Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

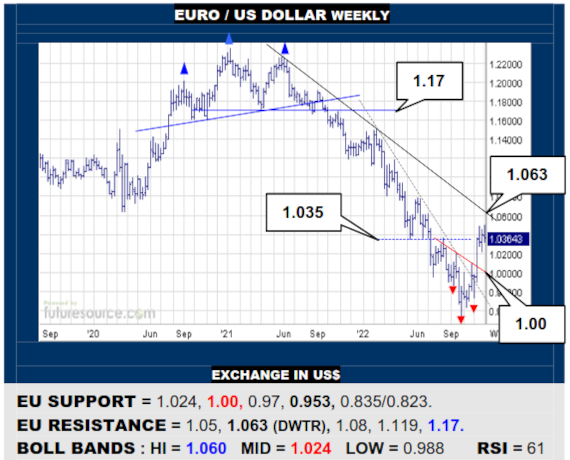

EURO / US DOLLAR WEEKLY

Leaving an inverse H&S in its wake, the EU has been trying to add a flag but must pop 1.05 to do so and thereby attack the weekly downtrend (1.063), the next key obstacle obscuring a path to 1.17. Meantime only swerving back under the mid band (1.024) would insert a small top in place of a flag to threaten the 1.00 base border.

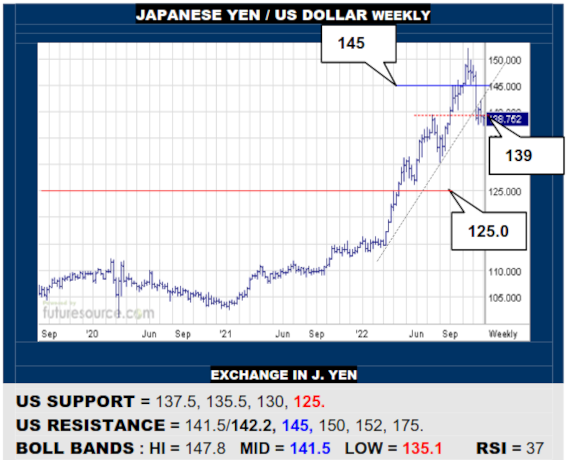

JAPANESE YEN / US DOLLAR WEEKLY

After forming an early Q4 top over 145, the US has fallen back to break its ‘22 uptrend, remaining confined below in subsequent action as 139 support wears away. Duly looking vulnerable to a bear flag and a further significant drop back towards 125. Only a jolt clear of 142.2 would retrieve and set up a challenge to the 145 barrier.

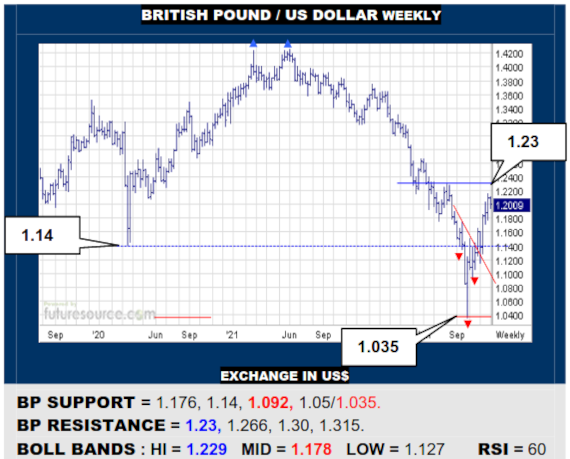

BRITISH POUND / US DOLLAR WEEKLY

The BP reacted back over a former 1.14 trough to install a steeply raked inverse H&S in Q4 and it has chased on from here towards the next interim hurdle at 1.23. If able to bust through, so the 1.30-1.32 vicinity would be the next goal but risk of an inside week initially warns to watch 1.176 for any sign of taking a swerve back to 1.14 first.

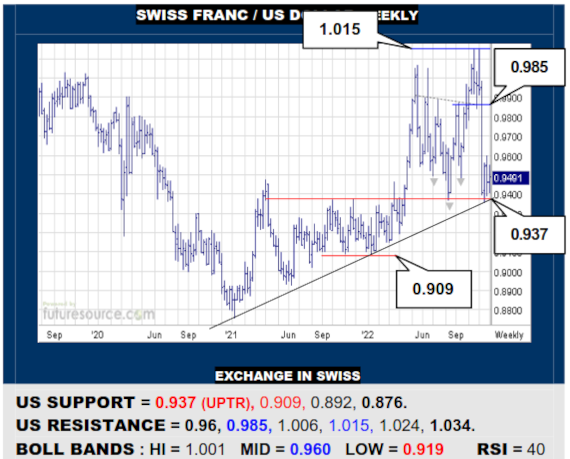

SWISS FRANC / US DOLLAR WEEKLY

The US took a steep tumble after a prior inverse H&S gave way to a new dual top as 0.985 gave way. This has returned it to the next key support at 0.937 where the ‘20’s uptrend is arriving. A further break here would apply a much heftier ’22 double top aimed back to 0.876. Must otherwise jog clear of 0.96 to regain sight of 0.985 once more.

