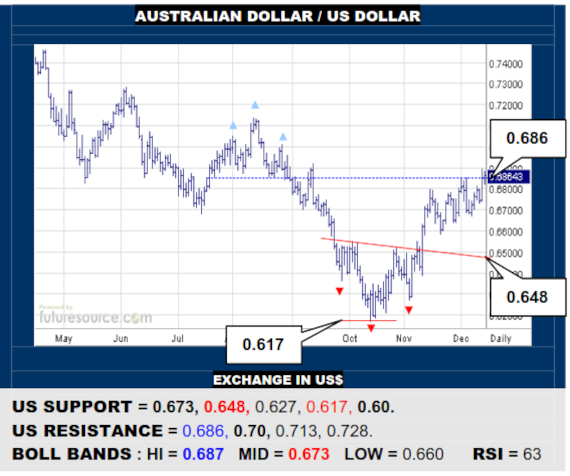

AUSTRALIAN DOLLAR / US DOLLAR

The AD is starting to make inroads against the summer H&S above 0.686 but with RSI provisionally diverging, it will still ultimately be about overhauling the far larger 0.70 weekly top frontier to really make a lasting impression. Thus again having to mind the mid band (0.673) for any signs of stumbling and veering back to the 0.648 base border.

BRAZILIAN REAL / US DOLLAR

The US has fought back against a small recent H&S but still appears to be floundering at the previously broken uptrend (5.35). Must gain grip over at least 5.30 and preferably 5.35 to secure a more reliable turn back up then to target 5.51. If unable to hold the 5.30’s, beware any slip through 5.16 quickly bringing a strike at the pivotal 5.00 figure.

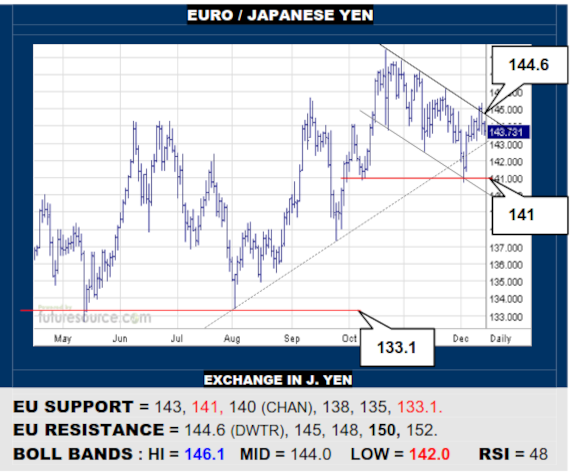

EURO / JAPANESE YEN

An initial bid to pull free of the recent descending channel was quickly quelled so the EU must reach and hold the 145’s to claim an escape that would play like a weekly flag, setting up a new leg higher to 152. A frail footing at best meantime and slipping out of the 143’s would threaten a new delve to 141, where more of an H&S could form.

EURO / BRITISH POUND

The EU continues to find bracing at its lower Bollinger band (0.854), which is preventing the period since Sep from evolving into a more serious top. Even so, it will take a reflex back over 0.865 to dig out from current pressure and invite a new flurry towards 0.883. If the mid 0.85’s gave way, beware hastier losses on down into the 0.82’s.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.