Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

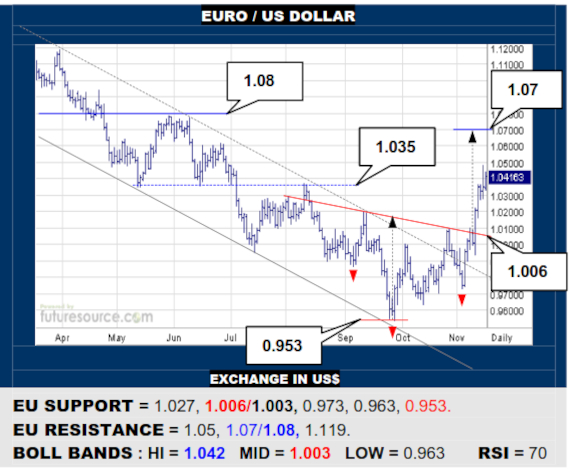

EURO / US DOLLAR

A powerful emergence from an inverse H&S has seen the EU disrupt the next resistance at 1.035 as it proceeds towards a 1.07 projection. RSI and ADX are picking up in sync with this rally, giving no cause to doubt the 1.07 goal before stiffer resistance should be met. Only a slip through 1.027 would warn of a dip back to the 1.006 base neckline.

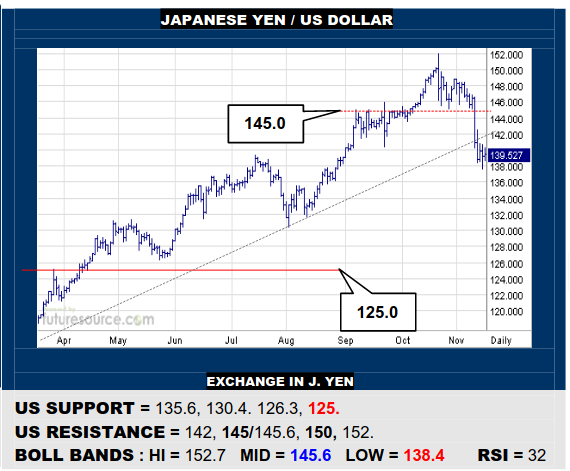

JAPANESE YEN / US DOLLAR

Breaking down through the 145 support applied a new top on the US and it has fallen sharply on through the ’22 uptrend as well. Duly looking extremely fragile as a result and at risk of further sizeable retrenchment to the 125 area. Only a surprising recovery back across the 145’s would perform any substantive repairs.

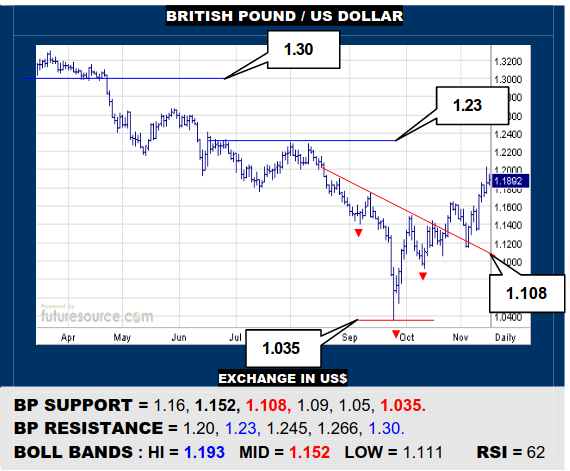

BRITISH POUND / US DOLLAR

Balancing on its inverse H&S neckline early in Nov, the BP has rallied away strongly through the 1.16’s and is now seeking the next rung up at 1.23 before likely next a next rest phase. Otherwise only veering back through 1.16 as the mid band intersects there would undercut this getaway and threaten delving back to the 1.11 vicinity again.

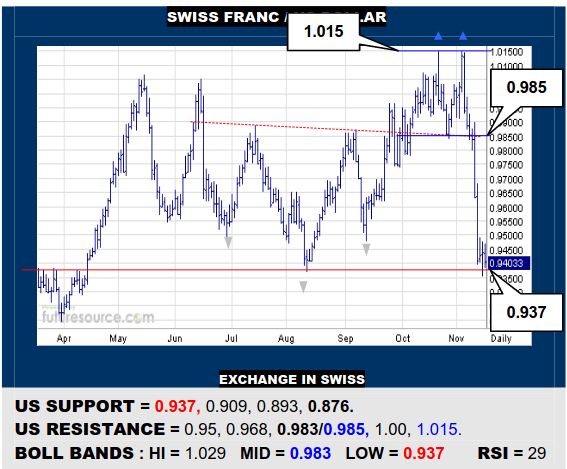

SWISS FRANC / US DOLLAR

Once the 0.985 neckline of the former inverse H&S cracked, the US suffered an abrupt freefall from the newly applied double top all the way back to the next key support pivot at 0.937. Grip here and a corrective bounce could feature. If 0.937 also gave way though, a far bigger double top would project all the way on back to the 0.87’s.

