Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

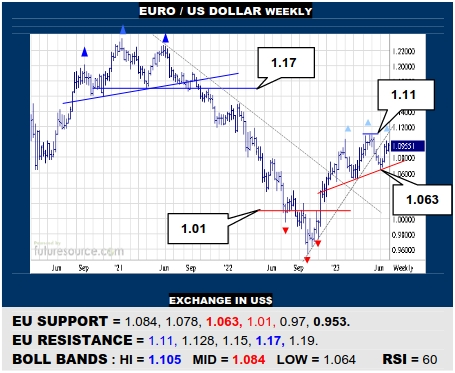

EURO / US DOLLAR WEEKLY

A key stage for the EU. It gathered up its prior uptrend break at 1.063 but must now bust clear of 1.11 to give this retrieval new drive across the then fairly open space towards 1.17. The concern being that if foiled shy of 1.11, a right shoulder to a ’23 H&S would start to show where a reversal through 1.063 would point back down to 1.01.

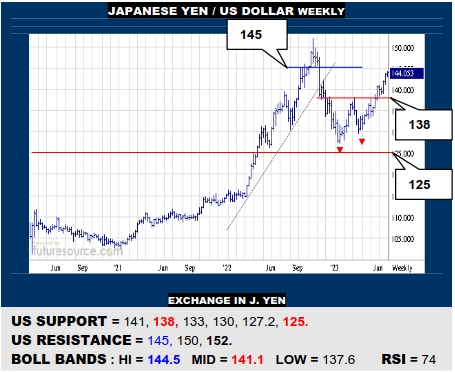

JAPANESE YEN / US DOLLAR WEEKLY

Having escaped a robust sub-138 double bottom, the US has since ploughed on to be nearing the next hurdle at 145. RSI is in step so that barrier needn’t be a lasting obstacle and 152 beckons beyond. Only several rebukes from 145 to veer back under 141 would warn of actually retracing to test the strength of the 138 base rim.

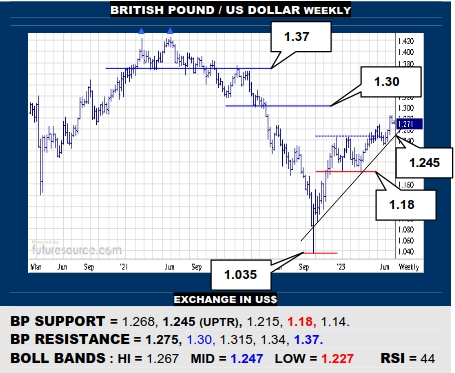

BRITISH POUND / US DOLLAR WEEKLY

A getaway over 1.268 but the BP flinched soon after and needs to now stay the course above here and really exceed a 1.275 Fibonacci retracement of the prior big ‘21/’22 decline to tempt ideas of reaching 1.37. If not, veering back under 1.268 would endanger the uptrend (1.245) and breaking that would threaten further fallout to 1.18.

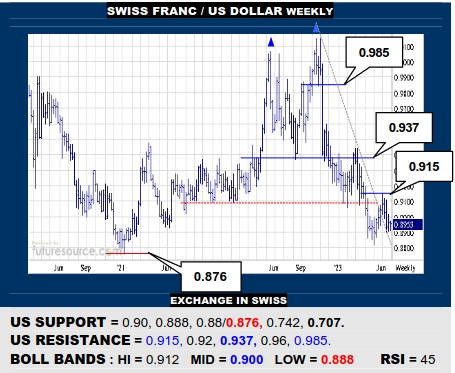

SWISS FRANC / US DOLLAR WEEKLY

Though dipping back in Jun, the US has thus far still preserved the prior escape from a hefty 6-month downtrend. If able to rally afresh from the 0.89 area and pop 0.915, it would build a useful base that could pry open the big dual top beyond 0.937. However, if pressed on beneath 0.876, there is a deep cavern that could then lead to 0.75.

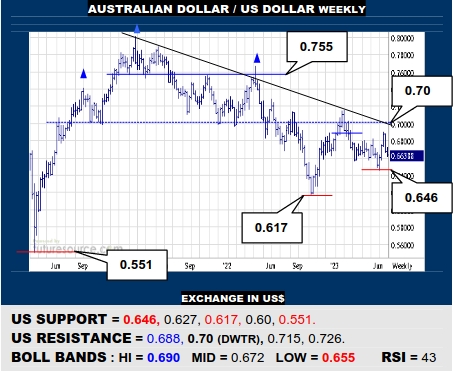

AUSTRALIAN DOLLAR / US DOLLAR WEEKLY

The AD’s Jun bounce was blunted by the Q1 top above 0.688, heading it off shy of the overall ‘20’s downtrend (0.70). A brief solar flare then without much lasting effect and things would look ominous if the 0.646 trough gave way to the backlash, fearing follow through below 0.617. Must gather in above 0.646 to revive hopes for another reach for 0.70.

BRAZILIAN REAL / US DOLLAR WEEKLY

Just initial signs of the US trying to find its feet but not in a location of great support previously so it would take a reflex back over 4.90 to create more of a groundswell and bring 5.10 into range. If remaining stumped shy of 4.90, be prepared for a further leg down to confront the major decade long uptrend that now stands at 4.50.

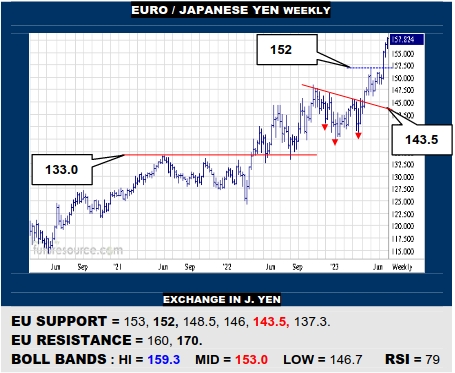

EURO / JAPANESE YEN WEEKLY

Resuming higher over 152 in Jun puts the EU out into clean air that effectively extends all the way up to the millennium high at 170, RSI and ADX both very much in step. Little cause to preempt an apex as yet then and only reeling back through 152 would mark a serious disruption to turn focus towards the inverse H&S (143.5).

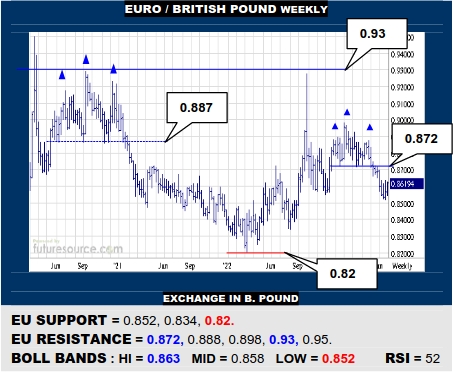

EURO / BRITISH POUND WEEKLY

The EU has pulled together a modest Jun base from which a stab back up to the heftier prior H&S over 0.872 looks possible. Would only view it as corrective however unless able to really punch through that 0.872 frontier. Otherwise wary that a quick stab at the 0.87’s could yet be followed by another swat lower towards the 0.82 precipice.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.