Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

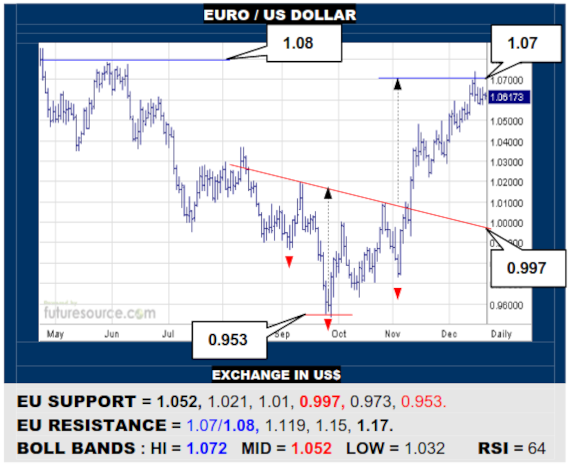

EURO / US DOLLAR

The EU tagged its 1.07 inverse H&S projection but then let off the gas as the $ Index meantime dabbed the brake in the 103’s. Immediate consolidation still has flaggish potential so a lunge out over 1.08 would be a next big step to raise sights towards 1.17. Watch the approach of the mid band though (1.052), any break threatening a setback to 1.01.

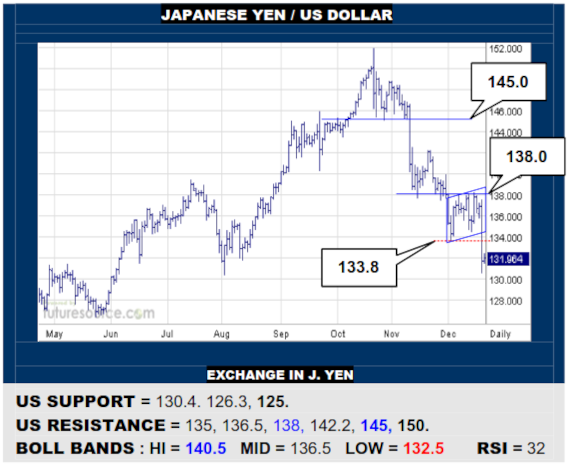

JAPANESE YEN / US DOLLAR

The US couldn’t fight back over the 138 resistance and a snap through 133.8 has rendered much of Dec as a bear flag. There is a minor trough at 130.4 but otherwise this has now exposed a path back down to a preceding main peak of ’15 at 125. Only a prompt reflex across 135 would give any cause to doubt the new flag.

BRITISH POUND / US DOLLAR

A probe beyond 1.23 proved short lived and the BP has slipped back through its mid band, intensifying the risk of a correction. There is a minor ledge at 1.188 but better bracing isn’t until back down in the 1.14’s ballpark so must be cautious. Only a fresh foray over 1.23 could persuade of firmer grip in the 1.20’s and reach on towards 1.30.

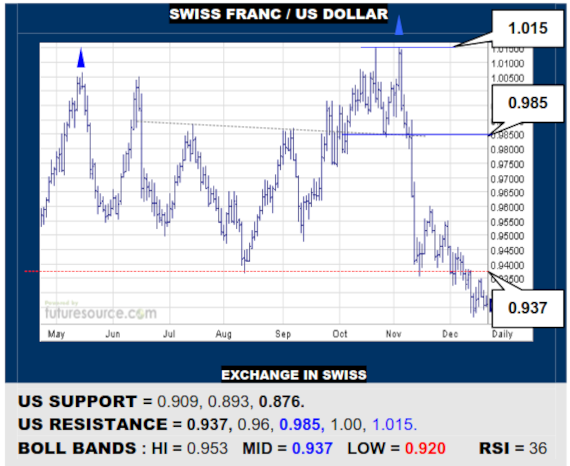

SWISS FRANC / US DOLLAR

The US staged a minor rebound late last week but faltered shy of the recent 0.937 breakdown point where a major ’22 double top resolved. That level is now also hosting the mid band and is thus the escape hatch from this predicament but meantime vulnerable to a next ledge at 0.909, beneath which swifter losses towards 0.876 could ensue.

