Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

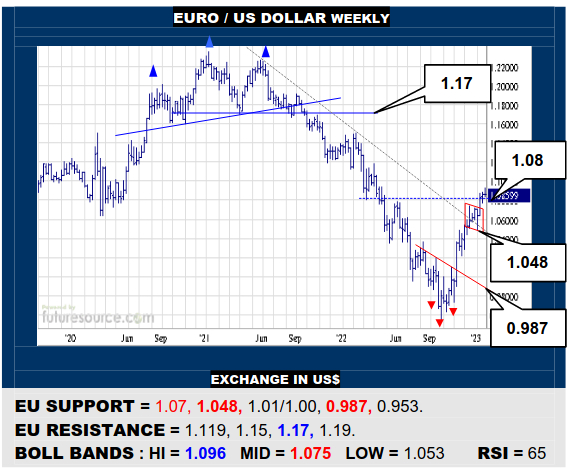

EURO / US DOLLAR WEEKLY

The Q4 downtrend exit has been endorsed by a flaggish Dec shape and subsequent ploughing on over 1.08, paving the EU’s way on up towards 1.12 and ultimately with sights drawn to 1.17 now. Only a swerve back under 1.07 would give warning of straying from the upside to endanger the 1.048 pivot back down towards 1.01/1.00.

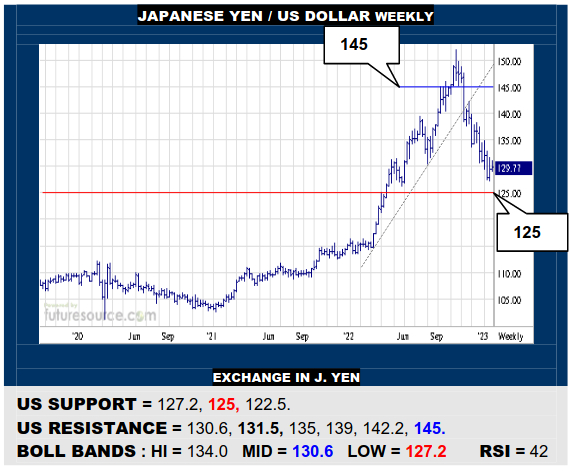

JAPANESE YEN / US DOLLAR WEEKLY

Breaking the ’22 uptrend has seen the US press much of the way back towards the next main monthly support shelf at 125 and there is now chance for an inside week to help tame the retreat. Minding 131.5 as a trigger for a bounce to 135 then but breaking 127.2 would instead point on down to test 125 before trying to bounce again.

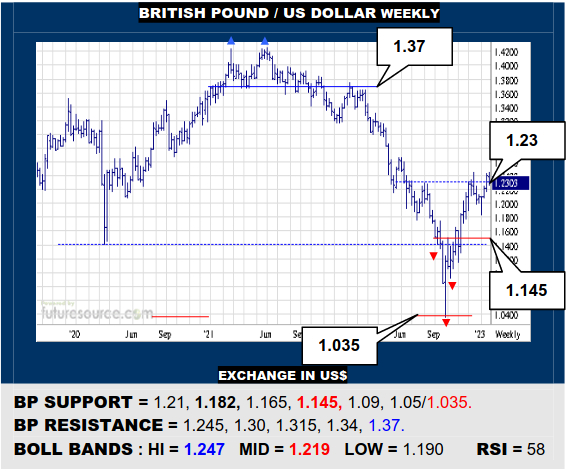

BRITISH POUND / US DOLLAR WEEKLY

The BP must prove its defeat of 1.23 by also breaking 1.245, then confirming moving on from a Dec correction and opening up a next leg of gains to 1.30. Keep an eye on the mid band meantime (1.219) however as a slip through there would err more towards a dual top evolving and so pin focus on 1.182 as a step back down to the 1.14’s.

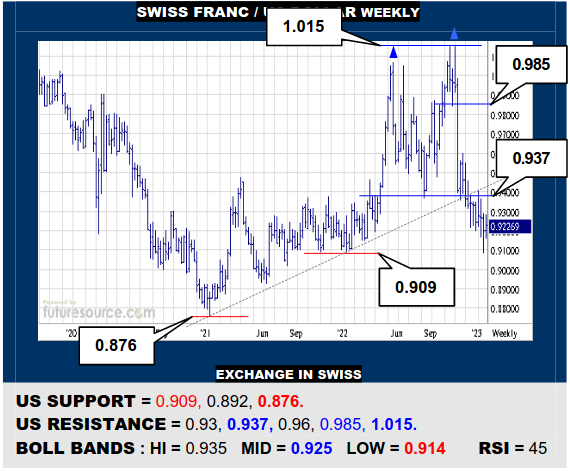

SWISS FRANC / US DOLLAR WEEKLY

The next support rung at 0.909 has blunted the US retreat but it is still going to demand a reflex back over the 0.937 border of ‘22’s major double top to reach fresh air and the chance for a bounce to 0.96. Not entirely trusting the 0.909 brace meanwhile and pressing on through could restore downside impetus all the way down to the 0.876 low.

