Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

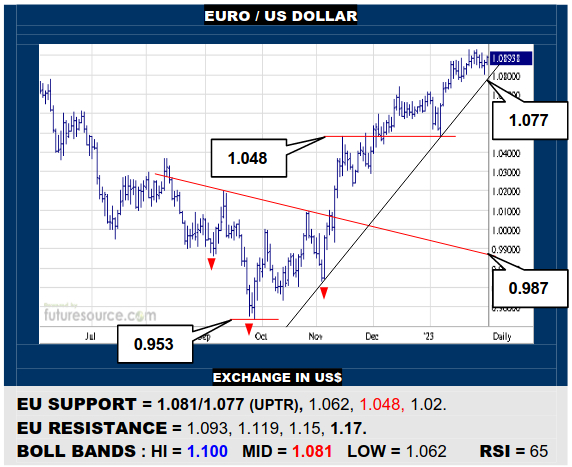

EURO / US DOLLAR

Upside impetus has faded and this has allowed time for the EU’s mid band and uptrend to pull in close behind (1.081/1.077). Would watch this pairing for any sign of growing distress that could trip a correction back to the lower Bollinger (1.062) or even the 1.048 ledge. Needing to otherwise bust clear of 1.093 to resume progress towards 1.12.

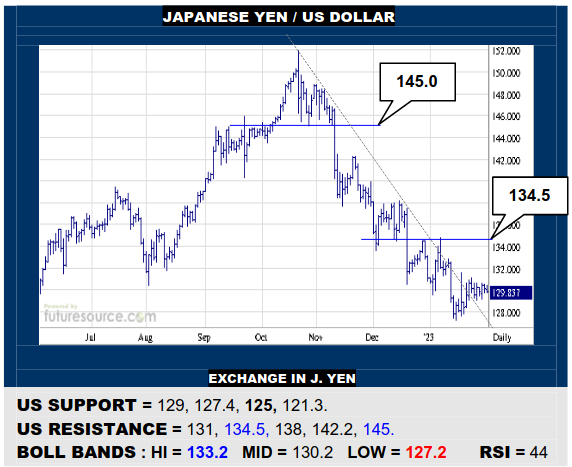

JAPANESE YEN / US DOLLAR

The US has quietly wriggled free of the Q4 downtrend but must now add a clean break of 131 to pull up from some flaggish congestion to train the sights on a next hurdle at 134.5. Can’t entirely trust the turn meanwhile so watch the nearby 129 support as a stumbling block that might yet bring about a delve to test weekly support at 125.

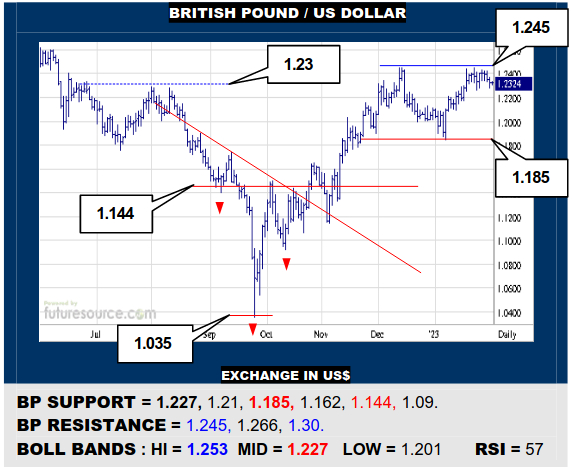

BRITISH POUND / US DOLLAR

The BP has been blunted again at 1.245. So far this has just resulted in a fortnights’ consolidation but must watch the mid band arriving at the 1.227 underside of that immediate pause. If it gave way, be ready for steps back to 1.21 and possibly a much more dangerous 1.185 test. Must otherwise overthrow 1.245 to open passage towards 1.30.

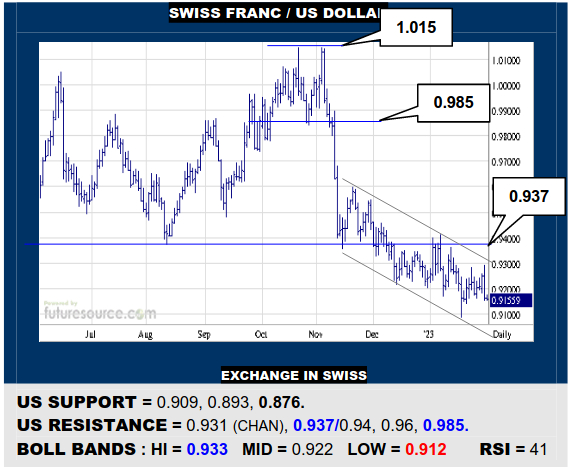

SWISS FRANC / US DOLLAR

US efforts to rebound have fizzled shy of 0.93, creating an ever more channeled look to the past two months. A decisive punch into the 0.93’s must occur to shed this channel and thus perhaps stir more zest with which to attack the main 0.937 weekly dual top frontier. Alas if 0.909 gave way, beware hastening losses on towards 0.876.

