Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

See a sample of TechCom’s Sugar Technical Review by clicking ‘Download PDF’ above.

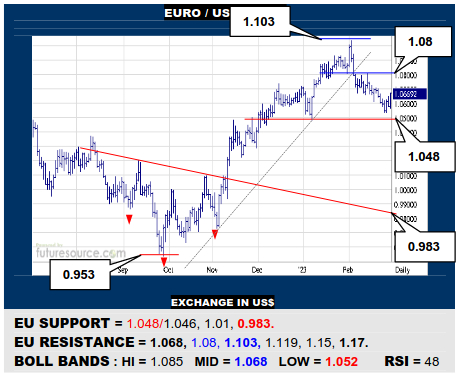

EURO / US DOLLAR

The EU is showing signs of fight just clear of the 1.048 ledge, which is backed by the lesser 38.2% Fib retracement (1.046). If it can jolt free of the mid band (1.068), look for a strike at 1.08 to give a better read on the success of this attempt to re-fire the engine. If ultimately held pinned under 1.08, do still be wary of an interim H&S top developing.

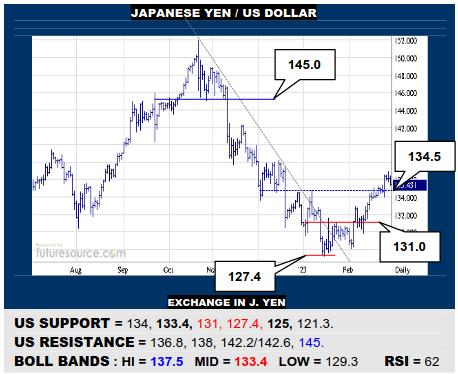

JAPANESE YEN / US DOLLAR

A small base under 131 followed the US downtrend escape and it has pulled back up to a 38.2% Fib retracement at 136.8. Must be a little more cautious here and mind the support niche between 134 and the oncoming mid band (133.4) for any signs of a serious new downturn. If able to hold 134, look for further progress to the 142’s.

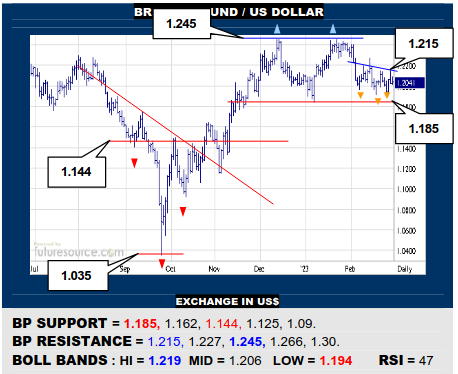

BRITISH POUND / US DOLLAR

The BP has continued to keep a distance above the key 1.185 support to thus avoid a heftier double top, creation of which would be liable to tip the balance back to at least 1.144 and probably deeper. Needing a hike over 1.215 meantime to paint Feb as a small new inverse H&S and thereby kick start a third strike at 1.245 in a bid to reach on to 1.30.

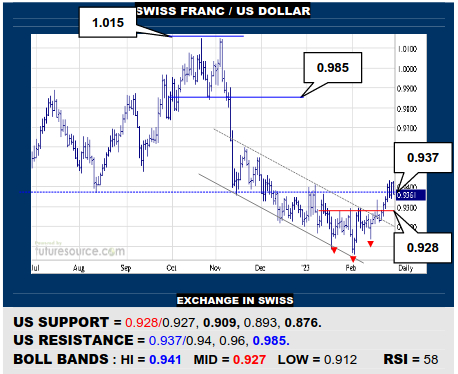

SWISS FRANC / US DOLLAR

The US wriggled free of the descending channel in Feb and has built an early ’23 inverse H&S under 0.928 from which it is attacking the big ’22 top above 0.937. Must really bust into the 0.94’s and hold to prove getting the better of that obstacle. Meanwhile minding that 0.928 base rim, any swat back below turning focus back down to 0.909 and lower.

