Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

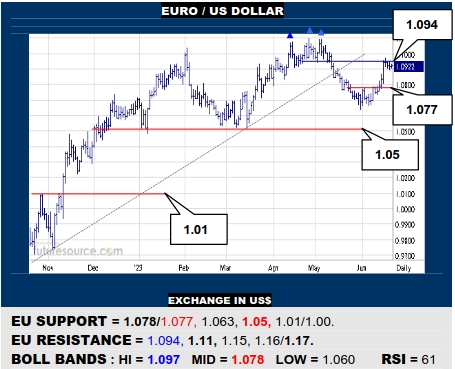

EURO / US DOLLAR

The new upswing by the EU has initially been blocked by the 1.094 rim of the early Q2 H&S but to no disruptive effect as consolidation that has followed has flaggish potential. Piercing 1.094 would thus pin the bullseye on 1.11 with an eye towards 1.17 beyond. Only reeling back under 1.077 would otherwise undercut the small nearby base.

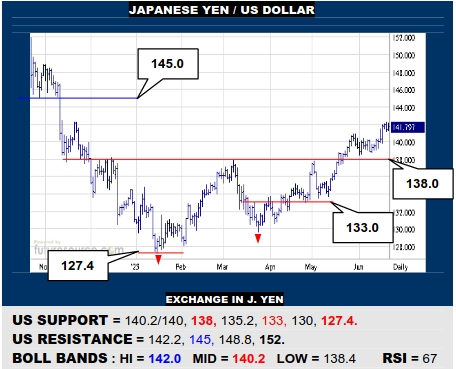

JAPANESE YEN / US DOLLAR

A spell of consolidation balanced safely above the large new sub-138 base and the US has pulled away higher as it continues the road that heads toward 145. Yet to get the nod from RSI, which remains in divergence however so would mind the 140 initial support ledge for any sign of dipping back to test out the 138 base border.

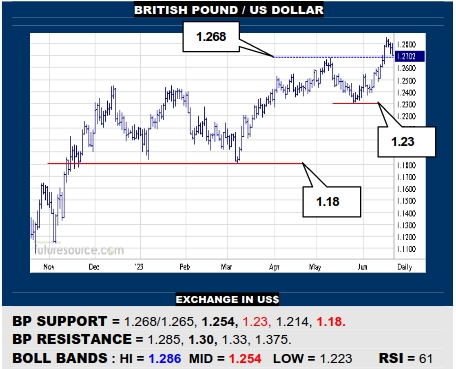

BRITISH POUND / US DOLLAR

The BP popped the prior 1.268 peak to extend its recovery last week but flinched with an inside day Monday to swerve back again. If it can still hold the 1.268 area, there would be little concern and a flag could bring another foray for 1.30 fairly soon. Pressing back under 1.265 however would warn of a more serious test of the mid band (1.254).

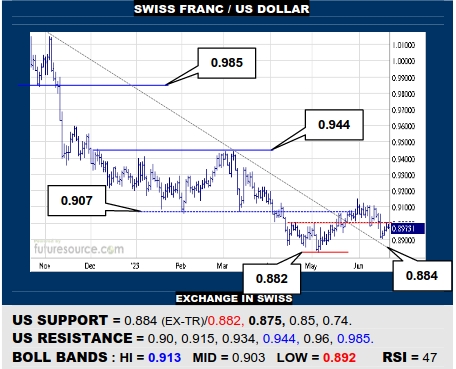

SWISS FRANC / US DOLLAR

The US has eroded back into the small sub-0.90 base but has thus far not troubled the previously broken downtrend (0.884). Hence, if it can quickly jog back over 0.90, the Jun setback would look ostensibly just corrective and a path over 0.915 towards 0.944 would beckon. If hemmed in under 0.90 though, beware an attack on the 0.882 trough.

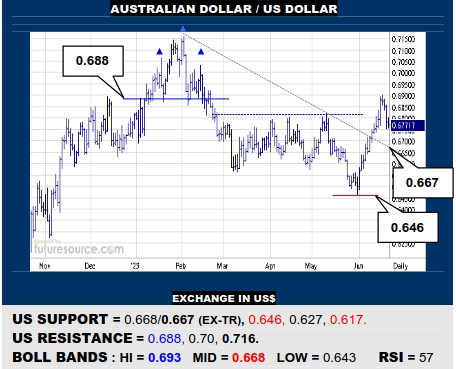

AUSTRALIAN DOLLAR / US DOLLAR

The AD jabbed the H&S above 0.688 but failed to make any lasting impact before swerving lower. Would currently make space for a bit more of a dip back to the mid band (0.668) and ex-downtrend (0.667) but if able to hold there, a new strike at 0.688 could follow. Only slicing back through the ex-trend would badly deflate the Jun recovery.

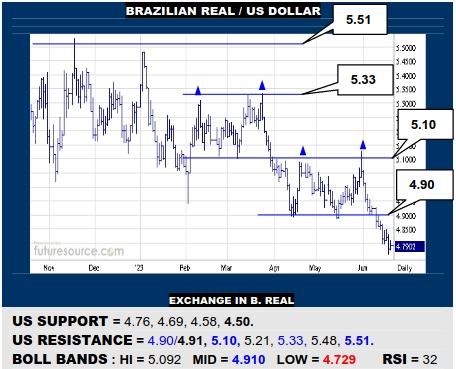

BRAZILIAN REAL / US DOLLAR

With a new Q2 dual top above 4.90 mimicking the Q1 version above 5.10, the US has pressed south as there just isn’t much underneath until the 4.50’s where a major decade uptrend could be reached. Must otherwise claw back over the 4.90 top border and intersecting mid band (4.91) to shake off this generally weary scene.

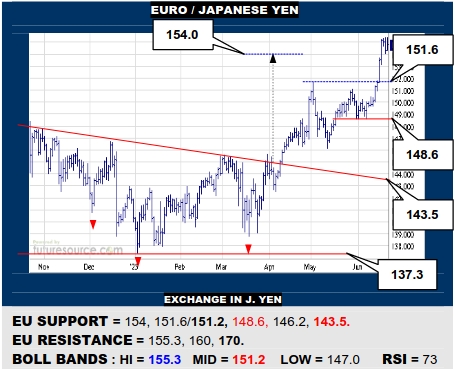

EURO / JAPANESE YEN

The EU has hustled on up to and through the 154 inverse H&S target and is initially managing some consolidation beyond. Duly mindful of a bull flag possibility so piercing 155.3 would keep goading on the rally across an open landscape towards ‘08’s 170 high. It would take a swerve back under 151.6 as the mid band arrives to do serious harm.

EURO / BRITISH POUND

Minor needling through the 0.855 support failed to cause a true snap and the EU has rebelled to attack the mid band (0.859). If able to secure a break by getting a grip in the low 0.86’s, look for a further try back up towards the early ’23 H&S neckline at 0.874. If foiled at 0.86 though, beware a more penetrating gouge under 0.855.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.