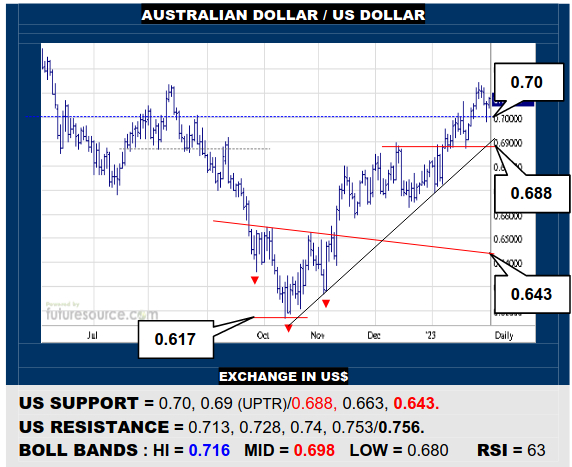

AUSTRALIAN DOLLAR / US DOLLAR

A nearby dip has been largely confined to the 0.70’s so the AD looks to be making more of an impression against the prior large weekly top this time, starting to light the way towards the 0.75’s. Only slipping from the 0.70’s would raise concerns, shifting focus onto the uptrend (0.69) and 0.688 rear guard where a more serious break could occur.

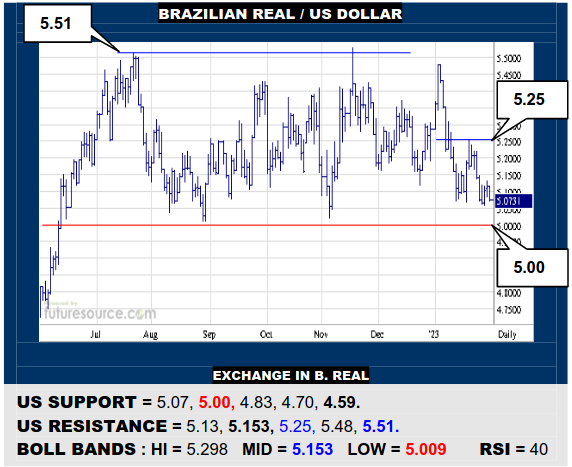

BRAZILIAN REAL / US DOLLAR

Support at 5.07 has thus far been shielding the pivotal 5.00 defence but recent days of congestion have a bear flaggish vibe so do still be prepared for that 5.00 strike where a major top could be created. Must alternatively reflex back over the mid band (5.153) to shake off this pressure and try for 5.25 in a bid to form a new dual bottom instead.

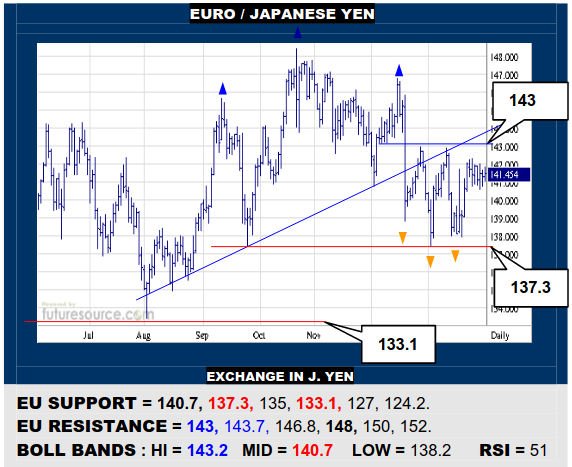

EURO / JAPANESE YEN

A spell of congestion has potential as a flag but it would still take a clean escape over 143 to add a more reassuring EU inverse H&S to serve as a launch pad for a new run at the 148’s. Meantime mindful of the mid bands’ close proximity (140.7) and a reversal through there would dilute the flag chance and point back towards 137.3 again.

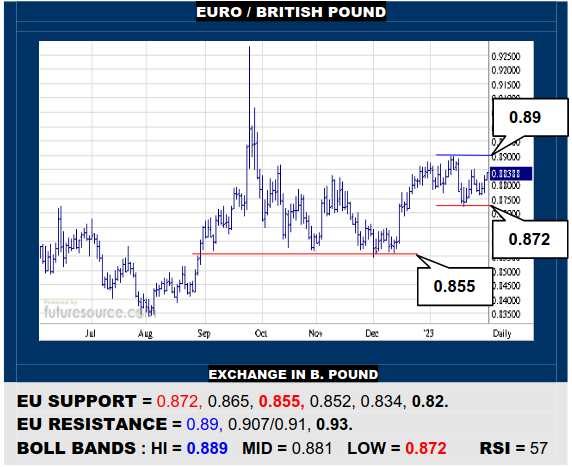

EURO / BRITISH POUND

Nip and tuck ranging for more than a month between 0.872 and 0.89 has also given time for the Bollinger corridor to adopt these same limits. A breakout topside would render this action as a weekly flag and buoy hopes to reach for 0.93 again while breaking down would target 0.855 once more as a tripwire for a broader top.