Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

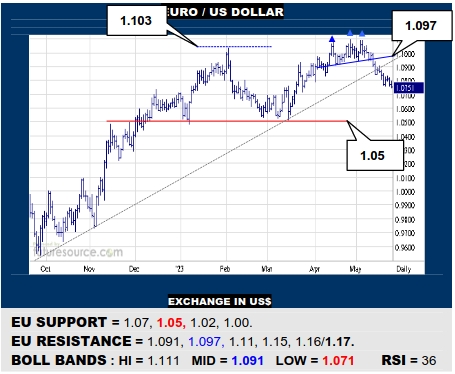

EURO / US DOLLAR

After a small H&S derailed the EU from its uptrend, it has continued to slip back towards an interim support at 1.07, the prospective tripwire on towards the pivotal 1.05 shelf where a much broader top could be created. It will otherwise require a reflex back over the mid band (1.091) and 1.097 top neckline to restore the higher footing here.

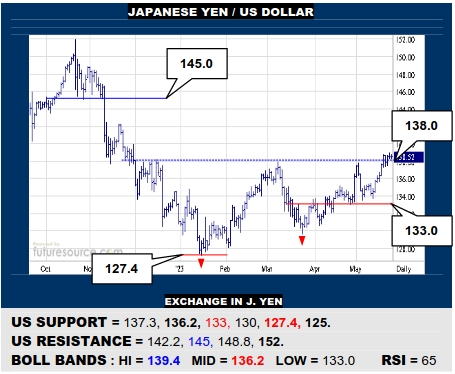

JAPANESE YEN / US DOLLAR

The US has provisionally edged by the 138 hurdle to hail a new six month double bottom, which appears to finally draw the curtain on a Q4 correction and sets sights on 145 initially with an eye on towards 152. Only if unable to solidify the 138 escape and steered back below the mid band (136.2) would the base be called into serious doubt.

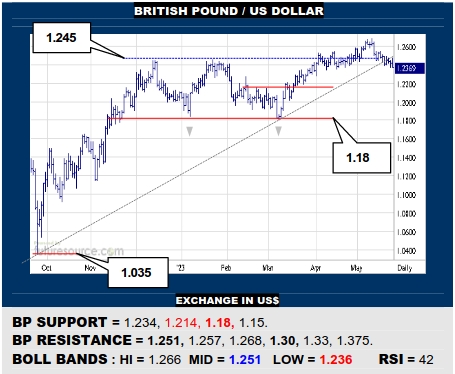

BRITISH POUND / US DOLLAR

The BP has eroded away its former uptrend and looks prone to further near term decay to 1.214 initially and later on towards the next main precipice at 1.18. Only gingerly losses in the past fortnight but it would take a jog back over the mid band (1.251) to also retrieve the trend break and restore grip at these heights to bring 1.30 into view again.

SWISS FRANC / US DOLLAR

Despite a failed first attempt, the US still appears to be shrugging off its downtrend and giving definition to a small new base under 0.90. It could do with a decisive lunge across 0.907 to reassure these events and raise horizons to the 0.94’s however. Minding the mid band meantime (0.894) for any sign of undercutting the trend escape.

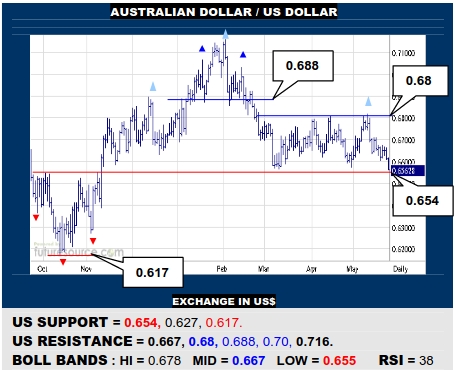

AUSTRALIAN DOLLAR / US DOLLAR

Pressure from the arriving mid band (0.667) has edged the AD down the hill towards a key 0.654 rim of a prior Q4 base. It looks prone to breaking through where not only would the base be diluted but a broad new six month H&S would be resolved to aim on towards 0.617. Only a reaction over that mid band could bring some relief.

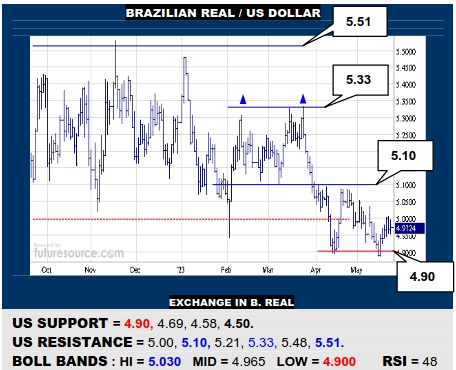

BRAZILIAN REAL / US DOLLAR

The US held on at 4.90 again but the bounce from there is struggling to re-enter the 5’s. Needing at least that next step to give reassurance that would set up a strike at the more pivotal 5.10 level where there would be a chance to flip a former dual top with a new dual bottom. Stay wary of plenty of open space lurking under 4.90 meanwhile.

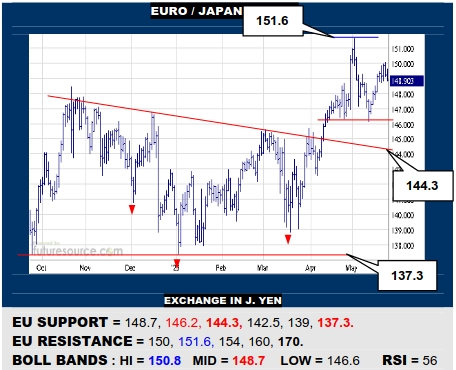

EURO / JAPANESE YEN

The EU’s bid to get back on the gas is showing some fatigue at 150 and would thus beware any abrupt twist back under the mid band (148.7) hinting at a new nearby peak that would start to lean more towards a scrappy Q2 H&S taking shape. Must drive through 150 to reassure the climb and bolster ideas of longer term gains to 170.

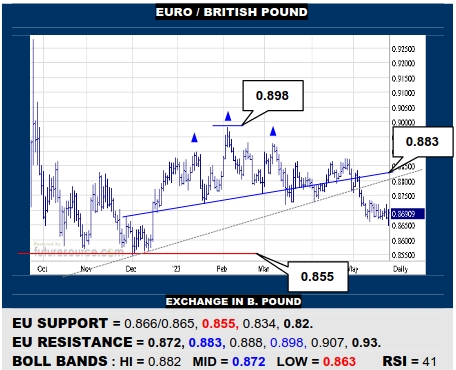

EURO / BRITISH POUND

An intraday jab through the nearby 0.866 ledge has been quickly recouped so there is some suggestion of the EU making ready for a corrective bounce if its 0.872 mid band can be popped, then seeking a test of the 0.883 H&S neckline. The mid 0.86’s must otherwise soon succumb to post a bear pennant and point on down to 0.855.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.