Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

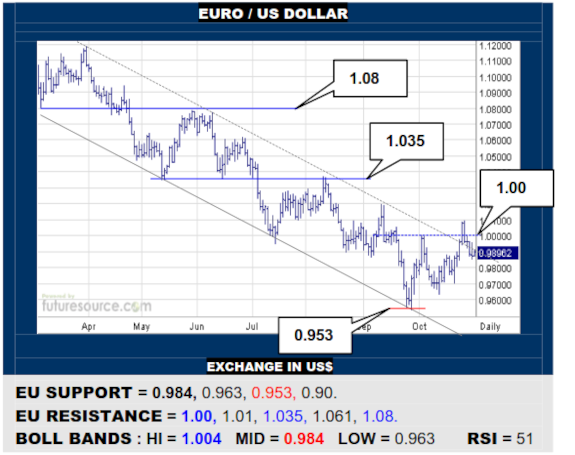

EURO / US DOLLAR

The EU has disrupted its ’22 downtrend but a brief look over 1.00 must be repeated and secured to really hail a trend escape and build a modest new triangle base as a stepping stone up to 1.035. Keeping a close eye on the mid band (0.984) meantime as a slip back below would dilute the rebellion and access the 0.95’s once more.

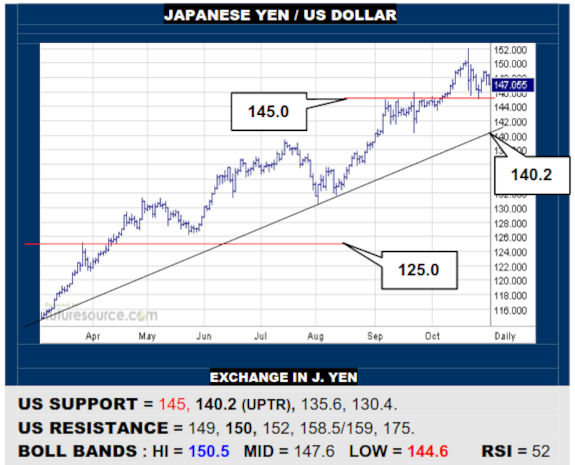

JAPANESE YEN / US DOLLAR

Initial 145 support withstood the reflex back out of the 150’s but the US must soon proceed over 150 again and prove traction there to reassure the broader climb, starting to then eye an interim goal of 158.5/159. If instead pressed back below 145, the nearby landscape would become toppier and a test of the uptrend would loom (140.2).

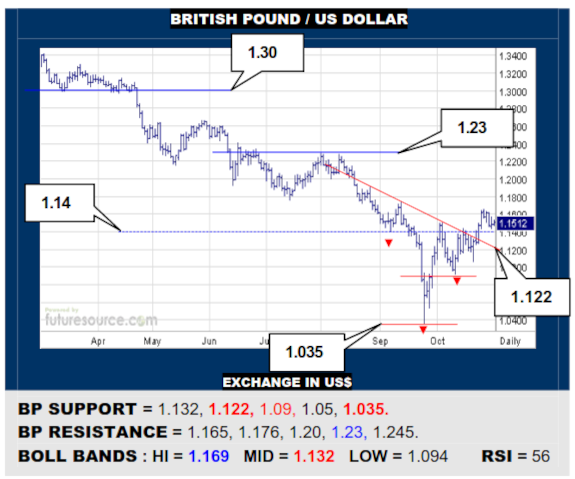

BRITISH POUND / US DOLLAR

The reemergence over the preceding 1.14 trough has built a Sep-Oct inverse H&S and the BP is showing some flaggish consolidation in the aftermath. Duly minding 1.165 as the exit trigger from the flag to reach on to 1.20 and probably 1.23 before next needing a rest. Only reeling back through the base neckline (1.122) would upend this scene.

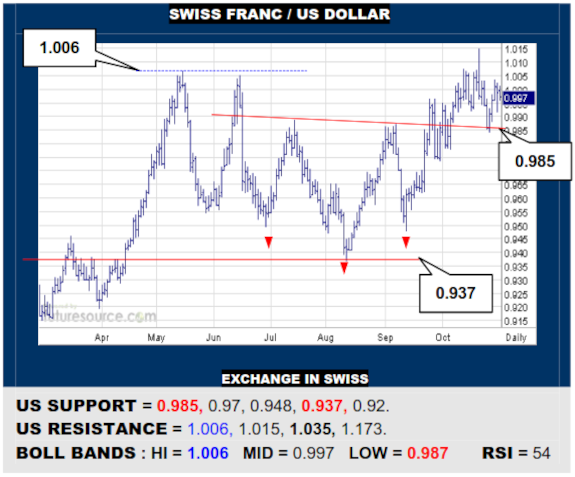

SWISS FRANC / US DOLLAR

The US caught the backlash from the 1.01’s aboard its 0.985 inverse H&S neckline but must reassure that resilience by exceeding 1.006 and this time getting a grip there. Success would thus prove the base and raise sights to 1.035. If blunted by 1.006 once more, watch the neckline support closely, a break opening the door back to 0.937.