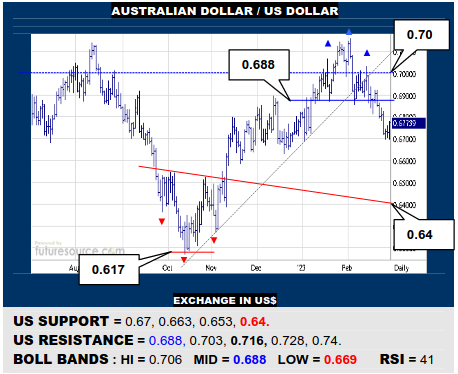

AUSTRALIAN DOLLAR / US DOLLAR

Rejection from the 0.70’s again ultimately led to a modest new early ’23 H&S forming above 0.688 so the AD looks prone to further Q1 retrenchment into the 0.64’s in due course. Only a prominent rebound to reach and hold the 0.69’s would dispel the new top and change the context of the Feb setback to look merely corrective after all.

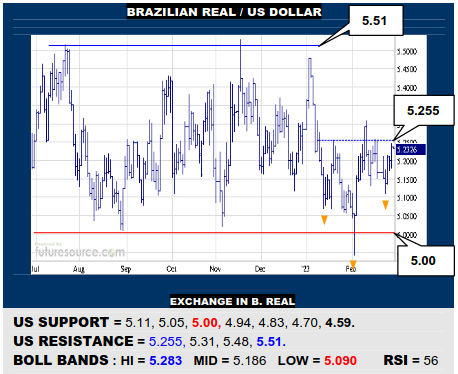

BRAZILIAN REAL / US DOLLAR

Very twitchy action but if the US could score another breakout over 5.255 and actually hold beyond, it would render early ’23 as a rather loose inverse H&S that could at last release a rally to try the 5.51 resistance again. If still fumbling at 5.255 though, stay wary of further sudden slips to 5.00 where the risk of a major top would still loom.

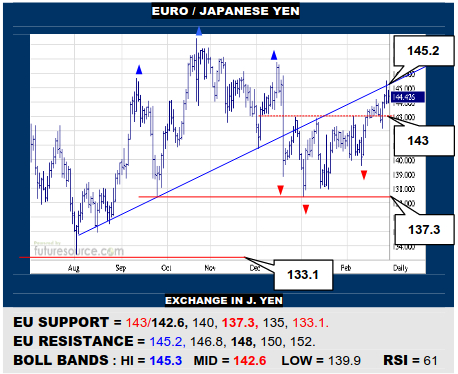

EURO / JAPANESE YEN

The EU finally battled across the 143 divide to suggest a new inverse H&S. Even so, it still needs to also defeat the neckline slope of the prior upright H&S (145.2) to really emphasize the new base creation and point on ahead to challenge 148. Watch the base rim and mid band (143/142.6) meantime for any sign of the recovery unraveling.

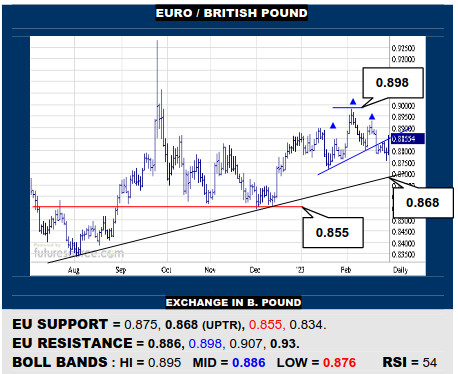

EURO / BRITISH POUND

The EU is bidding to shrug off the Feb setback while still a distance clear of the overall shallow uptrend (0.868) but needs to dispatch the mid band (0.886) to prove its success and return attentions to trying to access the 0.90’s. If blocked by the mid band, it would instead highlight a small Q1 H&S and threaten an actual test of the uptrend.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.