Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

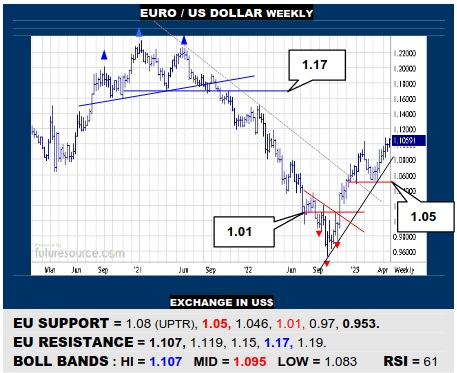

EURO / US DOLLAR WEEKLY

The EU tamed a Q1 dip clear of the lesser 38.2% retracement (1.046) and defeat of the 1.10’s would thus resume the broader downtrend escape to aim on up towards the next main obstacle of a ‘20/’21 H&S beyond 1.17. Only swerving back under the 1.08 uptrend would really rock the boat and raise risk of a toppier outcome via loss of 1.05.

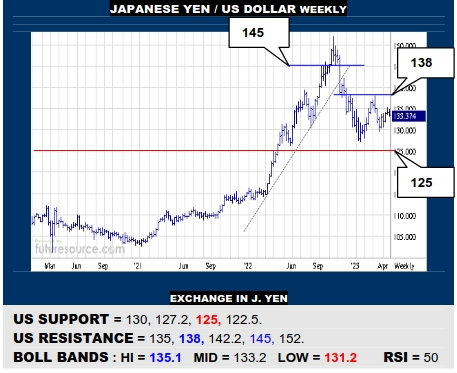

JAPANESE YEN / US DOLLAR WEEKLY

A Q4 US retreat was steadied early in ’23 while still clear of the main 125 monthly chart base rim but it will henceforth demand piercing 138 to really pull out of the setback and install a new higher base from which to try for the 150’s again. Meantime always eying 130 as a key prop to prevent a much more intensive examination of 125.

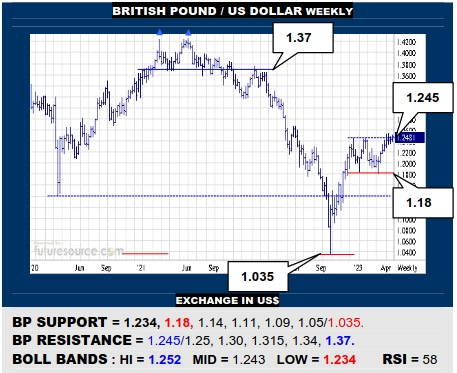

BRITISH POUND / US DOLLAR WEEKLY

Gathering up two dips at 1.18 during Q1, the BP must finally swat away the 1.24’s to shake free of a lengthy corrective phase and push on ahead to 1.30, ultimately with a mind to testing 1.37. It is proving hard work though so must keenly mind a 1.234 nearby ledge as any tip back below would signal failing and a third dangerous test of 1.18.

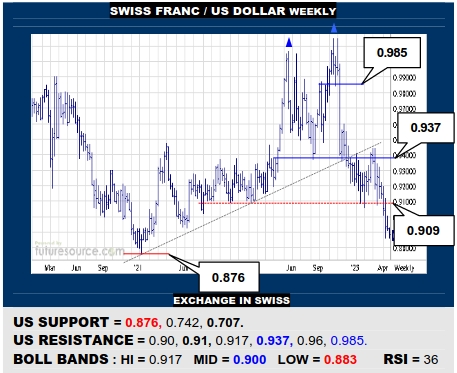

SWISS FRANC / US DOLLAR WEEKLY

The big ’22 double top kept the lid on a Q1 US rebellion and it has now broken on down towards the prior 0.876 early ’21 trough. There is a deep cavern into the low 0.70’s showing beneath there so it must hold 0.876 to preserve chances of fighting back, though needing to rebound over 0.91 to signal a potentially pivotal retrieval.

