Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

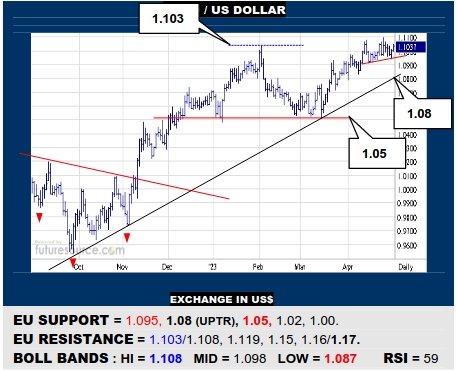

EURO / US DOLLAR

Several jabs over a prior 1.103 apex in Q2 still haven’t scored the EU a surefire break, needing the $ Index to crack 100.8 as well to hail a clean getaway to better light the path up to 1.17. With the Fed in play again, would meantime watch a nearby pivot at 1.095 to instead warn of a small new H&S forming that could endanger the uptrend (1.08).

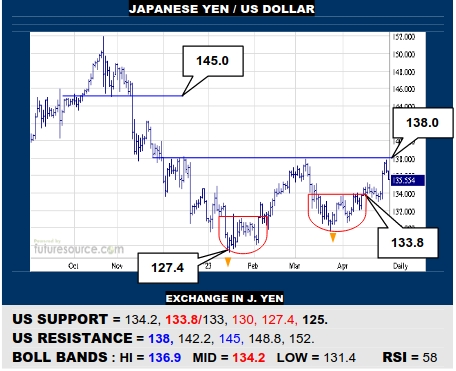

JAPANESE YEN / US DOLLAR

A new lunge higher by the US has been denied again by the pivotal 138 resistance. It must bust clear of that to pull together a large double bottom that could serve as a launch-pad to 145 initially but later on into the 150’s. Meantime watching the 133’s as key support to prevent the base framework from buckling and turning focus south again.

BRITISH POUND / US DOLLAR

The BP keeps nudging and cajoling beyond the prior 1.245 resistance but still without much of a spark, really now needing to depart the 1.25’s to suggest that the arriving uptrend was injecting some fresh impetus to better target 1.30. Meanwhile now keeping an eye on a new 1.243 pivot as a likely tripwire back to test the uptrend (1.228).

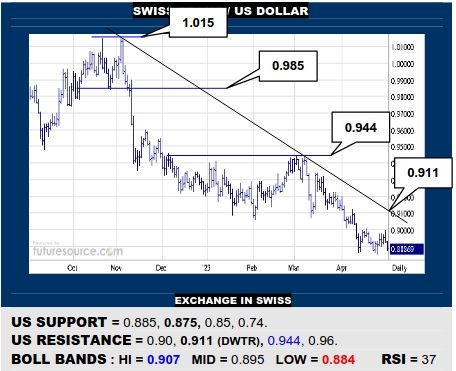

SWISS FRANC / US DOLLAR

Efforts by the US to shake off the latest step lower have been parried by 0.90 resistance so must now mind 0.885 as a possible bear flag tripwire to warn of a pending dice with key bracing at 0.875, a deep cavern looming below. Must otherwise shed that 0.90 obstacle to get to grips with the main downtrend (0.911), seeking a more lasting turn.

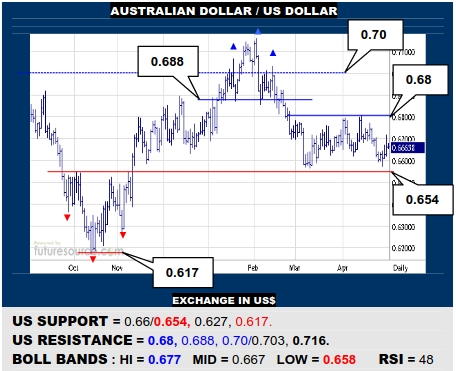

AUSTRALIAN DOLLAR / US DOLLAR

Sketchy ranging action in the AD has still respected the 0.66/0.654 buffering of a prior Q4 inverse H&S but must translate this into a boost over 0.68 to resolve a new Mch-May base that could make inroads against the upright H&S over 0.688. Cautious meantime as a break of 0.654 would develop a much broader top and target 0.617 again.

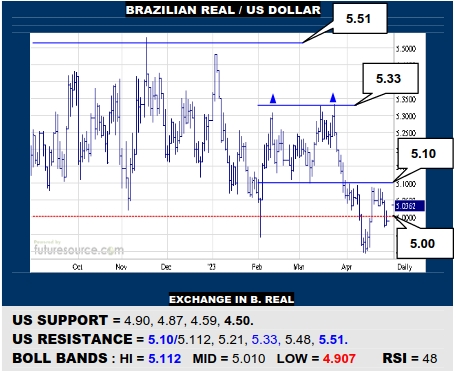

BRAZILIAN REAL / US DOLLAR

The US bounce from 4.90 stabbed back into the 5’s but was foiled by the 5.10 resistance, keeping it dangling precariously on the brink of a broad nine month top structure. Duly still watching 4.90 as a trigger for heavier losses towards a decade long uptrend at 4.50. Only a decisive blast clear of 5.10/5.11 would make more substantive repairs here.

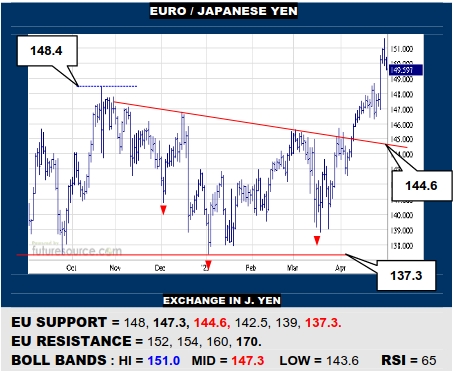

EURO / JAPANESE YEN

The EU breakout from a large inverse H&S has led on to conquering the prior 148.4 apex and enabling an initial stab at the 150’s, the base depth technically projecting to 154. Could tolerate a little corrective retrenchment to 148 without disputing upside prospects but loss of the mid band (147.3) would turn focus onto the base neckline (144.6).

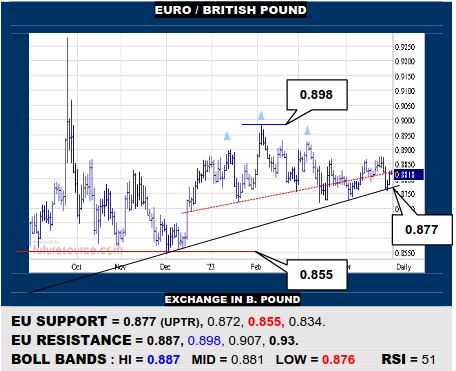

EURO / BRITISH POUND

Still a curious stalemate as the shallow uptrend has prevented the EU from succumbing to an implied Q1 H&S but it will still now take a decisive thrust beyond 0.887 to actually suggest dispelling the toppy shape and having a fresh shot at entering the 0.90’s. However, if the trend (0.877) were to snap, do then expect a deeper delve to 0.855.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.