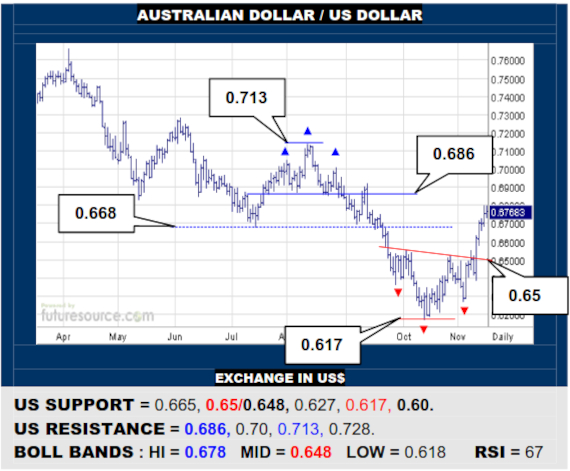

AUSTRALIAN DOLLAR / US DOLLAR

The AD completed a new inverse H&S as it popped 0.65 and has set off towards the preceding upright H&S at 0.686. Reaching there would ostensibly satisfy a depth projection of the new base so be prepared for some cooling at that point. Only veering back under 0.665 would suggest a more immediate correction to the 0.65 base neckline.

BRAZILIAN REAL / US DOLLAR

With the 5.00 support gathering back the uptrend break, the US has resurfaced over the ex-trend to pose another challenge to the 5.43 resistance. If finally able to bust through, there would be a good chance to also dispatch 5.51 and rally into the 5.70’s. Alas, if blocked at 5.43 again, watch the mid band (5.24) to warn of another 5.00 test.

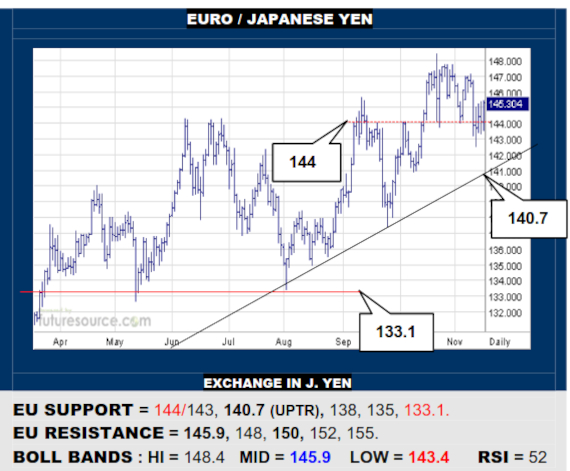

EURO / JAPANESE YEN

EU support at 144 has frayed but not utterly collapsed. Even so, be wary if the bid to revive was held in check by the mid band (145.9), in which case cautious of a bear flag threat that might yet spark a swat lower to confront the uptrend (140.7). Must hop back into the 146’s to otherwise steady the footing and refocus attention on the 148’s.

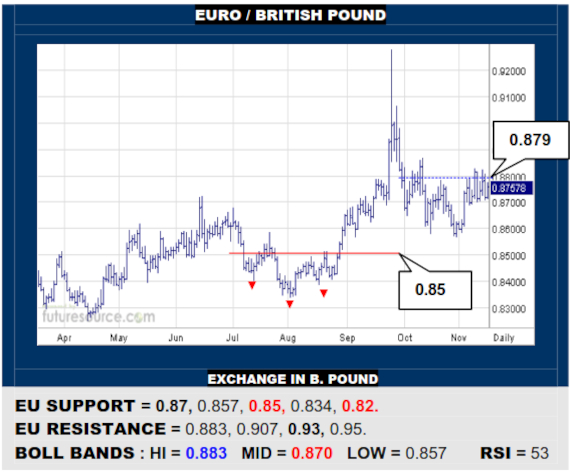

EURO / BRITISH POUND

Oct retrievals from the 0.85’s sparked an initial EU rebound but it has got stuck on the 0.88 border. Must thus now find a decisive jolt over 0.883 to shake awake again and make a new foray into the 0.90’s. Meantime wary of any slip off the mid band (0.87) prompting a sharp new dive that could reach through to the 0.85 shelf.