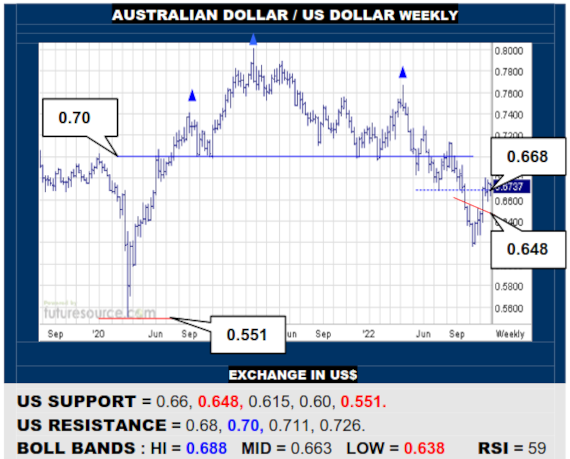

AUSTRALIAN DOLLAR / US DOLLAR WEEKLY

A Nov pause in the 0.66 to 0.68 span could yet culminate in a flag so still seeing a chance to engage the 0.70 border to the much bigger ‘20’s H&S top. Only twisting away under 0.66 would instead sound the corrective buzzer for a test of the 0.648 neckline of the small early Q4 inverse H&S, which must hold up to keep the recovery developing.

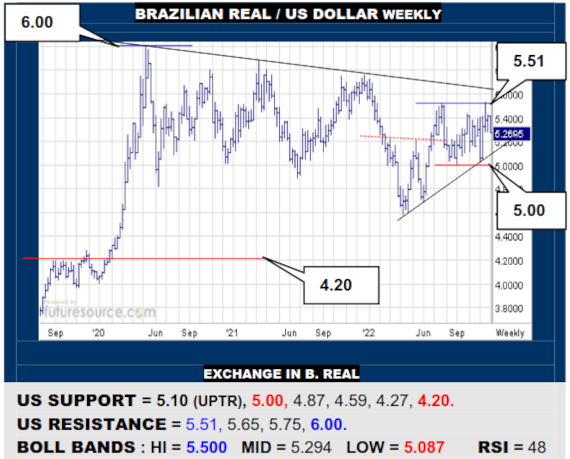

BRAZILIAN REAL / US DOLLAR WEEKLY

A second rebuke from 5.51 has seen the US now crack its mid band so it looks increasingly vulnerable to returning to the tweaked ’22 uptrend (5.10), loss of that even threatening ousting from the 5’s for a much harder fall. Only promptly gathering a dip aboard the trend could persuade there might still be a chance to dislodge that 5.51 barrier.

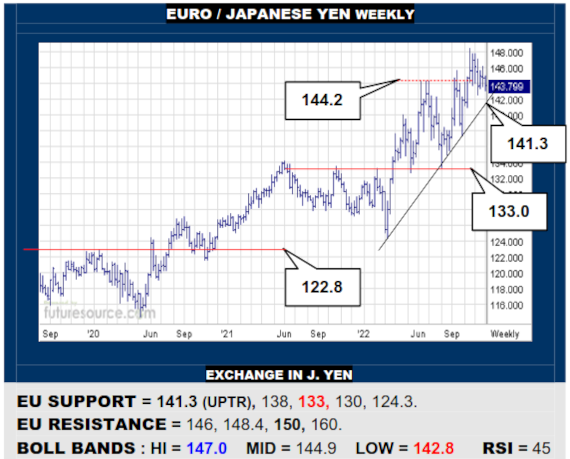

EURO / JAPANESE YEN WEEKLY

The EU is still trying to rein in its setback despite wearing through the 144.2 support. This means the ’22 uptrend is exposed but not looking unduly vulnerable thus far. While intact, there is a chance for Q4 to become a large flag to resume over 148. If the trend gave way though, beware a much sharper drop back to 133.

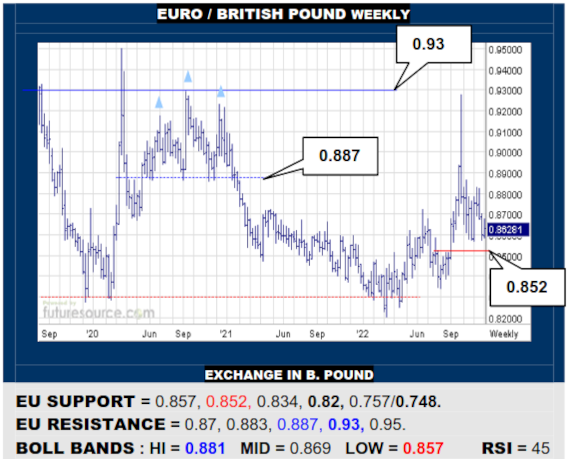

EURO / BRITISH POUND WEEKLY

The 0.85’s continue to buffer the EU and an inside week could be forming. Thus watching 0.87 as a potential trigger to fire up a new rally where a cleaner exit over 0.887 could bring 0.93 into range again. Only gnawing away the 0.857-0.852 buffering would instead apply a taller top here and warn of a new delve to the 0.82 vicinity.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.