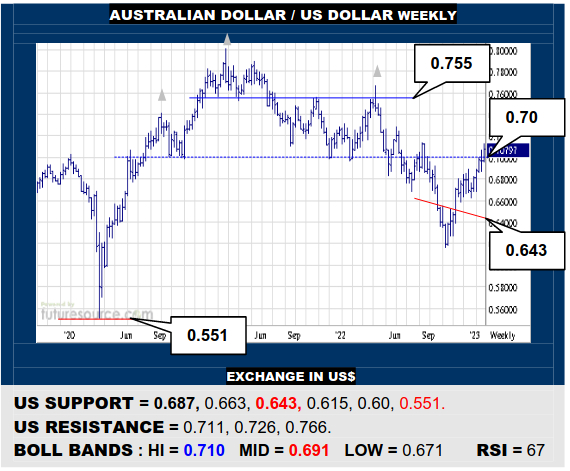

AUSTRALIAN DOLLAR / US DOLLAR WEEKLY

The AD has lunged into the 0.70’s and thus pried open the big ‘20’s H&S. If able to secure this achievement in the next week or so, it would expand the recovery path to 0.755 and even 0.80 would start to beckon. Must just keep a recent 0.687 trough under watch for any signs of distress, its demise threatening a delve back to the 0.65’s.

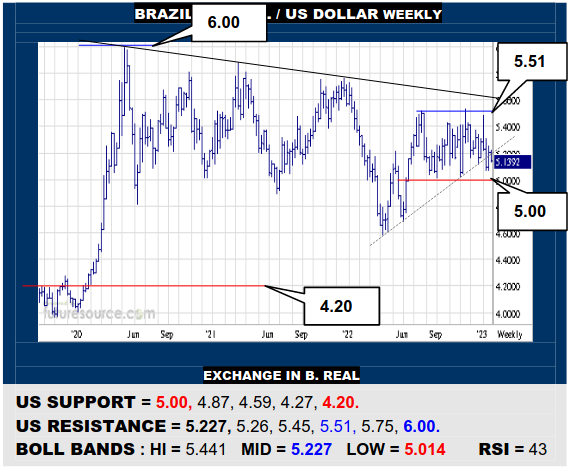

BRAZILIAN REAL / US DOLLAR WEEKLY

The ’22 uptrend has decayed early in ’23 and US attempts to revive have been confined beneath the mid band (5.227) so there feels like a growing risk posed to the pivotal 5.00 support, a break there resolving a hefty top aimed down to the 4.50’s. Only tearing free of the mid band would restore grip and allow another probe towards 5.51.

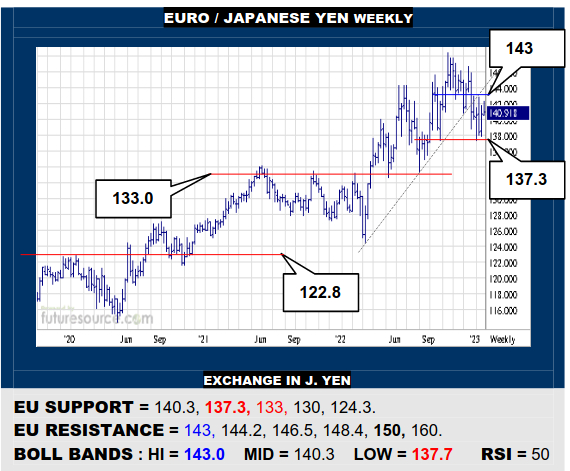

EURO / JAPANESE YEN WEEKLY

The EU has shown revived support at 137.3 but must now bust free of the 143 resistance to start ’23 with a new base pattern that could pin the crosshairs back on the 148’s. While blocked at 143, the balance will continue to waver and loss of 137.3 could instead apply a heftier top that would threaten to break back below 133.

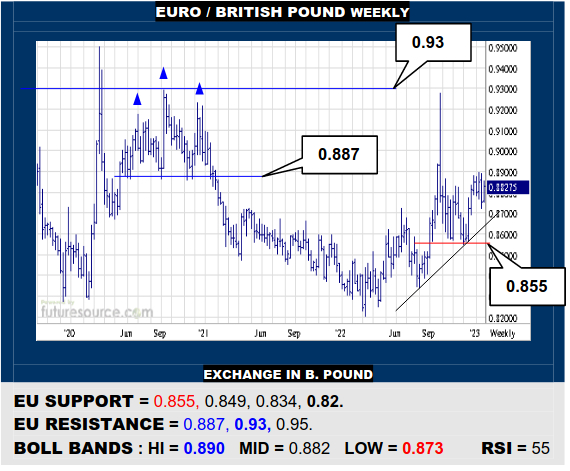

EURO / BRITISH POUND WEEKLY

Mid 0.85’s support has spurred the EU to resume hounding the 0.887 border of a ’20 H&S that was only very briefly pierced during ’22. Must punch through this into the 0.89’s to reassure the catch at 0.855 then and expose the path to 0.93 again. If denied and later pressed below 0.855, a large new top would point back down to 0.82 once more.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.