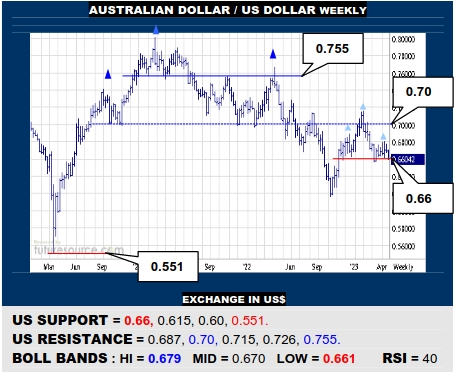

AUSTRALIAN DOLLAR / US DOLLAR WEEKLY

The big ‘20/’22 H&S over 0.70 smothered a Q4 revival early in ’23 and the AD now looks to be teetering on the 0.66 ledge. A clear cut slip off here would render a new smaller H&S beneath the 0.70+ example and threaten another delve down to 0.615. Only hanging on at 0.66 and reacting back over 0.687 would set up another stab at the 0.70’s.

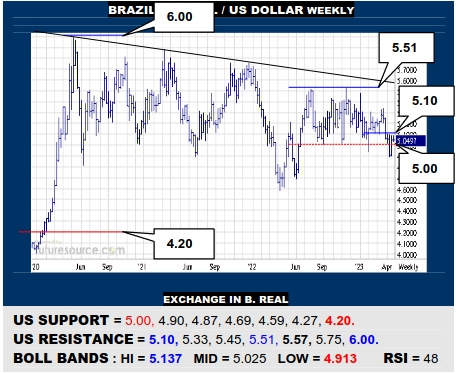

BRAZILIAN REAL / US DOLLAR WEEKLY

A gouge below 5.00 has been clawed back but the US will have to bust on through 5.10 to claim a more enduring retrieval, whereby the 5.30’s and maybe even 5.51 would come back into view. If held in check by 5.10, the second half of ’22 would retain its toppy character and a next foray south of 5.00 could reach on down to the 4.50’s.

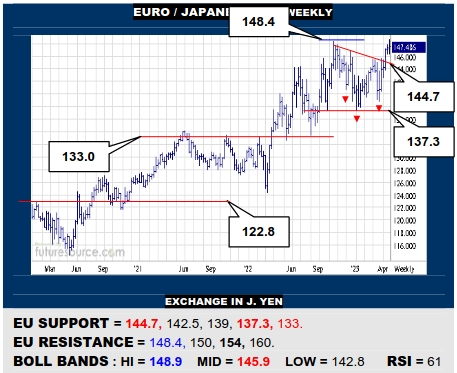

EURO / JAPANESE YEN WEEKLY

The EU has emerged from Q4/Q1 inverse H&S that suggests a corrective phase is over but it must still score a decisive getaway over 148.4 to prove this and so raise sights to a base projection at 154. However, if repeatedly foiled by 148.4, keep watch on the new base neckline (144.7) as a tripwire back into the upper 130’s.

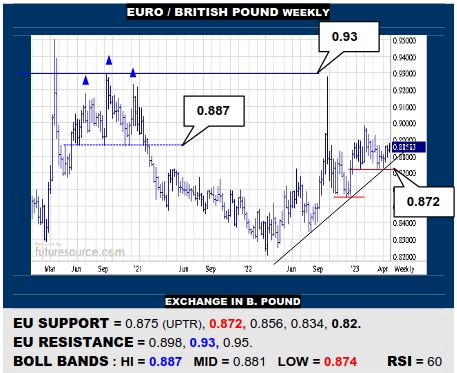

EURO / BRITISH POUND WEEKLY

The EU has scooped up several dips in the low 0.87’s with aid from an arriving mid term uptrend but must finally translate this into a stab into the 0.90’s that actually holds in order to set sights on 0.93. Still keeping close tabs on the trend (0.875) and 0.872 meanwhile as key bracing, any break below potentially sparking a new delve to 0.82.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.