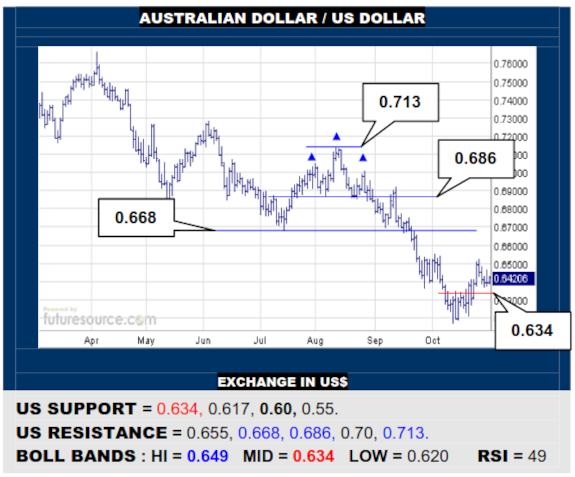

AUSTRALIAN DOLLAR / US DOLLAR

The AD has mustered an initial turn but needs to spear 0.655 to post a flag getaway and even render a nearby inverse H&S to really dial in focus on the next important hurdle at 0.668. Meanwhile closely eying the 0.634 ledge now hosting the mid band as a break back beneath would undo basing and flag ideas to threaten a drop on to 0.60.

BRAZILIAN REAL / US DOLLAR

Again denied in the 5.40 region, the US has taken a harder hit to break beneath its mid-year uptrend and Sep-Oct is looking dangerously toppy as a result. Thus wary of pressing on to attack 5.00 where a far bigger top could really tip the balance. Otherwise it will take a rebound to gain new grip over 5.25 to repair the trend break and stabilize anew.

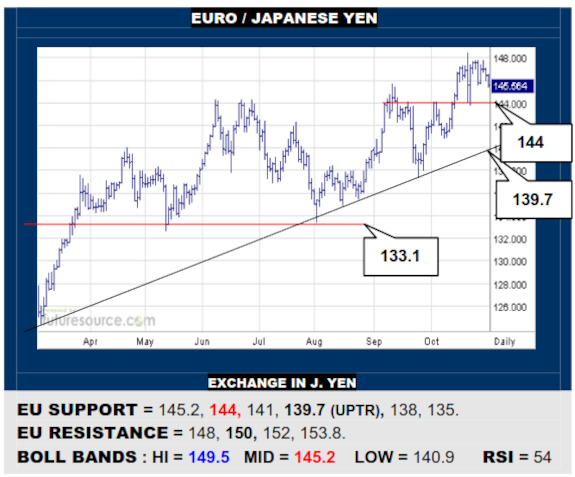

EURO / JAPANESE YEN

Support at 144 caught the initial reflex from the 148’s but the EU has faded again thereafter. This demands a close eye on that 144 brace, its failure installing a preliminary new dual top that could well then lead to a pivotal test of the uptrend (139.7). Must alternatively score a clean escape over 148 to reassure the step up and pave the way on to 152.

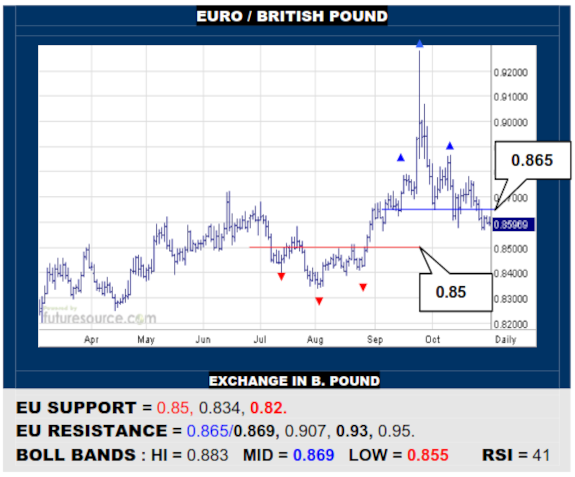

EURO / BRITISH POUND

A ragged Jly-Aug base under 0.85 is facing off against a ragged Sep-Oct top above 0.865. If the EU could pop 0.865 and the quite closely shadowing mid band (0.869), it would dispel the top shape and could reach into the 0.90’s again. On the other hand, loss of 0.85 would dilute the base and threaten a delve back to 0.82 again.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.