Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

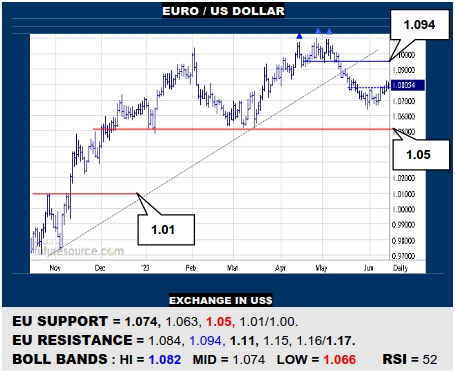

EURO / US DOLLAR

Fed watch of course but the EU has muscled a small fortnights’ base that appears to open the door back up to the prior small H&S at 1.094, even if needing to pop 1.11 to really shift up gears anew. Meanwhile must keep tabs on the mid band (1.074) as any swerve back beneath would dilute the base idea and warn of a further delve to 1.05.

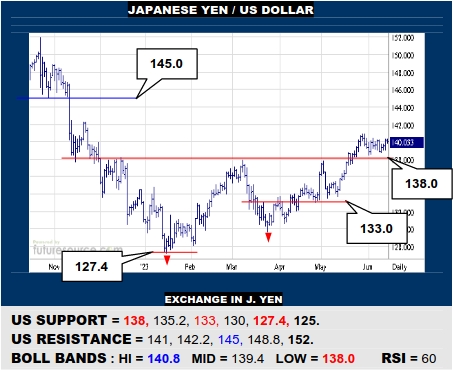

JAPANESE YEN / US DOLLAR

Despite exiting a large 6-month base in May, the US has just idled sideways since. Admittedly, staying clear of the 138 base rim does maintain chances for a flag/pennant so a getaway across 141 would suppose a next leg of gains kicking in aimed for 145. Only a clean snap back through 138 would undercut and threaten a setback to 133.

BRITISH POUND / US DOLLAR

The BP shrugged off its uptrend derailment quickly and has grappled back up towards the prior 1.268 peak just as the ex-trend happens to be intersecting. Escape over 1.268 would mark an impressive revival to pave the way on up to 1.30. Beware a couple of denials though, then eying the mid band (1.245) as the pivot back to attack 1.23 again.

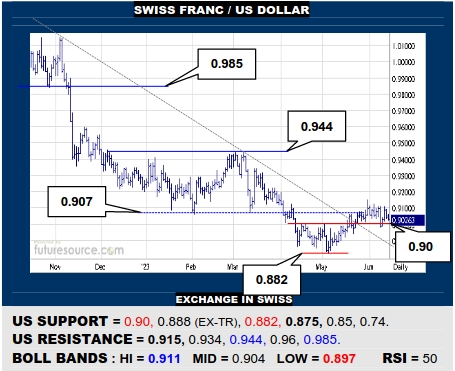

SWISS FRANC / US DOLLAR

The debt ceiling resolution stole the zest from a US downtrend escape and it has teetered uncertainly on the 0.90 rim of a prior small base. If it fell back through, be prepared for an ex-trend test (0.888), even if in no hurry to preempt damage to the 0.882 trough. Must otherwise pop 0.915 to dispel pre-Q2 clutter and hammer home the trend breakout.

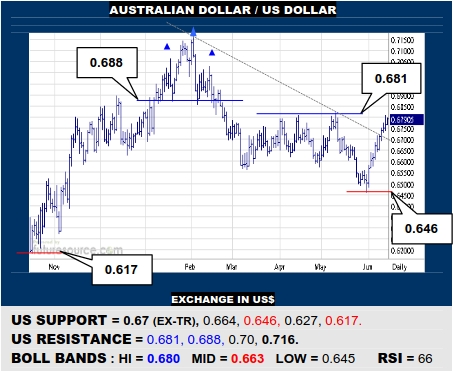

AUSTRALIAN DOLLAR / US DOLLAR

Quickly retrieving a dunk into a prior Q4 base under 0.654 cast late May as a false breakdown and the AD swept away its downtrend to be arriving at previous 0.68’s clutter. Hack out over 0.688 and this rally could bustle on to 0.715. If tripped in the 0.68’s, be ready for a dunk back to the broken trend (0.67) before trying to resume the offensive.

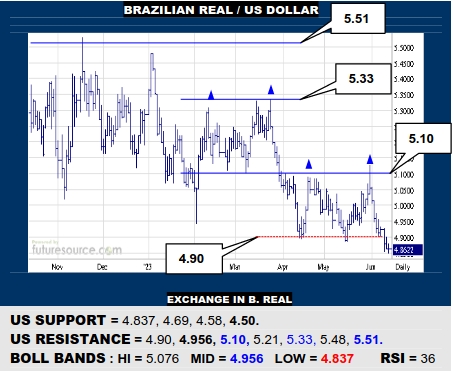

BRAZILIAN REAL / US DOLLAR

Q2 bounces were blunted by the prior Q1 double top and a similar but lower new dual top has resulted with the break below 4.90. There isn’t much of any substance underneath now until a multi-year uptrend at 4.50 so beware intensifying fallout. Only a reaction over the mid band (4.956) would dispel the latest top and offer passage back to 5.10.

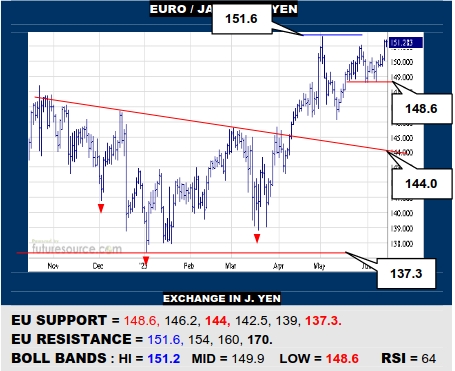

EURO / JAPANESE YEN

Safe handling aboard the 148.6 ledge has prompted the EU to try for the 151.6 prior peak again. Breaking beyond would initially point to the 154 projection from the previous large inverse H&S but otherwise there really isn’t much resistance then until way up at 170. Only reeling back through 148.6 would turn tail towards the 144 neckline.

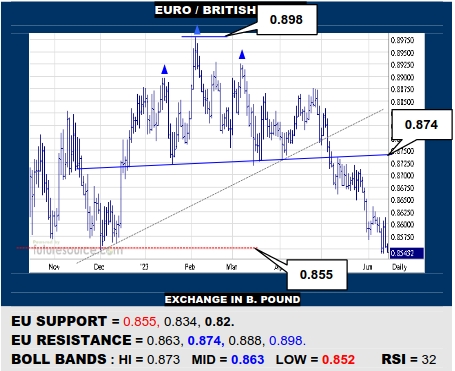

EURO / BRITISH POUND

The EU is starting to gnaw away the 0.855 support. A clearer cut break would initially open the door down to the projection of the H&S top at 0.847 but with further risk towards 0.82 thereafter onto the brink of a massive 7-year top. Must reflex over the mid band (0.863) to get better grip and have a shot back up to the 0.874 neckline.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.