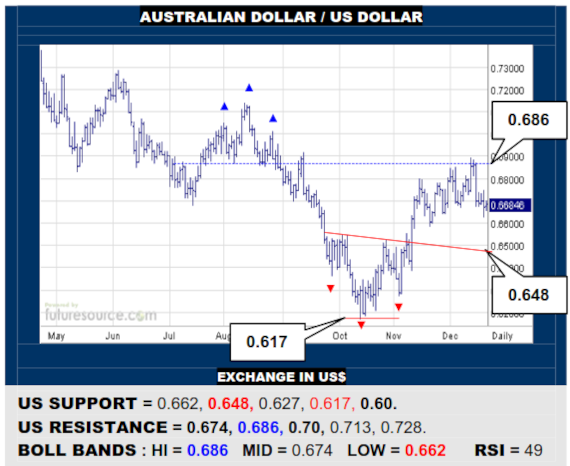

AUSTRALIAN DOLLAR / US DOLLAR

The AD could only make a brief stab into the H&S above 0.686 before doubling back through its mid band. The lower Bollinger is now trying to tame this retreat (0.662) but must spark a rebound over the mid band (0.674) to signal a quick retrieval. Otherwise be prepared for a further slide back to the 0.648 neckline of the prior inverse H&S.

BRAZILIAN REAL / US DOLLAR

While the US jabbed back into the Nov H&S, it was still then blunted by the ex-uptrend (5.38 now) and has swerved south again. Duly eyeing 5.16 as a trigger to intensify this trend derailment and probably thereby bring a test of the key 5.00 troughs where a much heftier double top could mature to tilt the balance back towards the mid 4’s.

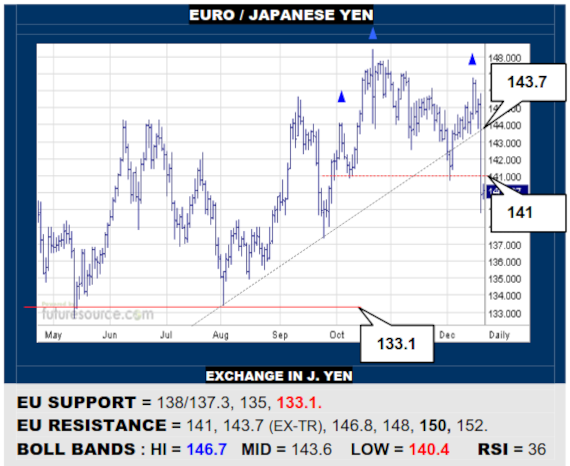

EURO / JAPANESE YEN

Floundering shy of the 148’s again has seen the EU turn tail back through the second half uptrend, the resulting dive piercing 141 to shape Q4 into an awkward sort of H&S top. This makes for a much wearier pattern and threatens a further slide to the 133’s. Needing a potent rebound over the ex-trend (143.7) to restore a firmer footing.

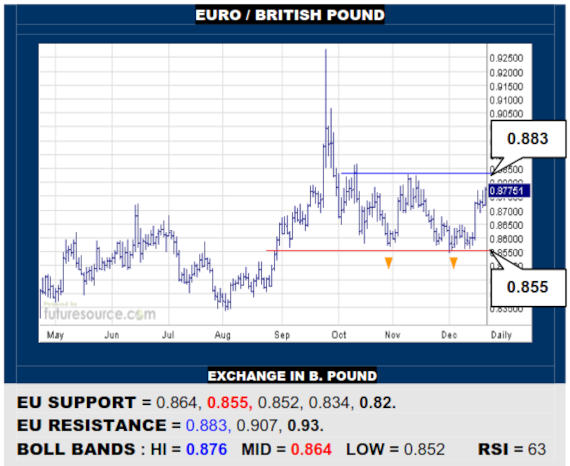

EURO / BRITISH POUND

Mid 0.85’s support aided by the lower Bollinger band managed to instill new life in the EU and it is making for the upper edge of the Q4 range at 0.883. Busting beyond would build a new double bottom, a firmer foundation for a fresh foray into the 0.90’s. Meantime only twisting back under the mid band (0.864) would raise new doubt.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.